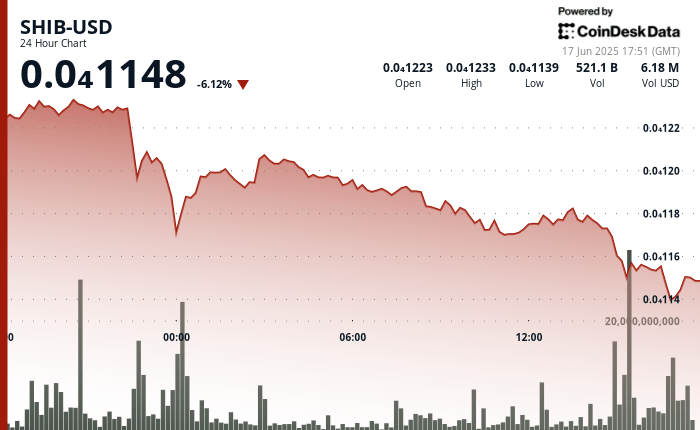

Shiba Inu (SHIB), the second largest Jeme in the world by market value, faced a sale pressure alongside losses on the wider cryptography market and American actions.

According to data source, according to data source Coindesk. Bitcoin, the main cryptocurrency by market value, slipped by almost 3% to $ 103,800. Risk aversion occurred after President Donald Trump has minimized reports from his administration requesting a truce with Iran and threatened the assassination of the Iranian supreme chief of Ayatollah Ali Khamenei, calling for the unconditional rebellion of Iran in the current war with Israel.

The drop in shib follows the resistance rejection of 0.00001230 Monday, which opened the sale with exceptionally high negotiation volumes greater than 1.2 billion tokens.

The support had briefly emerged at approximately 0.0000,000,167 early today, but was finally pierced by the bears, which reduced prices.

Market analysts note that SHIB’s performance reflects market trends in larger cryptocurrencies, which continue to be influenced by global economic factors and commercial disputes between major economies.

While traditional financial markets react to these tensions, cryptocurrencies and shibs face increased volatility while traders closely monitor the levels of support and resistance for the signs of directional movement.

Key ai Insights (Monday-tiesday)

- Erase the rejection at the level of resistance of 0.0000123 during the period of 20: 00-21: 00.

- Aggressive sale with an exceptionally high volume (1.23b and 1.31b) during the period of 22: 00-00: 00.

- Support emerged approximately 0.00001167, coinciding with high volume purchase interest.

- The lowering momentum seems to lose steam as prices have consolidated in the range of 0.00001176 to 0.00001182.

- Decrease in the obvious sales pressure in the decreasing volume profile.

- Increase in volatility in the last hour, forming a significant price structure between 0.000011175 and $ 0.00001182.

- The recovery attempt reached a local summit of 0.00001182 at 1:30 p.m., accompanied by a substantial volume (8.8b).

- The bullish momentum was short -lived while the sellers returned at 1:44 p.m., which dropped the price of 3% with an exceptional volume (9.7b).

- The last minutes show a consolidation of approximately 0.0000001175, with volatility and a decreasing volume suggesting the exhaustion of the sale pressure.