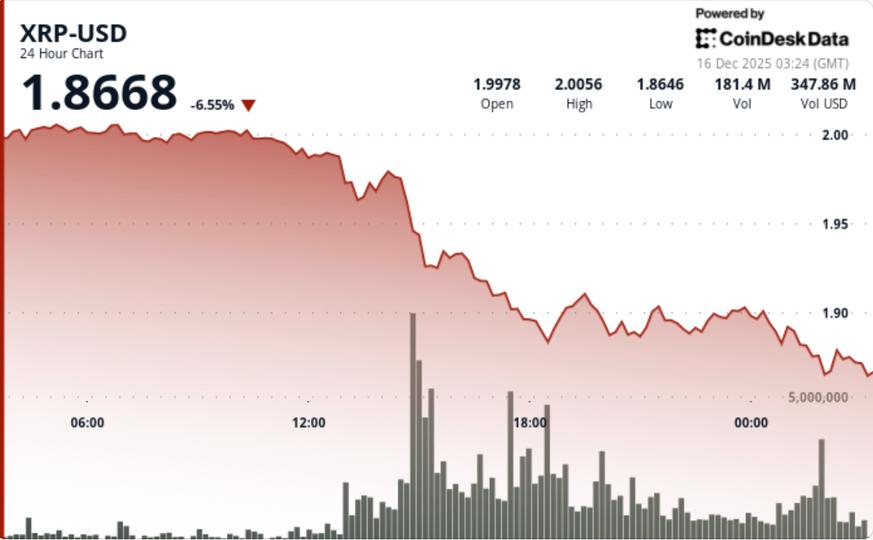

XRP lost a key technical level after a failed breakout attempt, with heavy volume confirming a move toward near-term bearish control.

News context

XRP fell 2.6% in the past 24 hours from $1.95 to $1.90 as broader crypto markets showed signs of fatigue. The move follows several failed attempts to maintain momentum above recent resistance, leaving XRP vulnerable once support levels are retested.

There were no new fundamental catalysts driving the sell-off. Instead, the move took place in a technically sensitive area, where positioning had developed following earlier rebound attempts. As price stalled near resistance, selling pressure re-emerged, crushing bids during the European trading session.

Technical analysis

The break below the $1.93 Fibonacci level marked a clear technical failure. This area had previously served as a pivot during consolidation, and its loss shifts the short-term structure in favor of sellers.

Volume increased sharply during the rejection, with turnover increasing 107% above daily averages, confirming that this development was due to active distribution rather than low liquidity drift. The attempted rally towards $1.95 showed early momentum with higher highs, but failure to hold above $1.92 triggered a systematic sell-off.

Structurally, XRP has moved from range expansion to range rejection. As long as the price remains capped below the $1.93 to $1.95 area, attempts to move higher are corrective rather than trend changes.

Price Action Summary

XRP traded in a $0.09 range during the session, initially pushing towards $1.95 before reversing sharply. Selling intensified once the price returned to the $1.92 to $1.94 range, with bids thinning near the lower limit.

After the outage, XRP stabilized near $1.90, where selling pressure eased and volume began to normalize. The hourly price action shows consolidation forming just above the $1.88-$1.90 area, although no strong reversal signals have emerged yet.

What Traders Need to Know

The $1.93 level now constitutes the first major resistance. Any recovery attempt must reclaim this area on strong volume to bring momentum back toward neutrality. Failure to do so keeps downside risk in play.

On the other hand, $1.88 to $1.90 is the immediate area to watch. An extended break below this base would expose deeper support levels, while a successful defense could allow XRP to consolidate ahead of the next directional move.

For now, volume behavior remains critical. Continued selling during rallies would confirm the ongoing distribution, while decreasing volume near support would suggest that the market is moving from breakdown to stabilization.