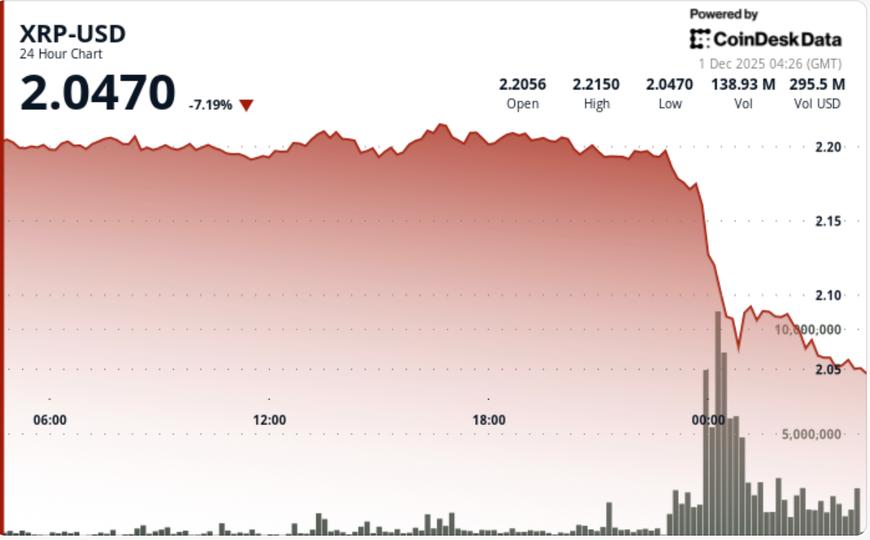

Le XRP a plongé de 7 % à 2,05 $ alors qu’une violente vague de ventes institutionnelles a franchi les niveaux de support critiques, maîtrisant les forts afflux d’ETF et forçant le jeton à revenir dans sa fourchette de correction de novembre.

• XRP spot ETF inflows reached $666.6 million this month, led by 21Shares’ new TOXR listing.

• Foreign exchange supply fell 45% over 60 days, showing large-scale accumulation

• Whale wallets added 150 million XRP since November 25 despite the latest outage

• Selling pressure intensified on Tuesday as risk assets largely weakened.

Despite the expansion of institutional infrastructure around XRP, short-term flows have become strongly bearish. ETF demand proved unable to counter the significant derivatives unwind and sell-off during the afternoon session. Market liquidity weakened as broader crypto benchmarks softened, accelerating the decline.

The break below $2.16 marked a decisive failure of XRP’s recent consolidation structure. This level has served as a pivot over the past three weeks, making its loss a key signal that sellers are regaining momentum.

The move pushed XRP back into a descending channel defined by consecutive lower highs of $2.38, $2.30, and $2.22. The structure reflects increasing control by the bears, with each rebound producing decreasing follow-through.

The volume confirmed the legitimacy of the distribution, reaching 309.2 million, more than 4.6 times the moving average. This level of activity is generally a sign of institutional output rather than noise. Several new intraday tests of $2.05, each accompanied by more than 3 million spikes, showed buyers defending the psychological bottom, but with no confirmed reversal.

Momentum indicators reflect deep short-term oversold conditions, but not enough divergence to indicate a completed correction wave. The $2.05 to $2.00 zone remains crucial; its loss exposes November’s largest demand band between $1.80 and $1.87.

XRP fell from $2.21 to $2.05 in a sharp 7.2% decline. The most aggressive selling occurred after the drop from $2.16, triggering cascading liquidations to the close. Volume jumped to 309.2 million, up 464% from the daily average, confirming intense distribution.

The hourly candles formed a descending channel with lower highs and tightening range behavior. Several failed rallies near $2.12 indicated continued selling pressure. Buyers repeatedly absorbed declines to $2.05, but without strong enough momentum to reclaim broken support.

• It is essential to hold $2.05; a breakdown then exposes $1.87 to $1.80

• Reclaiming $2.16 is necessary to invalidate the bearish structure.

• ETF inflows support long-term outlook, but near-term band remains heavy

• Watch for bullish divergence on the hourly RSI and MACD as early reversal signals.

• A high volume recovery from $2.12 to $2.16 would indicate accumulation is resuming.