The native token of Oracle Network Chainlink Friday, by establishing a higher hollow, displaying a gain of 6.7% this week. The price action was supported by a series of news titles on institutions and protocols supporting the services of Chainlink.

Plasma (XPL) said on Friday that he joined Chainlink Scale, adopting the Oracle services of Chainlink for his blockchain focused on Stablecoin payments. The network has integrated the ChainLink (CCIP) transversal interoperability protocol, data flows and data flow services, supporting developers to create stablecoin use cases on plasma.

“By adopting the Chainlink standard and by joining the ChainLink scale program, Plasma shows how new layer 1 networks can be launched with the quality of business stablecoin infrastructure from the first day,” said Johann Eid, Chainlink Labs business director, the development organization behind Chainlink.

The news follows the Swiss Bank UBS starting a pilot with ChainLink earlier this week, integrating the CCIP protocol with the Swift messaging system for token fund operations.

Meanwhile, the ChainLink Reserve, an installation that buys tokens on the free market using the income from integration and protocol services, bought Thursday 46,441 links, which earns a total of 417,000 tokens, worth $ 9.5 million.

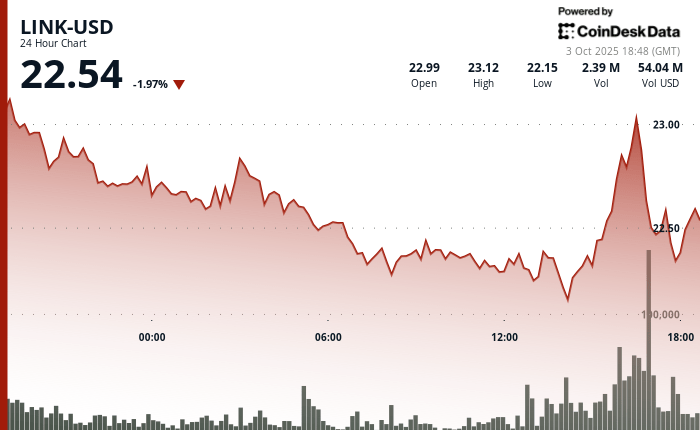

The technical indicators report an upward impulse returns for Link, establishing a lower clear resistance but in the face of resistance at $ 23, suggested the Coindesk Data search model.

- Link changed his hands into a fork of $ 0.96 between $ 22.13 and $ 23.09, which represents a fluctuation of 4.27% during the 24 -hour period.

- Critical support established at $ 22.13 with substantial purchase interests with a high volume of 1,409,489 units, above the daily average of 1,178,000.

- The token has dug a light lower pattern, suggesting a boost renewed to the resistance area of $ 23.10.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.