Oracle Network native token Sun has flowed at its lowest price since the beginning of August, abandoning the gains of the past few weeks in the middle of a broader weakness of the cryptography market.

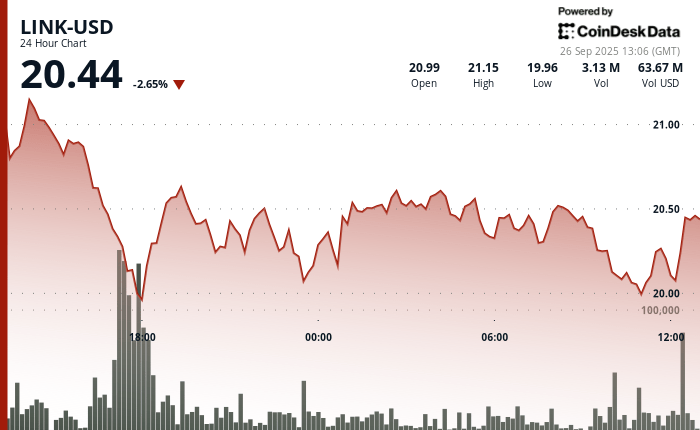

Link fell briefly less than $ 20 several times during the night from Thursday to Friday, decreasing about 4% in the last 24 hours and down almost 28% compared to the vertices of August.

This decision occurred despite a coherent purchase activity. Thursday, the Caliber wealth management company (CWD) bought additional $ 4 million in liaison tokens as part of its digital asset treasury strategy. With the latest purchase, the company brought Total Link Holdings to $ 10 million, according to the press release.

The ChainLink Reserve, an installation that buys tokens using integration income and protocol services, withdrawing free market offer, also bought almost 47,903 links on Thursday, worth a little less than $ 1 million at current prices. The initiative has bought more than 370,000 tokens ($ 7.5 million) since its August launch.

Despite the downward trend, Link shows signs of slamming the downward trend with the defense of buyers of the price level of $ 20, suggested the model of technical analysis of Coindesk Research. However, bulls must cross the subsequent resistance cluster around $ 20.57 for a more persistent change in trend.

- Price movement: Link fell 5% from $ 21.16 to $ 19.95 before rebounding at $ 20.26, with substantial intraday fluctuation with business support at the $ 20.00 psychological barrier.

- Macroeconomic influences: The volatility of wide-based cryptocurrency reflected the feeling of risk aversion, because bitcoin fell below $ 109,000 and the main altcoins fell.

- Microeconomic components: an in progress volume of negotiation exceeding 5 million units during the institutional participation suggested by the sale, while the following recovery on continuous purchase interest indicates a robust underlying appetite for the liaison tokens.

- Volume assessment: suspended volume of 5,031,849 units during the decline created company support at $ 19.95.

- Support areas: essential support region identified between $ 19.95 and $ 20.00 with multiple successful validations.

- Resistance objectives: subsequent resistance cluster positioned nearly $ 20.57 with intermediate resistance at $ 20.30 – $ 20.35.

- Momentum signals: Optimistic measured movement formation indicates a sustained ascending momentum capacity.