Shiba Inu seeks to establish a foot above the simple 200-day mobile average (SMA) While whales increase their mastiff Stash at a summit of almost four years.

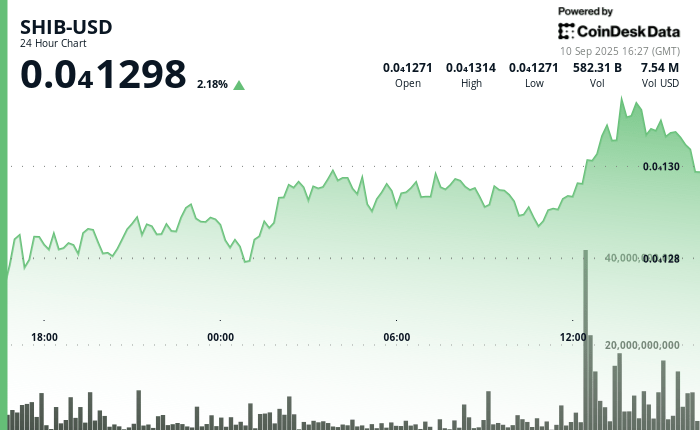

SHIB showed considerable force throughout the trading 24 hours a day, from $ 0.0000,1287 to 0.00001312, constituting a respectable assessment of 2%.

At the time of the press, the token exchanged near the 200 -day SMA of $ 0.00001300. An escape would confirm a passage from a lowering to a bullish trend, because the 200 -day SMA is widely followed as a long -term trajectory barometer. Note that the bulls have already failed twice in the past four weeks to guarantee break.

That said, the last attempt could succeed because it is marked by taking charge of trading volumes. According to the information model on the information on the Coindesk market, while Shib approached 200 -day SMA, volumes succeeded in an extraordinary 943.1 billion tokens, suggesting a deployment of institutional capital and validating the optimistic trajectory of the rupture.

Key technical information

- The prices appreciated from 0.00001287 to $ 0.00001312, which represents a gain of 2% over 24 hours.

- A substantial support was established near the level of $ 0.00001270, with a coherent emergence of buyers.

- Resistance penetration occurred at $ 0.00001300 at high level of high volume.

- Pinnacle session reached $ 0.0000,1316 over an extraordinary volume of 943.1 billion tokens.

- Psychological support threshold at $ 0.00001300 successfully defended throughout the rally phase.

- The token destruction rate experienced an extraordinary escalation of 1,682% with 1.3 million tokens withdrawn from traffic, while the activity of the Shibarium network has demonstrated a resurgence with daily transactions exceeding 1.2 million.

- The financial markets currently attribute 100% a probability to the reductions of American interest rates within eight days, the memems cryptocurrency derivatives presenting an increased institutional commitment, because an open interest in Shib appreciated 4%.

The Dogecoin whale hiding place increases

Mastiff The first throw of memes in the world per market value, has increased by more than 10% in a week, much higher by expectations for a SPOT DOGE ETF approval in the United States

The rally is marked by a sharp increase in the number of parts held by Doges whales.

According to Santiment, portfolios holding 1 m to 10 m Doge began to accumulate at the end of the August dump and have since increased their total assets to 10.91 billion Doge, a summit of almost four years, representing 7.23% of the same corner supply.