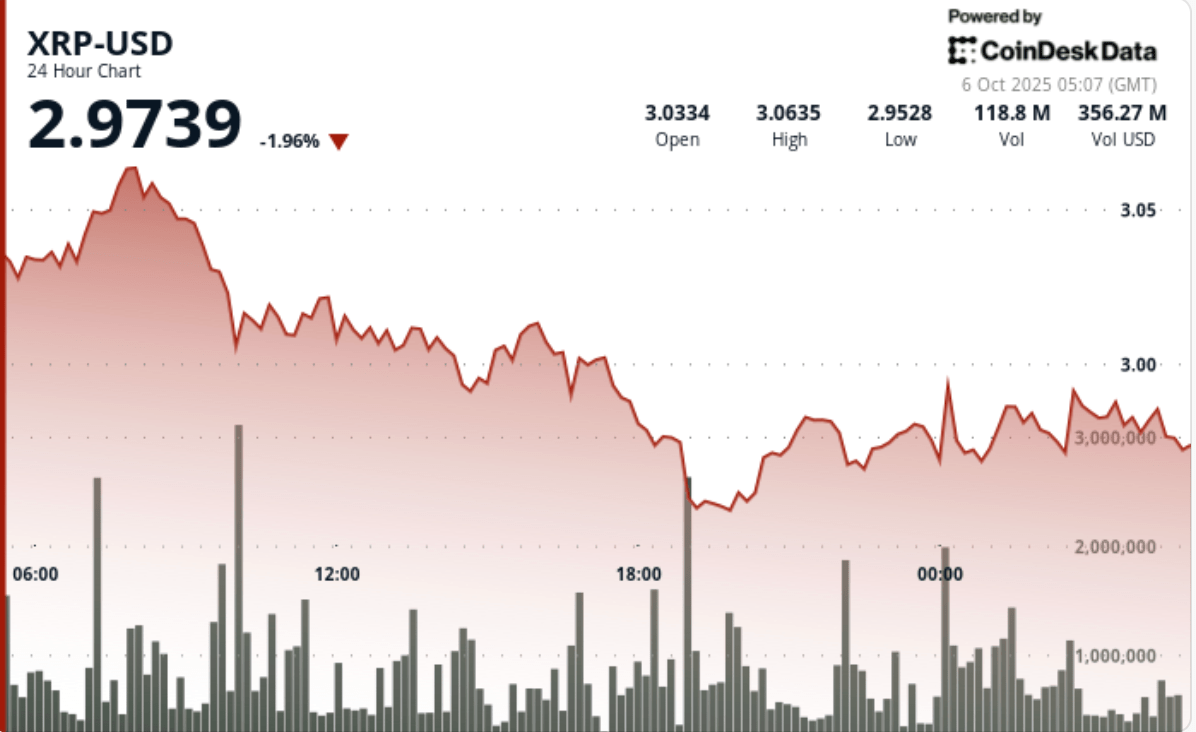

The early XRP rally at $ 3.07 encountered a high distribution over a high volume, leaving a high volume ceiling intact and pulling the price at $ 2.98. The institutional prints confirmed $ 3.07 in resistance, while repeated defenses nearly $ 2.98 maintained the losses.

New context

XRP slipped 1% from October 5, 3:00 a.m. to October 6 02:00 am, from $ 3.01 to $ 2.98 despite the opening force.

The token increased $ 3.07 early, only to cope with a concentrated sales pressure.

Analysts said that institutional offices were active in resistance, with a turnover of 17% above daily averages. Despite the lower control for a large part of the session, XRP ended with a rebound of $ 2.98, signaling the interest of continuous accumulation.

Summary of price action

- XRP exchanged a corridor of $ 0.09, or an intra -day range of 3%, between $ 2.98 and $ 3.07.

- The price culminated at $ 3.07 before net rejection on chips of 64.3 million, compared to 54.7 million means.

- The sales pressure resulted in XRP at $ 2.98, where support was defended several times.

- A dip at the end of the session launched a rinsing of 1.95 m in volume at $ 2,979, immediately absorbed by buyers.

- The rebound flows stabilized the price almost $ 2.98, with recovery volumes on average of 750,000 per bar.

Technical analysis

- The resistance is firmly established at $ 3.07, validated by a sales pressure above average and repeated failures to break higher. The support came to $ 2.98, where buyers were constantly involved, including a high volume flush absorbed at the end of the session.

- Price Action reflects a decline based on rejection in a band of $ 3.07 to $ 2.98. While the sellers dominated two thirds of the session, the defense of $ 2.98 shows that the institutions continue to accumulate on decreases, keeping the structure intact for another higher attempt.

Which traders are looking at?

- Whether $ 2.98 is support in upcoming sessions.

- If $ 3.07 remains a hard ceiling or weaken under a renewed pressure.

- Signs of the institutional entries supported as ETF catalysts approached.

- Potential test of $ 3.10 If buyers can recover control over $ 3.03.