The

The move came amid sharp reversals in Bitcoin, US stocks and AI-related stocks, leaving altcoins exposed as liquidity dwindled and derivatives positioning was reset.

News context

- Crypto markets saw violent seesaw action in early US trading, with bitcoin briefly rising from $87,000 to over $90,000 before returning to the $87,000 zone.

- This reversal coincided with sharp losses in AI-related stocks including Nvidia, Broadcom and Oracle, down 3-6%, leading the Nasdaq down more than 1%.

- Sentiment weakened after reports that Blue Owl Capital pulled out of financing a $10 billion Oracle data center project, putting pressure on risk assets linked to AI infrastructure.

- The sudden swings triggered more than $190 million in cryptocurrency liquidations in four hours, with $72 million in long positions and $121 million in short positions, according to CoinGlass.

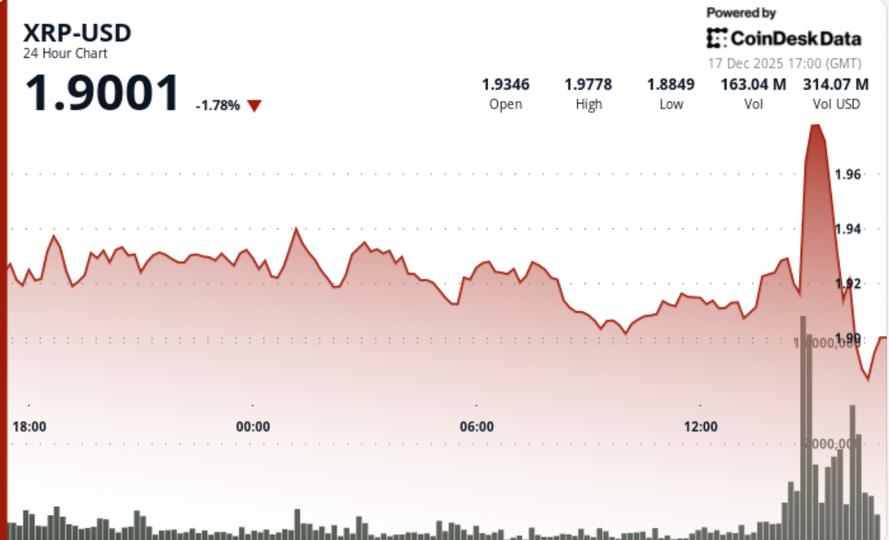

- XRP slightly underperformed the broader market as derivatives-driven flows hit mid-beta altcoins harder during the volatility spike.

Technical analysis

- Support: Immediate: $1.90, now the first line of defense Secondary: $1.75 – $1.64, deeper liquidity zone if $1.90 fails

- Resistance: Short term: $1.94 to $1.99, former support has become a bid Psychological: $2.00, now firmly rejected

- Volume Structure: A rejection near $1.9885 printed the highest volume of the session. High activity confirms distribution, not passive selling. No evidence yet of seller exhaustion.

- Trend Structure: Breaking below the key Fibonacci retracement moves the structure lower. Lower highs formed ahead of the rejection, signaling waning momentum. The consolidation is resolved to the downside.

- Momentum Check: Failure to tighten above $2.00 acted as a bull trap. Price acceptance below $1.94 keeps the bearish bias intact.

What traders are watching

- Whether $1.90 is valid, a clean breakout quickly exposes $1.75 to $1.64.

- Reaction if price retests $1.94 to $1.99 – rejection confirms trend continuation.

- Is macroeconomic volatility easing or continuing to force multi-asset deleveraging?

- Derivatives positioning after $190 million in liquidations – direction depends on who reloads first.

- Relative performance of XRP versus BTC if bitcoin stabilizes near $87,000