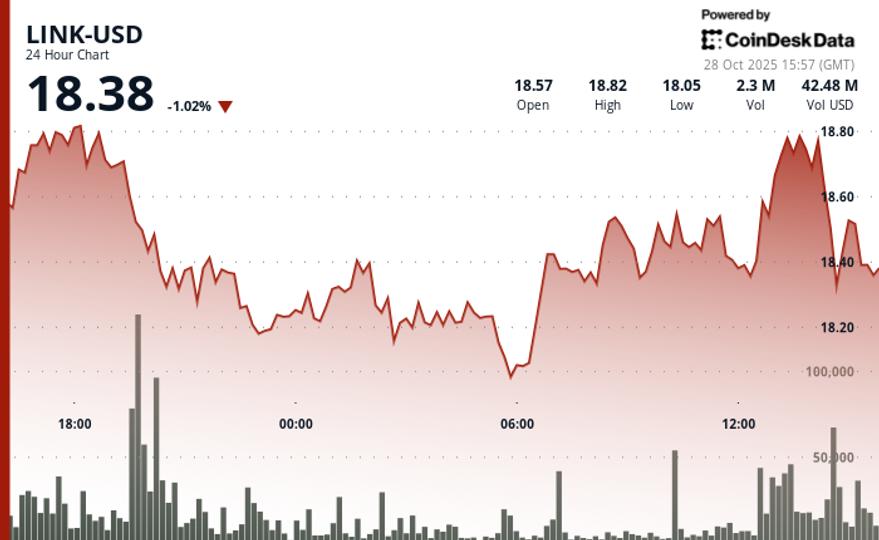

The native token of the Oracle Chainlink network fluctuated just above $18 during a volatile Tuesday session amid real-world adoption momentum.

Trading volume reached 2.27 million tokens, 91% above the daily average, but resistance at the $19 level limited several rally attempts, CoinDesk Research’s market analysis model showed.

In news, Chainlink signed a partnership on Tuesday with Balcony, a real estate tokenization platform working with local governments. Balcony will use Chainlink’s Execution Environment (CRE) to put on-chain over $240 billion of government-sourced real estate data. The partnership aims to make real estate assets programmable, transparent and verifiable, starting with parcel-level land records.

Balcony’s Keystone platform, powered by Chainlink CRE, allows authenticated real estate data to flow directly on-chain, helping to create compliant digital real estate marketplaces. The deal also highlights Chainlink’s growing role in tokenized real-world assets (RWA), where secure and regulated data management is key to institutional adoption.

Meanwhile, Virtune, a digital asset manager and crypto fund issuer regulated in Sweden, said on Tuesday it has integrated Chainlink’s proof of reserve service into its $450 million digital asset exchange-traded products (ETPs). The feature verifies and reports aggregated holdings of in-game assets without revealing individual wallet addresses, ensuring investors that ETPs own the underlying assets.

Key technical levels signal bullish continuation for LINK

- Support/Resistance: Primary support holds at $18.21 with secondary support near $18.30, while resistance remains firm at $18.82 with an expected overhead bid near $19.00.

- Volume Analysis: The allocation volume of 2.27 million tokens exceeded the average by 91%, validating institutional participation and momentum.

- Chart Patterns: Ascending structure from the low of $18.04 complemented by a decisive breakout confirming the uptrend.

- Targets and Risk/Reward: Immediate upside targets a psychological level of $19.00; downside risk contained within the $18.40 support zone.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.