Shiba Inu

The second largest Jeme in the world by market value, is negotiated on the lower territory under the cloud of Ichimoku after having faced a high volume sale during the night.

The Cloud Ichimoku, a technical indicator developed by a Japanese journalist in the 1960s, is used to analyze market trends, identify the levels of support and resistance and momentum. It is made up of several lines and a cloud -shaped area, which all provide an overview of potential price movements.

The multisgments above and below the cloud represent bull and lower changes in market trends.

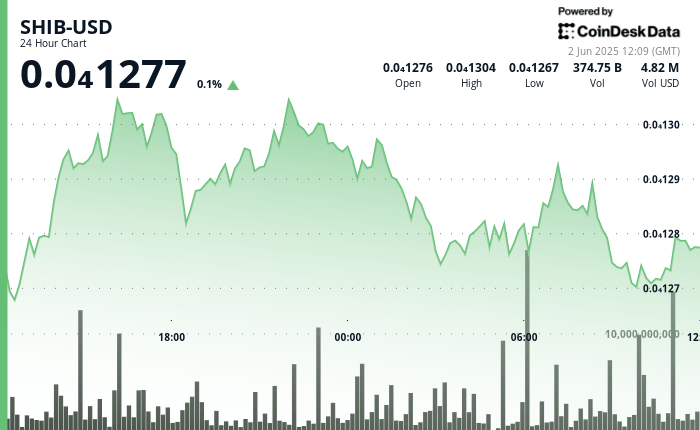

SHIB experienced a high volume sale at a key resistance at 0.00001307 Sunday between 6:00 a.m. and 10:00 p.m. UTC, and then fell to 0.00001274, remaining in the lower territory under the Ichimoku cloud.

Geopolitical tensions and changing trade policies continue to influence the markets of cryptocurrencies, Shiba Inu (Shib) demonstrating resilience in the midst of broader economic uncertainty.

While maintaining its higher scope, Shib is faced with significant resistance because global trade disputes have an impact on the feeling of investors in traditional and digital asset classes.

Key technical information

- The resistance of the keys appeared at 0.00001307, with high volume sales pressure during sessions of 4:00 p.m. and 10:00 p.m.

- Solid support formed at 0.00001275, supported by a volume greater than the average during the reversal of 3:00 am.

- During the last hour, SHIB experienced significant volatility with a significant price overvoltage of 0.00001289 to 0.00001293 during the period 07: 13-07: 19.

This bullish momentum has strongly reversed at 07:27, when prices dropped from 1.2% to 0.00001283, forming a clear resistance zone around 0.00001293. - The last 30 minutes have shown consolidation between 0.00001283 and 0.00001285, with a decrease in volume suggesting exhaustion after previous volatility.