Global economic tensions and the uncertainties of trade policy continue to create volatility on the cryptography market, a soil which sails by these challenges than many alternatives.

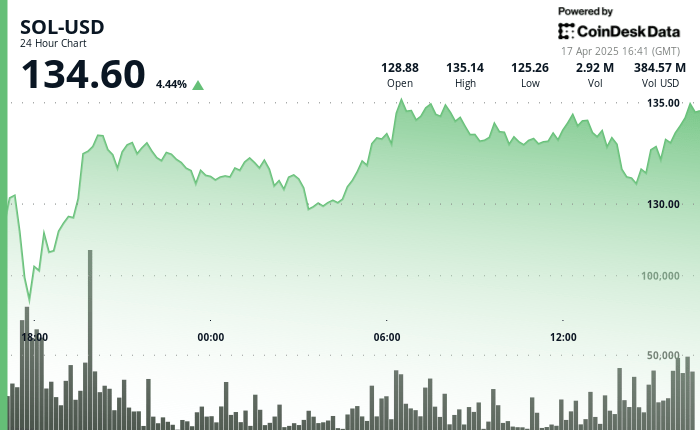

The price of Solana Token increased by more than 4% on Thursday, while the wider market gauge, Coindesk 20, increased by around 3%.

The fork from $ 125 to $ 127 for Sol has become a critical support area which has managed to reject several attempts to decline, while the area from $ 133.50 to $ 133.60 represents significant resistance, according to the Technical Analysis model of Coindesk Research.

Blockchain data shows more than 32 million soil (more than 5% of the total offer) accumulated at $ 129.79, which established it as a crucial pivot point for a future price action.

Strengths of technical analysis

- Sol has established a well -defined support area between 125 and $ 127, which managed to reject several attempts to decline.

- The price demonstrates strong resilience, recovering 4.5% compared to its lowest April 16 from $ 123.64 to $ 135.57, establishing a clear trend.

- Canada launched the first Solana ETF spot in North America on April 16, published by asset managers, in particular 3iq, purposes, Evolve and CI, stimulating institutional interest.

- Solana recovered first place from the Dex activity, exceeding Ethereum after a gain of 16% over seven days, with a total locked value (TVL) increasing by $ 7.08 billion.

- The volume analysis shows a particularly strong accumulation during the overvoltage of April 16, with more than 3 million negotiated units, the price broke out with the level of resistance of $ 130.

- The Fibonacci of High Fibonacci of April 14 ($ 136.01) at the bottom of April 16 suggests that the recent gathering recovered the critical level of 61.8%.

- In the last 100 minutes of negotiation, Sol has a significant drop correction, going from $ 134.11 to $ 130.81, representing a drop of 2.5%.

- The sale intensified around 14: 03-14: 07, when the volume increased spectacular to more than 92,000 units during a candle in a single minute.

- A strong resistance area at $ 133.50 at $ 133.60 has rejected several recovery attempts.

- Notable ventilation occurred at the support level of $ 132.00, triggering cascade liquidations.

- Prices have now traced beyond the level of fibonacci of 78.6%, which suggests a potential continuation to the support area from 125 to $ 127 if the lower time persists.

Warning: This article was generated with AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy. This article may include information from external sources, which is listed below if necessary.

External references:

- “The basis of Solana’s cost moves strongly: $ 129 appears as a key pivot area”, published on April 16, 2025.

- Newsbtc, “Solana retests the Bearish rupture zone – Target of $ 65 still at stake?” Posted on April 17, 2025.

- Cointelegraph, “Why is Solana up this week?” Posted on April 12, 2025.

- Cryptopotato, “Solana (floor) jumps 7% per day, Bitcoin (BTC) Eyes 85K $ again (Market Watch)”, published on April 17, 2025.

- Cointelegraph, “Solana Price is up 36% compared to its Crypto crash – $ 180 Sol is the next stop?” Posted on April 16, 2025.