Karachi:

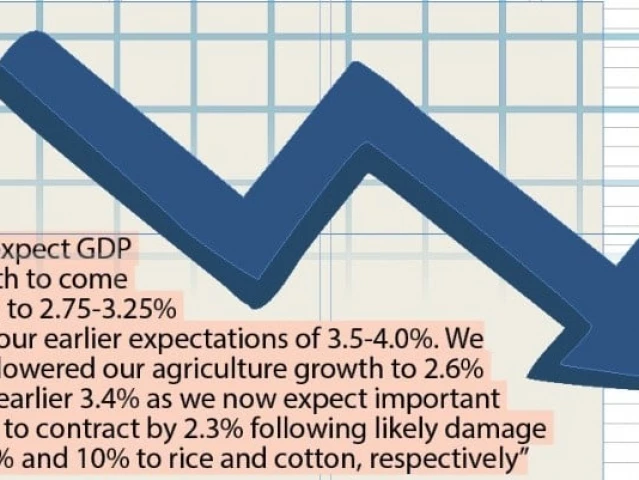

The Pakistan State Bank (SBP) has reduced its growth prospects for the 2012 fiscal year, warning that devastating floods will maintain real expansion of GDP near the lower end of its forecast range from 3.25% to 4.25% previous. Private sector analysts, however, paint an even more sinking image, with topline titles revising its projection at only 2.75% -.

Topline Securities has reduced Pakistan’s economic growth forecasts for exercise 26, warning that floods and heavy rains have disrupted agriculture and are likely to weigh on wider macroeconomic indicators. The revised prospects occur days before the second semi-annual examination of the International Monetary Fund (IMF) of the installation of the extended $ 7 billion fund (EFF) on September 25, 2025.

Topline provides that agricultural growth was cut at 2.6%against 3.4%, key crops should contract by 2.3%. “We are now expecting damage of 15% and 10% in rice and cotton, respectively,” said the report.

A few days earlier, Arif Habib Limited (AHL) also revised its projections on agricultural production due to floods.

“We expect GDP growth to be down 3.46% to 3.17% after the woods,” said Sana Tawfiq of Ahl, speaking to L’Express PK Press Club.

The economy of Pakistan faces new opposite winds, as initial estimates place the cost of floods from 2025 to 409 billion rupees ($ 1.4 billion), or 0.33% of GDP, according to Ahl Research. Agriculture brought weight with losses exceeding 302 billion rupees (0.24% of GDP), highlighting the vulnerability of the sector with climatic shocks. Damage to transport and communication are valued at 97.6 billion rupees, while housing losses amounted to 8.95 billion rupees. Loss of cattle were minimal at Rs0.5 billion.

Research on topline titles, Shankar Talreja, noted that the current account deficit (CAD) is expected at the upper end by 0-0.5% of GDP, because imports should increase by 10% against 9% earlier, while exports can only increase by 1% compared to the projection of 4% previous. Shipments of funds, however, are revised up to 6%, or 40.2 billion dollars, “reflecting historical increases during crises”.

Floods have triggered increased food price increases, wheat and flour from 38 to 40% and key vegetables that increases approximately 40% in recent weeks. Inflation of financial year 26 is now planned at 6.5% to 7.5%, compared to 6% -7% earlier. September food inflation is projected alone at 8% to 9% of months in months.

Sheikh Muhammad Tehseen, a businessman, warned that the decline in agricultural production after recent floods would have a large range in the food value chain. He said the disturbance will not only reduce the domestic availability of key products, but would also strike food exports, including packaged and transformed items, thus affecting Pakistan’s commercial income.

Tehseen urged the government to formulate a complete strategy to cushion the agricultural sector against these shocks. He recommended measures to stimulate the production of crops in non -affected areas to compensate for potential deficits. At the same time, he underlined support for local industries by capping energy and public services and by lowering the policy rate. Such steps, he argued, would improve industrial production, would maintain exports and contribute to reducing the imminent trade deficit.

President of the Sindh Abadgar Board (SAB), Mahmood Nawaz Shah, pinned a little hope about the cotton. Stressing that cotton arrivals in the Sindh increased by around 40%, exceeding expectations, he said that Sindh now represents almost half of the Pakistan cotton area, with losses capped at around 10%. While Punjab can see setbacks in the coming weeks, the Sindh harvest remains resilient. Rice production should also remain stable, potential losses not crossing 10%, which increases the hopes of a bumper harvest if last year’s challenges do not happen again. Pending the Rabi season, Shah stressed the importance of Wheat, noting that the adequate winter rains could ensure sufficient water supply. Even a wheat deficit of 5 to 10%, he added, could be balanced by gains in other food crops.

Given these risks, Topline no longer sees monetary relief. “We expect the policy rate to be at 11% instead of our previous 10% forecasts,” he said.

The budget deficit for fiscal year 26 is revised up to 4.8% of GDP, compared to 4.1%, because income is projected at Rs13.6 Billions against the previous RS14.1 Billion. The main balance is expected at 1.6% of GDP. The government has declared an agricultural emergency, with possible derogations from electricity for households affected by floods.

Despite the pressures, Topline expects the IMF program to remain intact. “Any relaxation on income or balance objectives cannot be excluded, given the previous ones during past floods,” he said.

Pakistan’s external financing obligation amounts to $ 10.5 to 11.5 billion, with projected reserves greater than $ 17 billion in June 2026. The RUPIE is scheduled for RS292-297 by dollar on this date.

Topline has said that reforms remain on the right track, including the privatization of International Airline Pakistan, the resolution of circular debt and investment in mining, offshore drilling and renewable energies. The Reko Diq project should soon finish financial.

“Although floods pose short -term challenges, the resilient foot of Pakistan and the current reforms will support the recovery,” said the report.