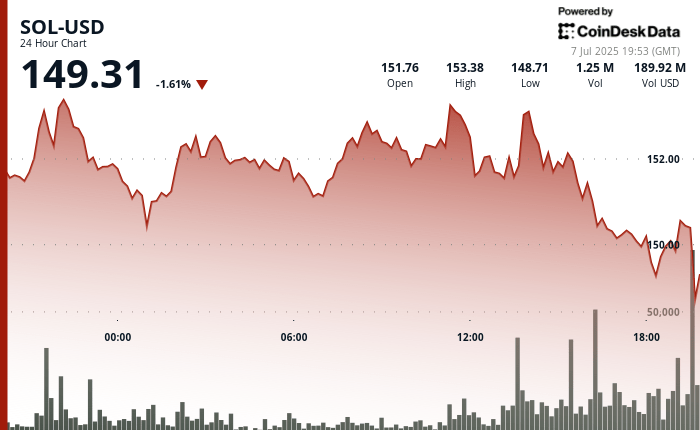

Solara (GROUND) decreased by 1.45% in the last 24 hours, going from $ 151.41 to $ 149.21 between July 6 at 7:00 p.m. UTC and July 7 at 6:00 p.m. UTC, according to the Coindesk Research technical analysis model. As for the wider market of cryptography, with regard to the Coindesk 20 index It is down 0.56% in the last 24 -hour period.

The token exchanged in a range wide of $ 4.58, culminating at $ 153.67 before a net sale leads the prices below the psychological level of $ 150. Increased volume near the session, a low buyer interest suggested in the $ 149 support area, helping soil to recover slightly at $ 149.31 at the end of the period.

Despite recent short -term weakness, the new data on the chain highlights the growing force of the Solana network.

According to data from the Artemis analysis platform, Solana equaled the active monthly addresses combined with all other L1 and L2 blockchains in June 2025. This user growth is accompanied by record network income, with Solana generating more than $ 271 million in Q2 2025, according to blockworks data. It was the third consecutive quarter of the blockchain leading all the income chains of the network, which consists of transaction costs and advice outside the protocol.

Together, these measures highlight Solana’s position as one of the most used blockchain in industry, both in terms of real users and economic flow. The coherent increase in network revenues also strengthens the sustainability of the solana fees model and ecosystem activity, even in the midst of volatile market conditions. While developers and users continue to adopt Solana’s high -speed infrastructure, these long -term value trends could support resistance at short -term prices.

Strengths of technical analysis

- Sol fell 1.45% from $ 151.41 to $ 149.21 between July 6 at 7:00 p.m. UTC and July 7 at 6:00 p.m. UTC.

- The negotiation range lasted $ 4.58 (3.07%)With a session summit of $ 153.67 and a hollow of $ 149.09.

- A major resistance was formed at $ 153.67 following a volume peak of 925,497 tokens during the hour 9:00 p.m. UTC on July 6.

- Over the past four hours, the price has decisively broken below the psychological level of $ 150 with a heavy volume, confirming the feeling of short -lived.

- Between 5:41 p.m. and 6:40 p.m. UTC on July 7, Sol went from $ 150.27 to $ 149.72.

- A strong sale occurred from 6:16 to 6:17 pm UTC, the price reaching $ 149.42 on a volume greater than 57,000 tokens.

- Buyers defended the $ 149 support area in the last minutes, triggering a 0.37% rebound in the low session.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.