XRP collapsed in one of its heaviest negotiations of 2025, plumming almost 5% while the institutions discharged in the beginnings Rex-Osprey ETF.

The dynamic Sell-The-News has erased $ 11 billion in market value and left tokens to defend critical support of $ 2.77.

New context

• American American ETF (Rex-Osprey) Recorded record of $ 37.7 million in volume of the first day, the largest ETF launch of 2025.

• Whale wallets moved $ 812 million in chips between unknown addresses during the session.

• Cryptographic derivatives experienced $ 1.7 billion in liquidations, with 90% from long positions.

• Fed Policy Pivot Pivot Looms: September inflation has cooled at 2.18%, the markets tariffing a reduction of 50 BPS before the end of the year.

• The domination of Bitcoin increased to 57.7% while the capital turned far from altcoins.

Summary of price action

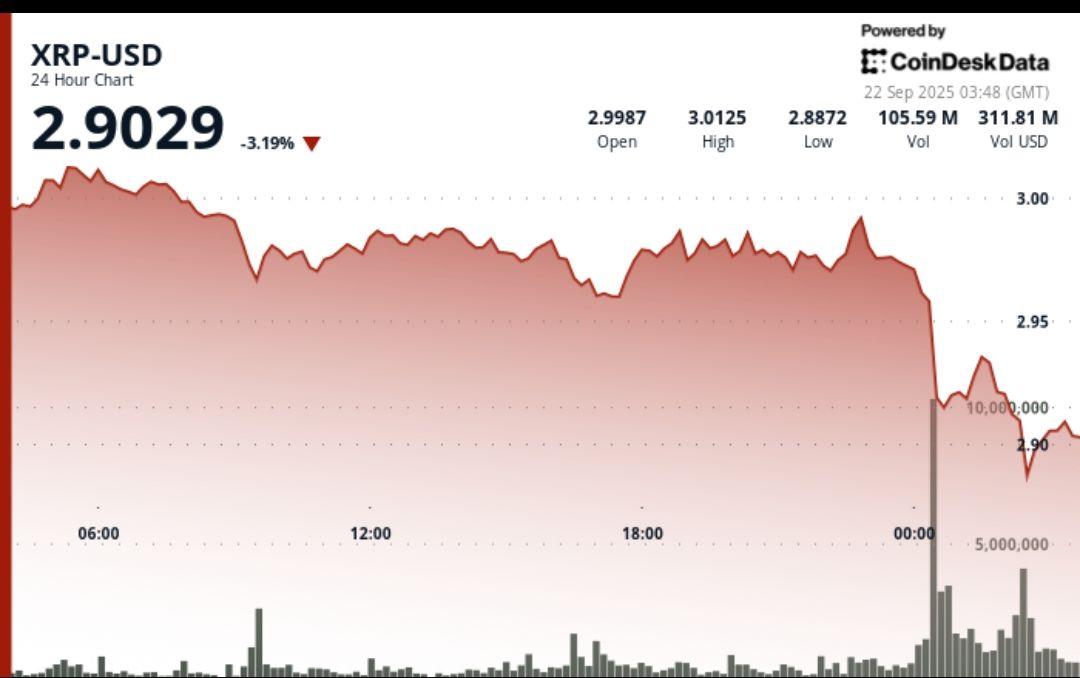

• XRP crashed from $ 2.87 to $ 2.77 in a 24 -hour period (September 22, 03: 00 – Sep 23 02:00 GMT)A drop of 4.9% on a range of $ 0.14.

• Flash crash at 06:00 GMT saw the price of $ 2.87 to $ 2.77 over a volume of 656.1 million (6x daily AVG 105m).

• The resistance hardened at $ 2.87 during the repeated intraday rejection.

• Recovery culminated at $ 2.86 per 1:00 p.m. GMT before stalling.

• The afternoon consolidation held $ 2.83 to $ 2.87 before the sellers took control.

• The last hour drop made the price from $ 2.85 to $ 2.83 (-0.7%)leaving XRP to $ 2.83 closed.

Technical analysis

• Support: $ 2.77 Critical Floor of Flash Crash; Secondary level $ 2.82 reported for the Retest.

• Resistance: heavy supply area at $ 2.87, with lower ups forming a fashionable channel.

• Volume: 656.1 m in crash vs 105m AVG confirms institutional dumping.

• Trend: upper less than $ 2,856 and stockings of less than $ 2.83 establish a short -term droppings.

• Indicators: Momentum is biased, with a risk of failure to $ 2.75 to $ 2.70 if $ 2.82 fail.

What traders look at

• Can the $ 2.77 support survive a second test after the Flash crash?

• ETF Flows: Day Two will ask for the price or will it confirm a Sell-the-News event?

• Whale portfolio behavior after $ 812 million moved during the session.

• Fed rate reduction path and its impact on the liquidity of the dollar.

• BTC dominance at 57.7% – The rotation pressure on altcoins probably persists.