Heavy institutional selling wipes out $10 billion in market value as leverage unfolds in derivatives markets.

News context

- XRP saw one of its biggest one-day drops this month, plunging 6% from $2.49 to $2.41 between October 14 and 15. The drop follows sustained whale distribution, with 2.23 billion tokens – worth around $5.5 billion – moving onto exchanges since October 10.

- Futures open interest collapsed 50% to $4.22 billion, signaling forced deleveraging as market makers reduced their risk exposure amid continued macroeconomic and regulatory uncertainty.

Price Action Summary

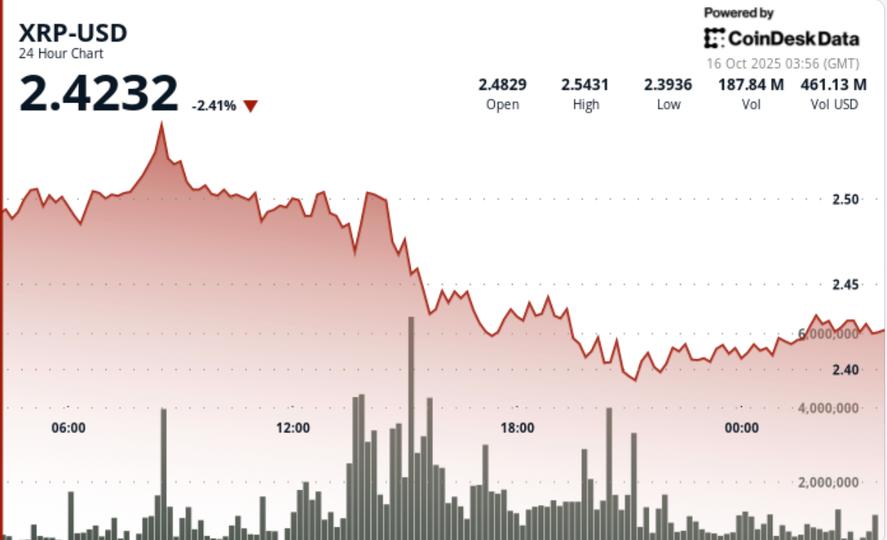

- XRP crashed from $2.56 to $2.41 during the 24-hour window ending October 15 at 8:00 p.m., marking a 6% decline and a trading range of $0.15 (6.3% intraday volatility).

- Intense selling pressure occurred from 1:00 p.m. to 3:00 p.m. as volumes increased from 119 million to 154 million.

- Support failed between $2.48 and $2.50, triggering cascading liquidations that pushed the price to $2.40.

- A brief attempt to recover to $2.44 around 7:27 p.m. was rejected; the price closed near the low at $2.41.

- Volumes in the final hour peaked at nearly 4.5 million, confirming capitulation before activity faded.

Technical analysis

- The break below $2.48 confirms a short-term trend reversal. Support now lies between $2.40 and $2.42, with intermediate resistance between $2.55 and $2.56 and a broader bid at $2.65.

- Volume-weighted metrics point to an institutional exodus rather than a retail panic. If $2.40 holds, expect leverage to normalize; a clear recovery above $2.55 would portend reaccumulation.

- Momentum oscillators remain oversold, but buyers have not yet increased their size. Funding rates on major derivatives platforms turned negative, reinforcing the bearish bias through midweek.

What traders are watching

- Can $2.40 support withstand further selling from whales or funds?

- Whether open interest rebuilds after a 50% drop – signal of stabilization or new shorts.

- Spot foreign exchange inflows versus outflows to assess whether accumulation resumes.

- Reaction close to resistance at $2.65 for any credible confirmation of a bounce.