Token native of Solana, soil

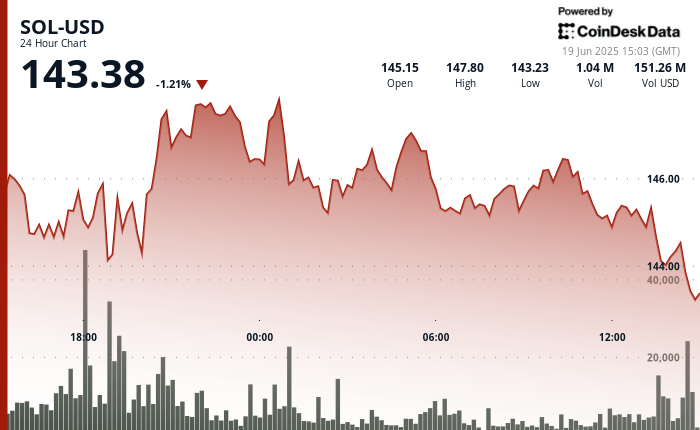

fell to $ 143.38 Tuesday, down 1.21%, ending near the lowest of the day after failing above $ 147, according to the Technical Analysis model of Coindesk Research.

The weakness occurred while the ecosystem attracted a new institutional support: the strategies of the Canadian Blockchain Sol have deposited with the Securities and Exchange American commission on June 18 to continue a registration at the NASDAQ under the Ticker Stke.

Although the deposit itself is not an immediate market engine, it highlights an increasing institutional commitment to the long-term perspectives of Solana. Sol Strategies revealed earlier this month that it has more than 420,000 soil, worth more than $ 61 million and has made the ground center for its cash strategy. The company is also asking for regulatory approval in Canada to collect up to $ 1 billion, in addition to a convertible ticket emission of $ 500 million in April, acquire and mark soil.

Despite these bullish signals, soil continues to negotiate defensively. The price action was confined to a horizontal strip for a large part of last week, the most recent attempted rupture greater than $ 147.80 not generating follow -up. The Bears resumed control during the last hours of negotiation, pushing soil below the psychological support of $ 144. With the price of prices below the major medium of moving and the volume shrinking in the middle of the session, the feeling remains fragile even if the long -term support intensifies.

Strengths of technical analysis

- Sol has exchanged a 24 -hour range of $ 143.23 at $ 147.80, a swing of 2.83%.

- The resistance took place at $ 147.80 after a failed escape during the UTC candle at 10:00 p.m. on June 18.

- The price has decreased regularly to $ 143.38, ending near the hollow after low recovery attempts.

- The sellers were active between 13: 46 and 14: 00 UTC, with a drop from $ 144.62 to $ 143.38 on a strong drop.

- The area from $ 144 to $ 145 remains critical; Not to recover it can open a path to deeper support nearly $ 140.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.