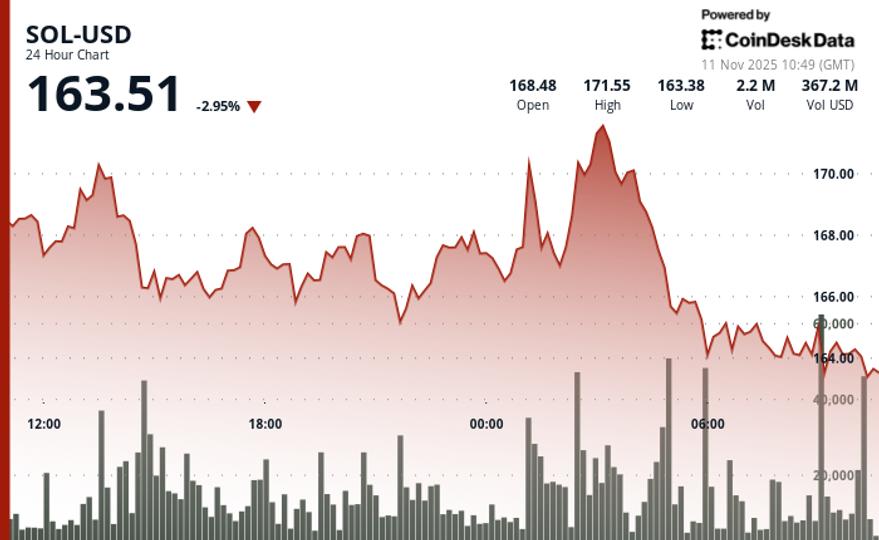

According to CoinDesk Research’s technical analysis data model, solana fell 3.1% to $164.30 during Tuesday’s session as the token broke through critical technical support levels.

SOL rose from $169.54 to $164.26 in the 24-hour period ending November 11 at 09:00 UTC, establishing a clear downtrend structure with several rejection points above $170.

The selling accelerated during Asian trading hours with significant volume accumulation. Trading activity surged 58% above the daily average as SOL tested the crucial $163.85 support zone. The session’s $8.06 range represented 4.9% volatility, with the largest volume spike occurring at 06:00 UTC with 1.47 million shares traded.

SOL underperformed the broader crypto market by 1.42% compared to the CoinDesk 5 Index (CD5), signaling targeted selling pressure on the token. A recent 60 Minutes analysis showed an aggressive bullish reversal that quickly collapsed, with SOL falling from $164.07 to $164.97 before giving up gains during a sharp sell-off at $163.46. This seesaw action highlighted the fragility of any upward momentum within the established downtrend.

The technical breakdown occurred without clear fundamental catalysts, suggesting that profit-taking and momentum-driven selling dominated the price action. Institutional flows remained mixed, with overnight accumulation patterns conflicting with diurnal distribution activities.

Technical failure vs support defense

While SOL broke through the psychological $165 level as volume patterns showed high selling interest, near-term price action focuses on whether the $163.50 area can hold as demand emerges. The downtrend structure remains intact, with highs below $170.48 and $171.92 providing overhead resistance.

Momentum indicators deteriorated throughout the session as each rally attempt weakened. Volume analysis revealed that selling pressure intensified during retests of highs, while bounces attracted only minimal buying interest, confirming the short-term bearish bias.

Key Technical Levels Signal Vulnerability for SOL

Support/Resistance: Critical support is now tested at $163.50 after the $165 breakout, while strong resistance remains at $170.50 with several failed breakout attempts.

Volume analysis: A significant volume spike occurred at 1.47 million shares (58% above the 24-hour average) when support was broken, with selling pressure peaking at 66,399 shares during the 09:16 UTC decline.

Chart templates: Downtrend structure established with highs below $170.48 and $171.92, followed by technical support failure and deteriorating momentum.

Risk/Reward: The $163.50 level represents the next critical test for the bulls, with technical indicators suggesting continued bearish pressure towards the $160 psychological support zone.

Analysis of the CD5 market: institutional rotation in a context of limited action

CD5 fell 1.63% from $1,851.31 to $1,821.19 during the 24-hour period, experiencing high volatility with an intraday range of $52.78 between $1,868.63 and $1,816.85, while institutional buying emerged during the overnight sessions, supporting the recovery after technical support of 1 $817.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.