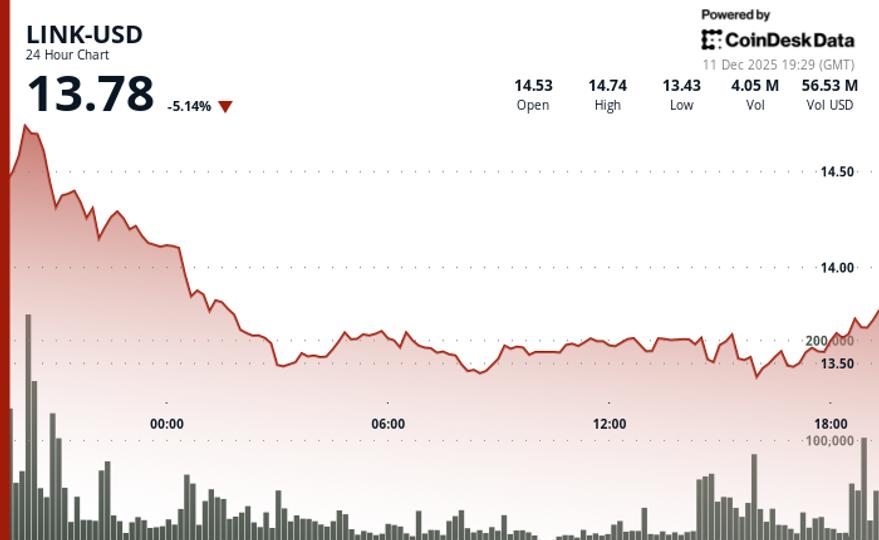

Chainlink’s LINK token fell nearly 5% in the past 24 hours to $13.74 on Thursday, reversing early gains despite a major announcement from Coinbase.

Earlier today, Coinbase revealed that it had selected Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to power a new bridge connecting its $7 billion in wrapped assets, including cbETH, cbBTC, and cbDOGE. The move marked a major institutional endorsement of Chainlink’s cross-chain infrastructure and its positioning in the tokenization space.

Separately, Nasdaq-listed digital asset treasury company Caliber (CWD) said it has started staking its LINK holdings for yield, starting with a rollout of 75,000 tokens.

Despite the headlines, overall market conditions dampened sentiment. Weak altcoin momentum and renewed concerns over the Federal Reserve’s rate outlook contributed to LINK’s decline from Wednesday’s high of $14.46 to Thursday’s low of $13.43.

However, bottom signals began to form towards the end of the session. Trading volume jumped 20.4% above the 7-day average, with a burst of more than 340,000 LINK traded between 6:42 p.m. and 6:45 p.m. UTC, according to CoinDesk data.

Accumulation patterns appeared just above key support at $13.46, suggesting institutional positioning amid broader weakness, technical analysis tool CoinDesk Research noted.

Key technical levels Signal stabilization

Support/Resistance:

- Main support: $13.46 (low session)

- Resistance: $14.88 (recent rejection zone)

- Psychological resistance: $14.00

Volume analysis:

- A late session peak of 340,000 tokens (2,000%+ above session average) confirmed renewed buying interest.

- Overall daily volume increased 20.4% above the weekly average

Chart templates:

- Consolidation between $13.43 and $13.67 after early selling

- Last hour breakout to $13.76 suggests possible near-term bottom

Targets and risk/reward:

- A break above $14.00 could target $14.38 and $14.88.

- Not holding $13.46 risks falling back towards $13.20.

Disclaimer: Parts of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.