Crypto’s big rally from Monday’s lows stalled in early U.S. action Wednesday as tech stocks quickly slipped on a disappointing AI-related report.

According to an article in The Information, Microsoft was reducing its sales quotas for artificial intelligence software. The software giant, the story continues, has lowered expectations for its next wave of AI products – “agents” – after slower-than-expected adoption by customers this year.

As a result, sales quotas for some AI tools have been lowered across several divisions, including Microsoft’s Azure cloud unit, after missing their growth targets in 2025. This comes after AI powerhouse OpenAI also cut its forecast for revenue from AI agents over the next five years earlier this year.

The market reaction was swift, with Microsoft (MSFT) falling nearly 3% on the news, and the Nasdaq 100 going from a gain of around 0.5% to a decline of 0.5%.

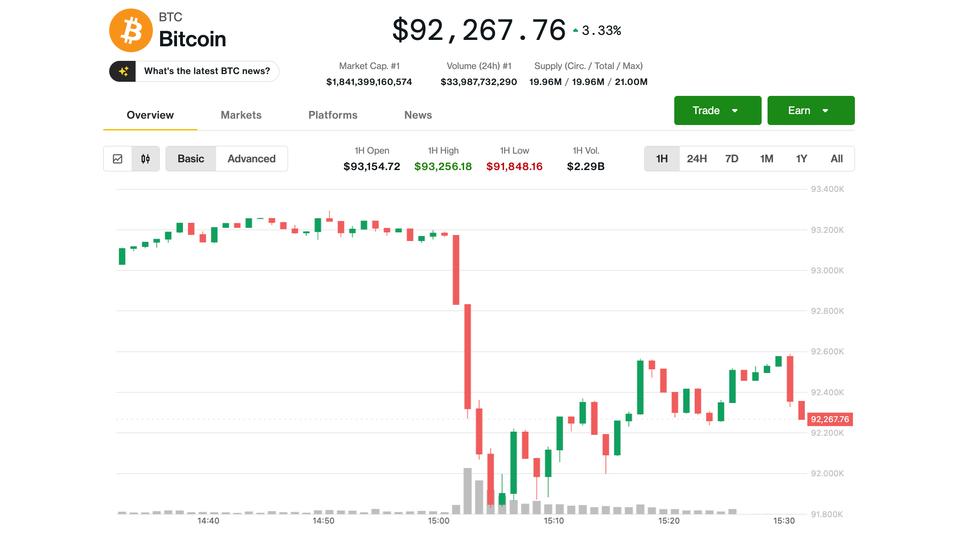

Cryptocurrency prices, closely correlated in recent weeks with falling technology stocks, fell in sympathy. BTC, trading above $93,000 overnight, immediately fell to $91,800. Recently, it was changing hands at around $92,300, still up 3.3% over the past 24 hours. Ethereum Ether slipped 1.8% from its session high, holding above $3,000.

Bitcoin mining stocks showed quiet movement in pre-market trading. Iren (IREN) slipped about 2%, while Cipher Mining (CIFR) and Core Scientific (CORZ) each fell about 1%. TeraWulf (WULF) remained stable.

Elsewhere in crypto-related stocks, MicroStrategy (MSTR) gained around 2% and Coinbase (COIN) rose 1%. New market entrants Circle (CRCL) and eToro (ETOR) increased by 2% and 3%, respectively.