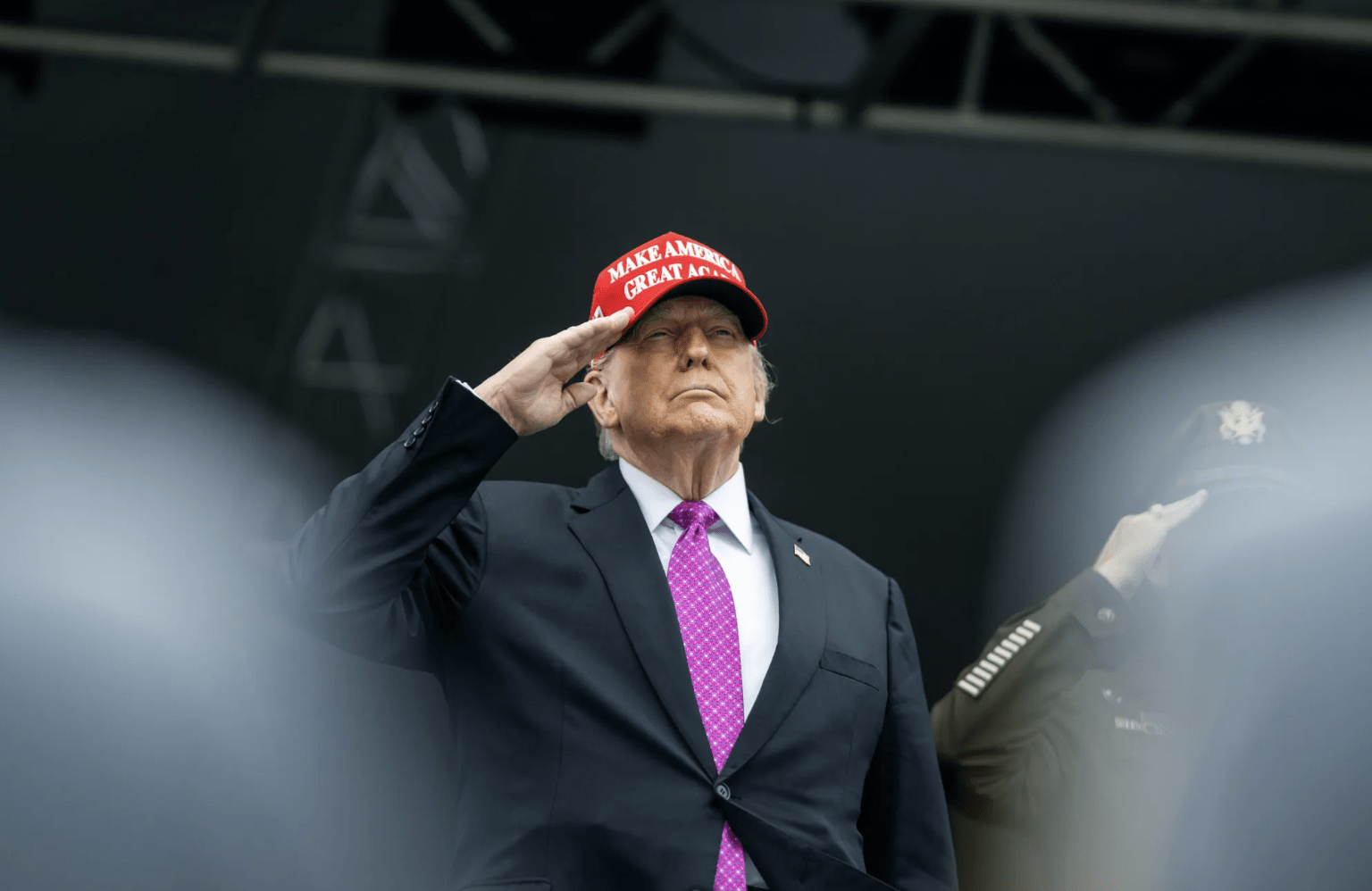

The prediction markets report skepticism that Donald Trump will be able to bend the federal reserve to his will this year, even though the American president moves to dismiss a governor of the Fed for what he thinks is just a cause.

On Polymarket, bettors have put the chance that Jerome Powell is forced to go out as president of the Fed in 2025 at only 10%, which suggests that investors do not believe that Trump can prevail over the independence of the central bank before the expiration of Powell’s mandate in May 2026.

Trump’s push to Fired, Governor Lisa Cook tells another story. He wants it to be withdrawn from the allegations of mortgage fraud, according to a letter published on Truth Social, making it the first in -office ever targeted by a presidential dismissal.

Cook, however, has refused to resign, arguing that the moves “for the cause” must apply to ruling misconduct, and not on private financial transactions prior to its appointment.

The markets estimate 27% of the chance to avoid Cook by December 31, indicating a risk of legal or political benefits, but still a strong expectation, it survives.

The story shows that the previous presidents also put pressure on the Fed, the Cato Institute stressing in a room in October 2024 that it is more common than some would make you believe.

Harry Truman pushed President Thomas McCabe in 1951 to finance the debt in wartime, Lyndon Johnson reprimanded William McChesney Martin in his Ranch in Texas to increase rates at the start of the Vietnam War, and Richard Nixon looked a lot at Arthur Burns in the early 1970s, campaign economists were then linked to the inflation of RUNAWAY.

A Cato study of 2013 by Thomas F. Cargill and Gerald P. O’Driscoll Jr. maintains that the independence of the federal reserve is more myth than reality, noting that the two parties interfere when they are politically timely.

If Trump was to withdraw Powell, it would certainly be controversial, but the markets could welcome him if they were considered to be paving the way to an easier monetary policy. A more aligned diet on the White House could reduce rates faster, weaken the dollar and lift risk assets creating largely a backdrop for Bitcoin .

Beyond the short-term rally, Powell’s dismissal would underline one of the fundamental arguments of the crypto: that Fiat systems are intrinsically political and subject to capture, while Bitcoin remains outside these pressures.

For Bitcoin, this combination of liquidity conditions, more loose plus a reinforced “hard” story could be a powerful adoption catalyst.

A change of guard at the Fed would obviously be a bullish story for Bitcoin, which is why the reaction of the market to Trump’s decision on Cook reflects a consensus on the fact that it is largely hot air.

Bitcoin has barely taken the news, up 0.3% in the immediate consequences, the largest digital asset still down 2.6% according to Coindesk market data.

The Coindesk 20, an index following the performance of the largest cryptographic assets, is negotiated below 4,000, down 5.3% by mid-day in Hong Kong.