By Omkar Godbole (All times ET unless otherwise noted)

Bitcoin and most major cryptocurrencies are weaker after the Chicago Mercantile Exchange, a proxy for institutional activity, denied reports of listing futures linked to XRP and SOL. Traditional markets are also holding their breath in anticipation of the Bank of Japan’s expected interest rate hike on Friday.

Despite BTC’s continued play above $100,000, retail demand remains robust. Glassnode’s shrimp-crab cohort, which includes addresses holding up to 10 BTC, absorbed 1.9 times the newly mined supply last month, totaling over 25,600 BTC. At the same time, long-term security holders have slowed their spending and profit-taking activities, demonstrating a cautious, but firm, commitment to their investments.

Staying below $100,000 could prove costly. According to Wintermute OTC trader Jake Ostrovskis, this would “make Monday’s inauguration a news-selling event and the narrative could change quite quickly.”

Reports suggest that the number of whale wallets holding between 1 and 10 million XRP has reached an all-time high of 2,083, signaling increased accumulation and confidence in its future performance.

In the world of innovation, discussions around Bitcoin Synths are gaining ground on X. These synthetic assets allow users to benefit from Bitcoin’s price movements without actually owning the cryptocurrency. Bitcoin Synths can be traded or used as collateral in lending protocols, avoiding the complexities associated with wrapped tokens and specialized bridges.

Ethereum layer 2 protocols are also making headlines with record transaction volumes, although concerns about their near capacity limits persist.

On the macroeconomic front, recent data from the Ministry of Labor shows that the “all tenant rent” index, a gauge of housing inflation in the Consumer Price Index (CPI), increased to a slower pace in the last quarter. The data suggests that recent inflation concerns may be overblown and the Fed may move away from its hawkish forecasts, which would be a positive sign for risk assets. Stay vigilant!

What to watch

- Cryptocurrency

- Macro

- January 23, 8:30 a.m.: The U.S. Department of Labor releases the weekly unemployment insurance claims report for the week ended January 18.

- Initial Unemployment Claims Est. 215,000 against the previous one. 217K.

- January 23, 10:00 a.m.: The National Association of Realtors releases the report on existing home sales in the United States for December 2024.

- Existing Home Sales East. 4.16 million against the previous one. 4.15M.

- Existing Home Sales MoM Prev. 4.8%.

- January 23, 4:30 p.m.: The Fed releases report H.4.1, the central bank’s balance sheet, for the week ended January 22.

- Total reserves Prev. $6.83 billion.

- January 23, 6:30 p.m.: The Japanese Ministry of the Interior and Communications releases the Consumer Price Index (CPI) report for December 2024.

- Inflation rate MoM Prev. 0.6%.

- Year-on-year core inflation rate Est. 3% compared to the previous one. 2.7%.

- Year-on-year inflation rate Prev. 2.9%.

- January 23, 10:00 p.m.: The Bank of Japan (BoJ) issues a statement on monetary policy.

- Interest Rate Decision Est. 0.5% compared to the previous one. 0.25%.

- January 23, 8:30 a.m.: The U.S. Department of Labor releases the weekly unemployment insurance claims report for the week ended January 18.

Token Events

- Votes and calls on governance

- Morpho DAO plans to reduce incentives by 30% across all networks and assets.

- Yearn DAO discusses funding and approves a sub-DAO called Bearn to focus on building and launching products on Berachain.

- Frax DAO is discussing a $5 million investment in World Liberty Financial (WLFI), the crypto project backed by US President Donald Trump’s family.

- January 23: Livepeer (LPT) hosts a Core Dev call.

- January 24: Deadline for Arbitrum BoLD activation vote. BoLD allows anyone to participate in validation and defend against malicious claims about the state of an Arbitrum chain.

- January 24: Hedera (HBAR) hosts a community call at 11 a.m.

- Unlocks

- January 31: Optimism (OP) will unlock 2.32% of the circulating supply worth $52.9 million.

- January 31: Jupiter (JUP) will unlock 41.5% of the circulating supply worth $626 million.

- Token Launches

- January 23: Sky (SKY) is listed on Bitget.

- January 23: Animecoin (ANIME) launches, with claims beginning at 8 a.m. The token will be listed on several exchanges, including Binance, OKX and KuCoin.

Conferences:

Symbolic discussion

By Francisco Rodrigues

- Azuki, a collection of non-fungible tokens (NFT), today introduces its Animecoin (ANIME) on Ethereum and Arbitrum. The token was announced on January 13.

- An airdrop will encompass Azuki NFT holders, Hyperliquid HYPE stakes, certain Arbitrum ecosystem participants, and Kaito yappers.

- It will also include some anime communities and BNB token holders who, between January 17 and 20, subscribed to Simple Earn with their tokens on Binance.

- The debut builds on a growing trend of NFT collections launching their own tokens, a trend that began in 2021 when the Bored Ape Yacht Club (BAYC) launched ApeCoin.

- Other examples include DeGods’ DUST and Pudgy Penguins’ PENGU tokens, which have a market cap of $1.6 billion.

- Other signs indicate that the NFT market is heating up, with Nansen recently highlighting that a Crypto Punk was sold for 170 ETH (around $540,000) while an Azuki was sold for 165 ETH. The Azuki NFT was purchased a month prior for 105 ETH.

Positioning of derivative products

- The delta cumulative volume indicator reveals that major cryptocurrencies, except TON, have seen net selling pressure in the perpetual futures markets over the past 24 hours.

- Block flows on Deribit and Paradigm included long positions in short-term BTC puts at $100,000, $95,000, and $70,000. An entity purchased ETH valued at $2.9k.

- BTC and ETH front-end calls now trade at par with puts.

Market movements:

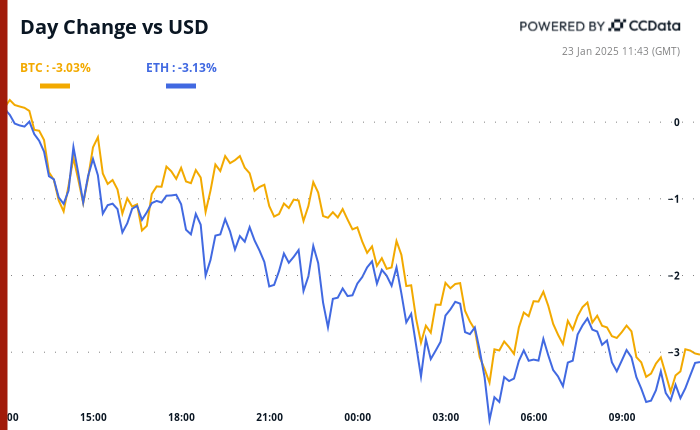

- BTC is down 4.1% from 4 p.m. ET Wednesday at $102,020 (24 hours: -2.71%)

- ETH is down 3.85% at $3,206.18 (24 hours: -2.83%)

- CoinDesk 20 is down 3.61% at 3,799.21 (24 hours: -3.58%)

- CESR Composite Ether Staking Rate Down 15 Basis Points to 3.15%

- BTC funding rate is -0.0019% (-2.08% annualized) on OKX

- The DXY is unchanged at 108.25

- Gold is down 0.35% at $2,761.10/oz

- Silver is down 0.73% at $30.57/oz

- The Nikkei 225 closed up 0.79% at 39,958.87

- Hang Seng closed 0.4% lower at 19,700.56

- FTSE is unchanged at 8,538.7

- The Euro Stoxx 50 is unchanged at 5203.6

- DJIA closed +0.3% at 44,156.73

- The S&P 500 closed +0.61% at 6,086.37

- The Nasdaq closed up 1.28% at 20,009.34

- The S&P/TSX Composite Index closed up 0.12% at 25,311.5

- The S&P 40 Latin America closed +1.21% at 2,297.32

- The 10-year US Treasury is up 3 basis points at 4.59%

- E-mini S&P 500 futures are down 0.19% at 6,109.00

- E-mini Nasdaq-100 futures are down 0.56% at 21,876.75

- E-mini Dow Jones Industrial Average futures unpriced at 44,384.00

Bitcoin Statistics:

- BTC dominance: 58.59

- Ethereum/Bitcoin ratio: 0.031

- Hashrate (seven-day moving average): 781 EH/s

- Hash price (spot): $58.9

- Total fees: 8.5 BTC/$876,410

- CME Futures Open Interest: 188,396 BTC

- BTC valued in gold: 37.1 ounces

- BTC vs gold market capitalization: 10.56%

Technical analysis

- BTC’s pullback from Monday’s high portends the formation of a double-top bearish reversal pattern.

- A move below the horizontal line would confirm the trend, potentially attracting more sellers to the market.

Crypto Stocks

- MicroStrategy (MSTR): Closed Wednesday at $377.31 (-3.03%), down 1.89% to $370.19 in pre-market trading.

- Coinbase Global (COIN): Closed at $295.85 (+0.56%), down 2.59% to $288.18 in pre-market trading.

- Galaxy Digital Holdings (GLXY): closed at CA$32.81 (+4.99%)

- MARA Holdings (MARA): Closed at $19.69 (+0.66%), down 2.54% to $19.19 in pre-market trading.

- Riot Platforms (RIOT): Closed at $13.14 (+3.14%), down 1.75% to $12.91 in pre-market trading.

- Core Scientific (CORZ): Closed at $15.97 (+4.58%), down 1.63% to $15.71 in pre-market trading.

- CleanSpark (CLSK): Closed at $11.14 (+1.64%), down 2.51% to $10.86 in pre-market trading.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): Closed at $25.53 (+2.24%), up 2.58% to $28.27 in pre-market trading.

- Semler Scientific (SMLR): Closed at $62.11 (-4.36%), up 2% to $64.90 in pre-market trading.

- Exodus Movement (EXOD): Closed at $41.00 (+2.5%), down 2.07% to $40.15 in pre-market trading.

ETF Feed

Spot BTC ETF:

- Daily net flow: $248.7 million

- Cumulative net flows: $39.23 billion

- Total BTC holdings ~1.161 million.

ETH Spot ETF

- Daily net flow: $70.7 million

- Cumulative net flows: $2.81 billion

- Total ETH holdings ~3.648 million.

Source: Farside Investors

Nocturnal flows

Chart of the day

- The chart shows a spike in the number of active addresses on Solana.

- Addresses holding USDC led the growth as the TRUMP token frenzy gripped the market over the weekend.