The Polkadot dowry has shown a significant increase in the interests of large buyers during a 24 -hour negotiation period, with business treasury allowances and a regulatory clarity resulting in sustained purchase pressure, according to the Technical Analysis model of Coindesk Research.

The model has shown that price action had demonstrated potential stability of institutional quality with supported business interest indicators.

In July, BIFROST had obtained more than 81% of the liquid layoff (LST) tokens market (LST), with more than 90 million dollars of total locked value (TVL), according to an article on X.

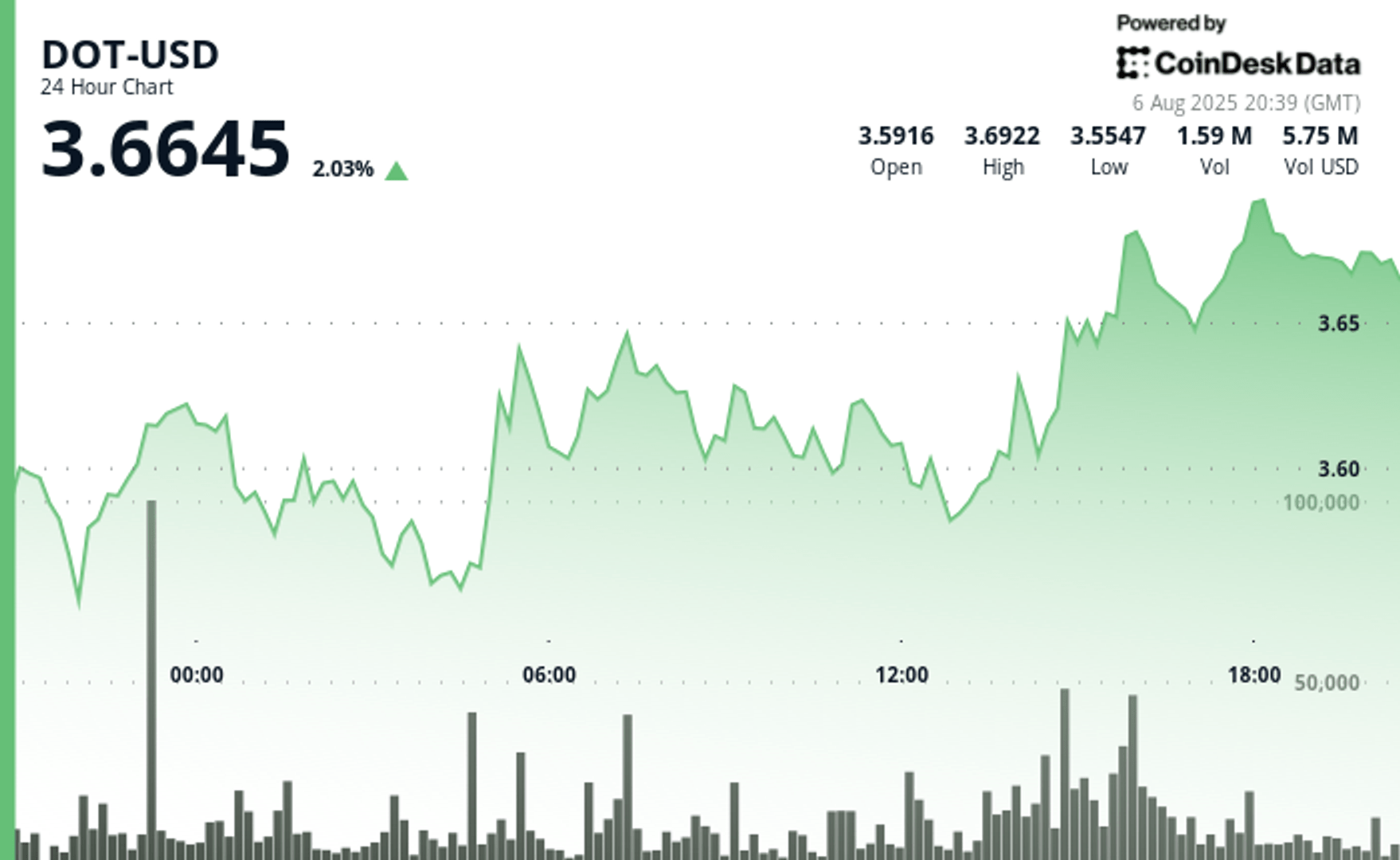

The dowry rally came while the wider cryptography market has also increased, with the wider market gauge, the Coindesk 20, recently increased by 2%.

During recent negotiations, Polkadot was more than 2.1% over 24 hours, exchanging about $ 3.66.

Technical analysis:

- Depending on the model.

- The allocation discussions of the corporate treasury have potentially contributed to resistance training near the main technical levels.

- The volume of negotiations exceeded institutional thresholds during standard decision -making hours of companies.

- The volume tips after opening hours are aligned with the typical business announcement synchronization models.

- Reduced volatility periods suggest that the institutional accumulation phases before the potential news of the adoption of companies.

- Action of prices has demonstrated institutional quality stability with supported indicators of prolonged interest.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.