In the financial markets, startups have long sought to market themselves as “technological companies” hoping that investors will appreciate them with multiple technology. And often they do it – at least for a while.

Traditional institutions have learned that hard. Throughout the 2010s, many companies rushed to reposition themselves as technological companies. Banks, payment processors and retailers began to be called Fintech or data companies. But few have won the multiple evaluation of true technological companies – because the fundamentals rarely corresponded to the story.

WeWork was among the most sadly famous examples: a real estate company disguised as a technological platform which ultimately collapsed under the weight of its own illusion. In financial services, Goldman Sachs launched Marcus in 2016 as a digital platform to compete with consumer Fintech. Despite the early traction, the initiative was reduced in 2023 after persistent profitability problems.

JPMorgan declared himself famous “a technological company with a banking license”, while BBVA and Wells Fargo have invested massively in digital transformation. However, few of these efforts have produced an economy at the level of the platform. Today, there is a cemetery of these corporate technological delusions – a clear reminder that no brand quantity can prevail over the structural constraints of commercial or regulated business models.

The crypto is now faced with a similar identity crisis. The protocols DEFI want to be valued like layer 1. The DAPPs of real assets (RWA) present themselves as sovereign networks. Everyone continues layer 1 “technological premium”.

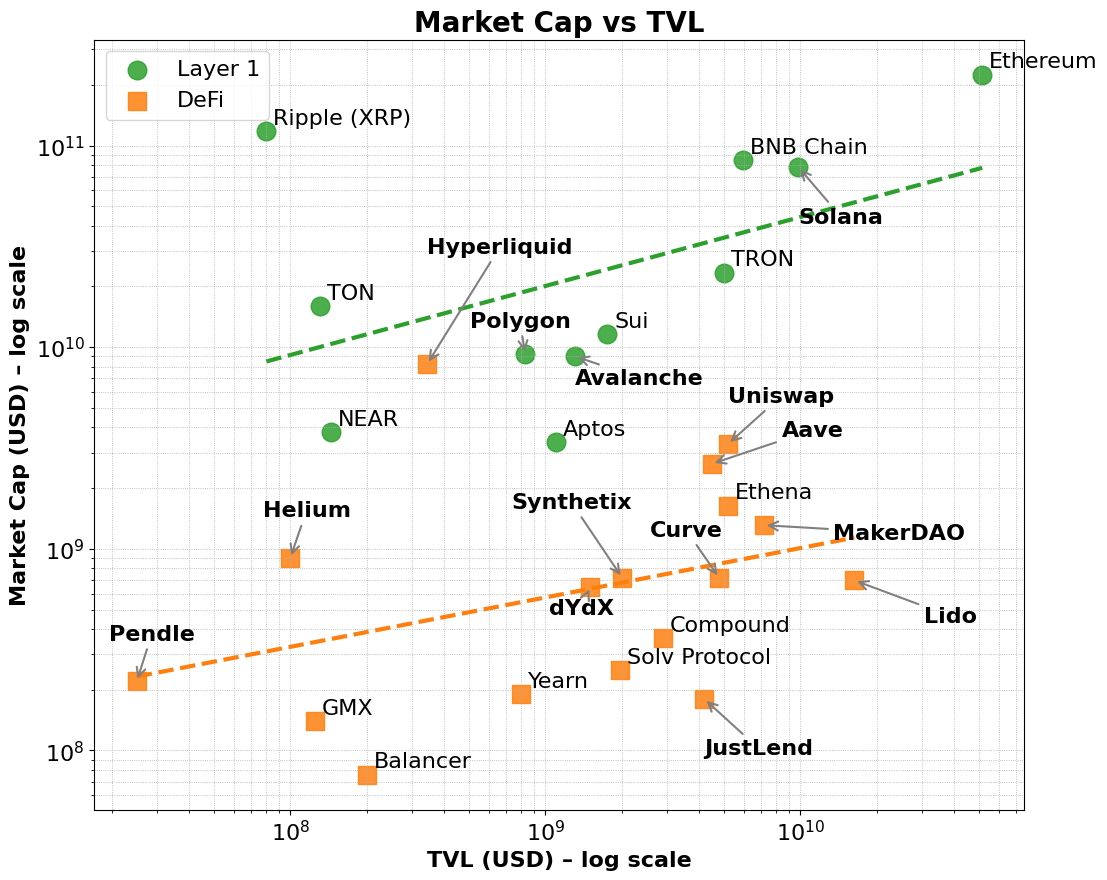

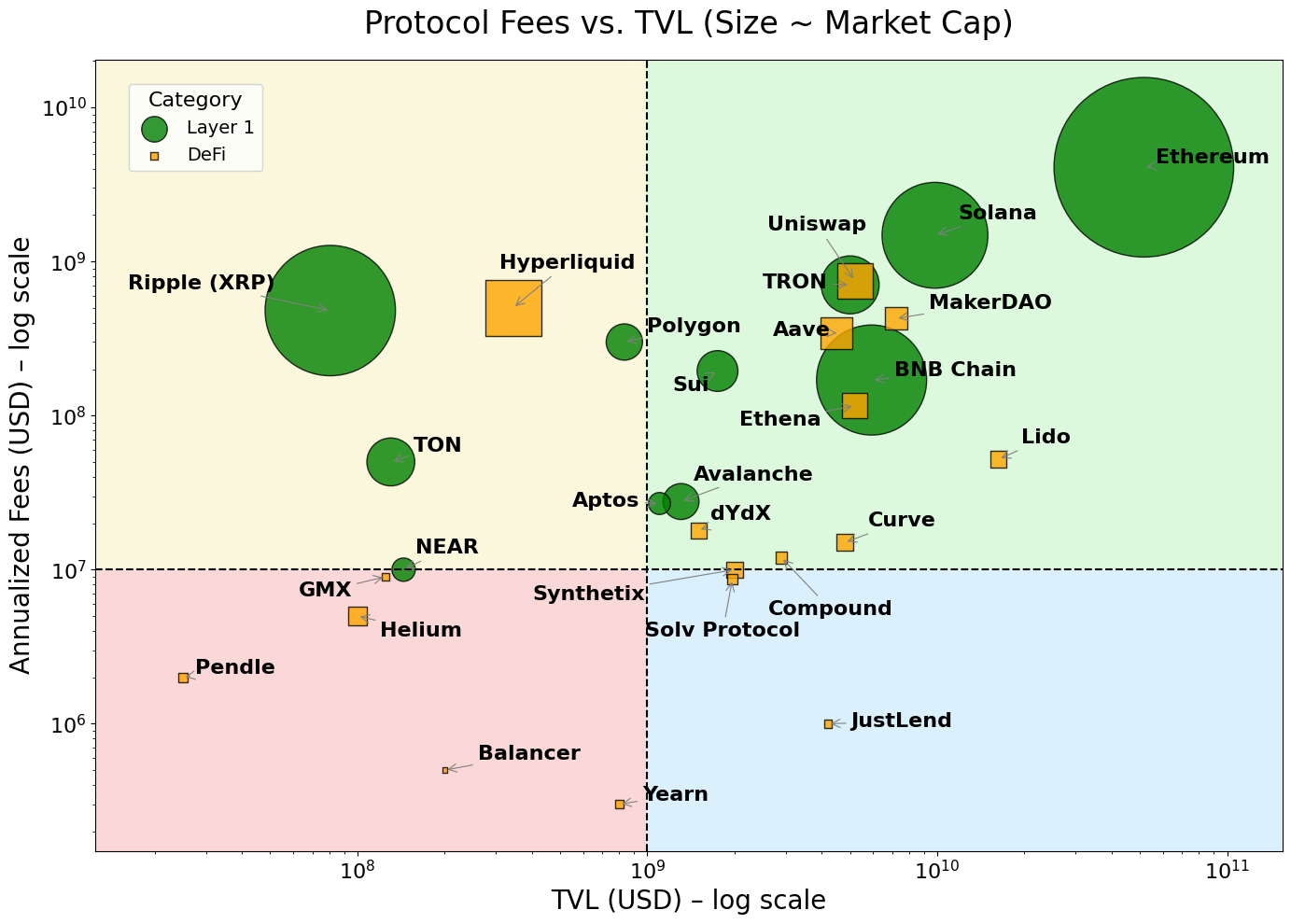

And to be fair – this bonus is real. Layer 1 networks such as Ethereum, Solana and BNB systematically control higher evaluation multiple, compared to metrics such as the total locked value (TVL) and the generation of costs. They benefit from a broader market story – the one that rewards infrastructure on applications and platforms on products.

This premium even holds during the control of the fundamentals. Many DEFI protocols have a high generation of TVL or fees, but still have trouble reaching comparable stock markets. On the other hand, layer 1 attracts the first users through valid incentives and native token economy, then develop in developer ecosystems and composable applications.

In the end, this premium reflects the capacity of layer 1 for a wide use in native token, the coordination of the ecosystem and long -term extensibility. In addition, as the volume of costs increases, these networks often see disproportionate increases in market capitalization – a sign that investors not only tariff current use, but the future effects of the potential and the composition of the networks.

This coat steering wheel, going from the adoption of infrastructure to the growth of ecosystems, helps to explain why layers 1 systematically command higher assessments than DAPPs, even when underlying performance measures seem similar.

This reflects how the stock markets distinguish the platforms from the products. Infrastructure companies like AWS, Microsoft Azure, Apple App Store or Meta developers ecosystem are more than service providers – they are ecosystems. They allow thousands of developers and companies to build, evolve and interact. Investors affect multiple higher not only for current income, but for the potential to support emerging use cases, network effects and economies of scale. On the other hand, even the SaaS tools or very profitable niche services rarely attract the same evaluation premium – their growth is limited by the limited composibility of API and close utility.

The same model is now played among suppliers of large -language models (LLM). Most run to position themselves not as chatbots, but as a fundamental infrastructure for AI applications. Everyone wants to be AWS – not Mailchimp.

Direction 1 in the crypto follow a similar logic. These are not just blockchains; These are coordination layers for decentralized calculation and state synchronization. They support a wide range of composable applications and assets. Their native tokens accumulate value by the activity of the basic layer: gas costs, stimulum, mev and more. Above all, these tokens also serve as mechanisms to encourage developers and users. Direction 1 benefits from self -reinforcing loops – between users, manufacturers, liquidity and chip demand – and they support vertical and horizontal scaling between the sectors. Read the full article here.

Most protocols, on the other hand, are not infrastructure. These are single -use products. Thus, the addition of a set of validators does not make them in layer 1 – it simply dresses an infrastructure optics to justify a higher evaluation.

This is where the Appchain trend enters the image. The appchains combine the application, the logic of the protocol and a layer of settlement in a vertically integrated battery. They promise a better capture of costs, user experience and “sovereignty”. In a few cases – like hyperliquid – they deliver. By controlling the complete battery, the hyperliquid has reached rapid execution, an excellent UX and a generation of significant costs – all without counting on tokens incentives. Developers can even deploy DAPPs on its underlying layer 1, taking advantage of its high performance decentralized exchange infrastructure. Although its scope remains narrow, it offers an overview of a certain level of potential for wider.

But most appchains are simply protocols that try to rename, with little use and no depth of ecosystem. They fight a war on two fronts: trying to build both infrastructure and a product simultaneously, often without the capital or the team to do well. The result is a fuzzy hybrid – not a fully efficient layer 1, and not a DAPP defining the category.

We have already seen it. A robot-advisor with a smooth user interface was always a wealth manager. A bank with open APIs was always a balance company. A coworking company with a polite application only rented offices. Finally, media threshing is attending – and the market resumes accordingly.

Rwa protocols are now falling into the same trap. Many are positioned as an infrastructure for tokenized finance – but without significant differentiation of the existing layer 1 or the sustainable adoption of users. At best, these are vertically integrated products without convincing need for a sovereign settlement layer. Worse, most did not reach the market produced in their case of basic use. They bolt the infrastructure and look at swollen stories, hoping to justify the assessments that their economy cannot support.

So what is the way to follow?

The answer is not false infrastructure status. It is a question of having your role of product or service – and of executing it exceptionally well. If your protocol solves a real problem and stimulates significant TVL growth, it is a solid base. But TVL alone will not make you a successful appchain.

What matters most is a real economic activity: TVL that stimulates the lasting generation of costs, user retention and a clear value accumulation for native token. In addition, if the developers rely on your protocol because it is really useful – not because it claims to be an infrastructure – the market will reward you. The platform status is won, not claimed.

Some DEFI protocols – such as Maker / Sky and Uniswap – follow this path. They evolve towards appchain style models that improve scalability and access to networks. But they do it from a position of strength: with established ecosystems, clear monetization and an adjustment of the product market.

On the other hand, the emerging RWA space has not yet demonstrated lasting traction. Almost all RWA protocols or centralized services rush to launch an apptchain – often supported by a fragile or not tested economy. As with the main protocols DEFI transitioning to an apptchain model, the best path to go for RWA protocols is to first take advantage of the existing layer 1 ecosystem, to create a traction of users and developers who lead to TVL growth, to demonstrate a generation of sustainable fees and to evolve then to an appchain infrastructure model – with a clear use and strategy.

Consequently, in the case of an appchain, the usefulness and the economy of the underlying demand must pass first. It is only once these are proven that the transition to a sovereign layer 1 becomes viable. This contrasts with the growth trajectory of layer 1 for general use, which can initially prioritize the construction of a validator and a merchant ecosystem. The generation of early fees is motivated by native token transactions, and over time, cross -scale market is expanding the network to include developers and end users – ultimately stimulating TVL growth and diversified costs.

As the crypto matures, the fog of the narration rises and investors become more demanding. Fashionable words like “appchain” and “layer 1” no longer pay attention to themselves. Without a clear value proposal, a sustainable token economy and a well -defined strategic trajectory, the protocols do not have the fundamental elements required for any credible transition to real infrastructure.

What crypto needs – especially in the RWA sector – is no more layer 1. It needs better products. And the market will reward those who focus on construction exactly.

Figure 1. VS TVL stock market for deffi and layer 1

Figure 2. The layers 1 are grouped around higher costs and DAPP around the lower costs