XRP rose modestly as trading activity increased, although momentum indicators warn of near-term consolidation risk.

News context

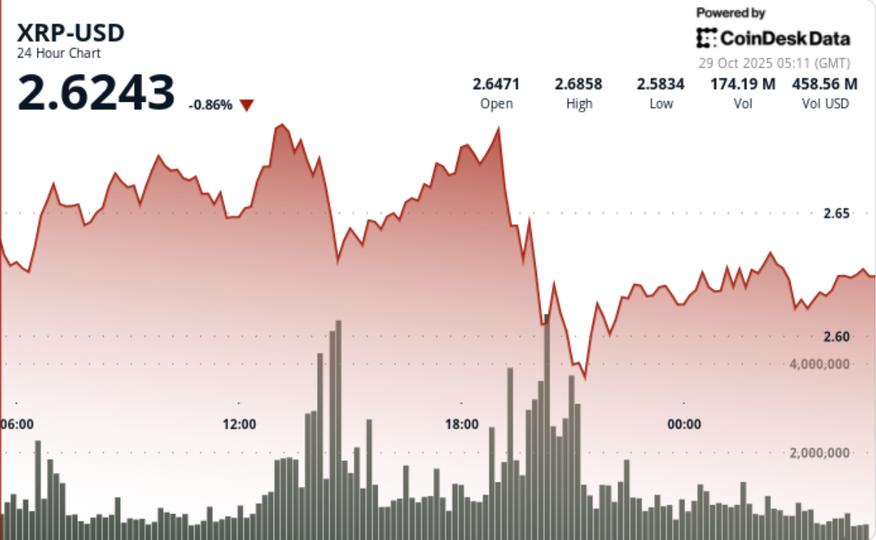

- XRP climbed 0.60% to $2.623, while trading volume jumped around 47% above its seven-day average, indicating increased institutional interest amid a lack of strong breakout catalysts.

- The token still faces resistance from a rejection near $2.68 and several analysts warn that while bullish chart trends exist, recent momentum could be capped.

Price Action Summary

- During the session, XRP traded within a range of $0.11, oscillating between ~$2.64 and ~$2.62.

- A peak volume of around 167.3 million tokens (≈140% above the 24-hour average) was recorded during the failed breakout near the $2.68 resistance.

- The psychological support level of $2.60 has held up despite several tests. This price action reflects a controlled accumulation rather than a complete breakout.

Technical analysis

- The attempted break above $2.68 was rejected, confirming that resistance remains firm.

- The support zone at ~$2.60 showed resilience, but momentum indicators, such as the TD Sequential, triggered signals of caution.

- The chart structure shows consolidation between $2.60 and $2.67, which may form the basis for a future move, but also warns of a possible short-term break.

- The increase in volume validates the interest, but the lack of a clear breakout suggests the move is still in setup mode.

What Traders Should Know

- Traders should check if XRP can maintain the support band around $2.60 to $2.63.

- A sustained close above $2.65 coupled with renewed volume would tilt the bullish bias and open targets around $2.70 to $2.90.

- Conversely, a break below around $2.60 would expose it to a retest of around $2.55 or lower.

- The upcoming ETF decision window and institutional flows remain key catalysts to watch.