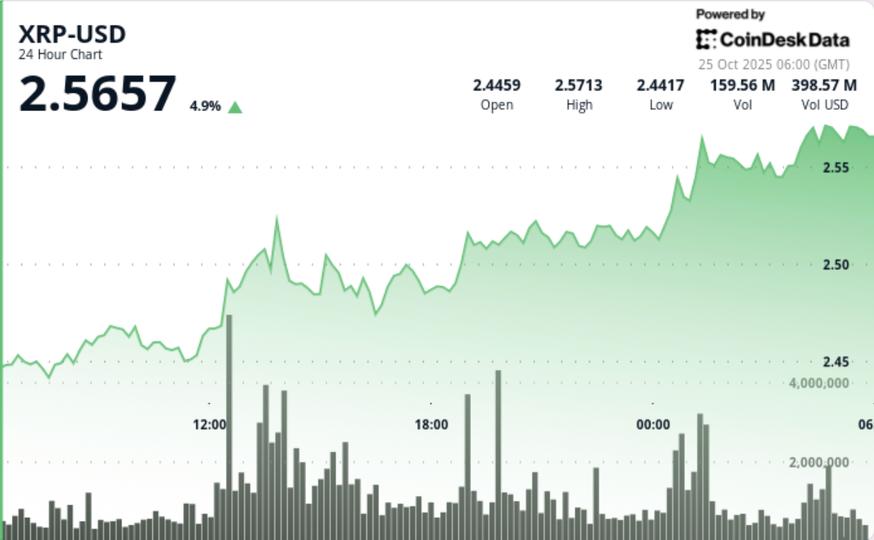

XRP extended its gains above the $2.50 mark on Thursday, breaking key resistance as volume surged 31% above weekly averages. The move came amid broader risk sentiment in crypto markets, with bitcoin rising and traders rotating into large-cap tokens showing technically defined setups.

News context

- The token’s latest advance follows weeks of consolidation between $2.35 and $2.50, with technical strategists following an inverse head-and-shoulders basis through mid-October.

- Thursday’s decisive move through the neckline to $2.50 confirmed this trend, opening a potential continuation phase towards the $2.65-$2.80 range if buying persists.

- Market positioning changed as macroeconomic sentiment improved. Weaker inflation data in the United States and a decline in Treasury yields have triggered risk flows into major altcoins. XRP outperformed the CoinDesk 5 Index by around five percentage points, signaling asset-specific accumulation rather than sector-specific dynamics.

Price Action Summary

- XRP rose from $2.50 to $2.57 during the session, with intraday volume peaking at 142 million, 31% above its seven-day average.

- The breakout was defined by three higher sequential lows at $2.44, $2.48, and $2.51, confirming a controlled buildup through the $2.50 area.

- While brief profit-taking emerged near $2.58, XRP held above breakout support, suggesting institutions added additional exposure during retesting.

- High spot volume combined with moderate derivatives leverage confirmed true buying interest rather than short squeeze dynamics.

Technical analysis

- The inverse head and shoulders formation now defines XRP’s short-term technical bias. Momentum indicators including RSI and MACD have both increased on the daily chart, while expanding volume validates the strength of the move.

- Immediate resistance lies at $2.60, followed by secondary targets near $2.80. Failing to hold $2.50 at the close would neutralize the bullish structure, potentially inviting a rotation toward support at $2.40 to $2.42.

What Traders Should Know

Traders are watching to see if $2.50 constitutes the new base – a level now considered the pivot for near-term trend confirmation. Foreign exchange balance data shows that XRP reserves have fallen by approximately 3.3% since the beginning of October, a historically bullish signal linked to whale accumulation phases.

Open interest rates have stabilized and funding rates remain neutral, leaving the movement largely spot-driven. Sustained volume above 130 million through the weekend could validate the continuation towards $2.70-2.80, while decreasing participation could bring prices back into the $2.40-2.55 range.