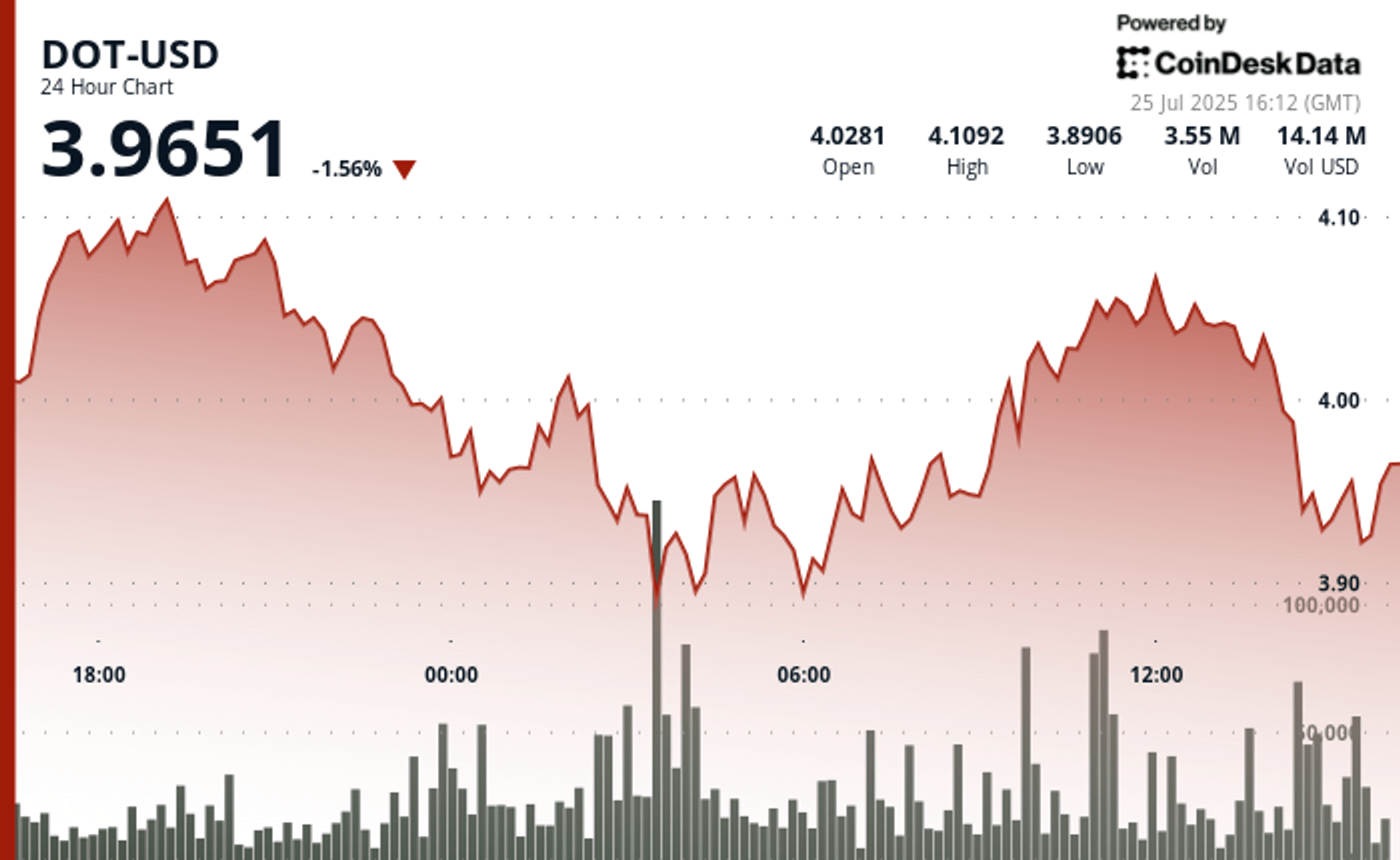

The Polkadot dowry has encountered a continuous downward dynamic despite several recovery attempts, fluctuating between $ 3.87 and $ 4.11 throughout the 24 -hour period, depending on the Technical Analysis model of Coindesk Research.

The model has shown that substantial institutional purchase activity has developed in critical support areas around $ 3.87 to $ 3.93, especially during high volume sessions at 3:00 a.m. and 2:00 p.m.

A significant support developed in the range of $ 3.87 to $ 3.93 with resistance at $ 4.11, depending on the model.

The drop in Polkadot came while the wider cryptography market also dropped, with the wider market gauge, the Coindesk 20, recently down 3%.

During recent negotiations, the DOT was down 1.9% over 24 hours, exchanging about $ 3.94.

Technical analysis:

- Reduction of the range of $ 0.24 constituting 6% divergence between a peak of $ 4.11 and a hollow of $ 3.87.

- The volume exceeded the average of 24 hours of 2.87 million during critical support assessments at 3:00 a.m. and 2:00 p.m.

- Robust resistance at $ 4.11 threshold with an increasing boost of sale establishing a moving ceiling upwards.

- The support territory established in a range of $ 3.87 to $ 3.93 with significant purchase interest in high volume.

- The V -shaped recovery training emerged during the final negotiation period with a sustained rally of $ 3.92 minimum.

- Praced above the resistance threshold of $ 3.94 suggesting a potential transformation of short-term feeling.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.