- SK HYNIX sees the demand for a long -distance memory to increase by 30% per year until 2030

- American prices may not affect manufacturers of South Korean fleas thanks to the main American investments

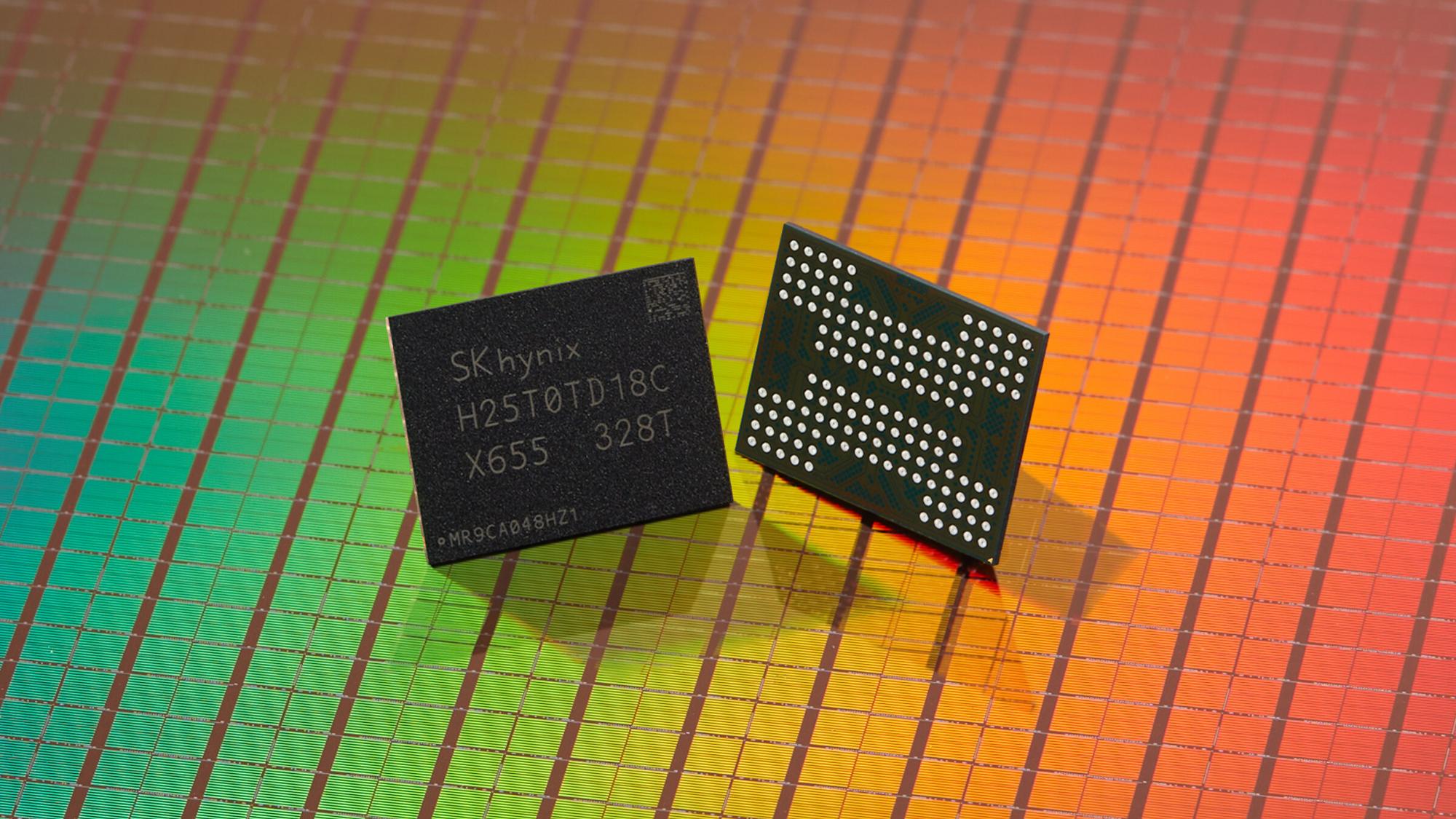

- HBM technology stacks chips vertically for greater efficiency and reduced energy consumption

SK Hynix provides rapid expansion in the AI memory segment, estimating an annual growth rate of 30% for high bandwidth (HBM) memory until 2030.

The projection of the company intervenes in a context of uncertainty surrounding the potential American prices of approximately 100% on the chips of semiconductors of the nations without American manufacturing operations.

While US President Donald Trump said the pricing plan is targeting “all tokens and semiconductors entering the United States”, South Korean officials said SK Hynix and Samsung Electronics would not be subject to measures due to their ongoing and planned American investments.

Market prospects and strategic orientation

Choi Joon-Yong, HBM business planning manager at SK Hynix, said: “The AI request from the end user is almost very firm and solid … Each customer has a different taste.”

“We are confident to provide, to make the right competitive product to customers,” he added.

He also suggested that capital expenses of the main cloud service providers such as Amazon, Microsoft and Google could be revised upwards.

Choi believes that the correlation between the expansion of AI infrastructure and HBM demand is direct, although factors such as energy availability has been taken into account in forecasts.

Addressing PK Press Club, the company provides that the personalized HBM sector will reach tens of billions of dollars by 2030, drawn by the performance requirements of advanced AI applications.

This specialized dram technology, introduced for the first time in 2013, stacks chips vertically to reduce energy consumption and physical imprint while improving the effectiveness of data processing.

SK Hynix and competitors, including Samsung and Micron Technology, develop HBM4 products that integrate a “basic matrix” for memory management, which makes the substitution of rival products more difficult.

Currently, the biggest customers like NVIDIA receive highly personalized solutions, while small customers often count on standardized conceptions.

The position of the company as the main HBM supplier of Nvidia underlines its influence in the material space of the AI.

However, Samsung recently warned that short -term HBM3E production could exceed the growth in market demand, which could pressure prices.

Despite the current pricing discussions, SK Hynix market confidence remains stable.

The company is investing in American manufacturing capacity, including an advanced fleas packaging factory and a research installation on Indiana AI, which could help save commercial disturbances.

South Korea flea exports to the United States were evaluated at $ 10.7 billion last year, with HBM expeditions to Taiwan for packaging increasingly increasing in 2024.

While SK Hynix’s optimism reflects the expected increase in IA infrastructure expenses, market analysts highlight the cyclic nature of the semiconductor industry, where excess pressures and prices are recurring challenges.

The company’s ability to provide competitive products on an increasingly shaped market by personalization could determine its resilience.