Sol, the native token of Solana, hovered just below $ 200 early Wednesday after a wave of bullish developments – including a great business accumulation and bold analysts’ projections – a renewed momentum in the sixth most precious cryptocurrency by market capitalization.

On Monday, the Consumer Upexi Inc. brand platform (Upxi) revealed that it had acquired an additional 100,000 soil, bringing its total assets to 1,818,809 soil worth around 331 million dollars. The company listed by the NASDAQ financed the purchase thanks to an increase on the actions and convertible tickets of $ 200 million, marking its third successful capital round since the launch of its Sol Treasury strategy in April.

In a press release, Upexi said that more than half of his tokens were bought in locked form at a reduced price, which led to an unparalleled gain of $ 58 million when taking into account the appreciation of the tokens and the reduced acquisition cost. Almost all of its soil is now marked out, the company plans to generate up to $ 26 million in annual return depending on the current rate of 8%.

Upexi CEO Allan Marshall has developed the strategy as a leading model for the management of the Altcoin treasury on public procurement. “We think that positions Upexi as an optimal vehicle for investors looking for exposure to digital assets,” he said. The company has also introduced a new evaluation reference which it calls “basic MNAV”, calculated as the ratio of market capitalization of the value in dollars of soil held. As of July 18, Upexi was negotiated at 1.2x its value of net soil assets.

The news of the company coincided with an upward forecast of the popular pseudonym analyst of “Christiaan” cryptography, which posted on X that Solana “is ready for a massive pump” and could reach $ 400 at $ 500 on this Haussier market.

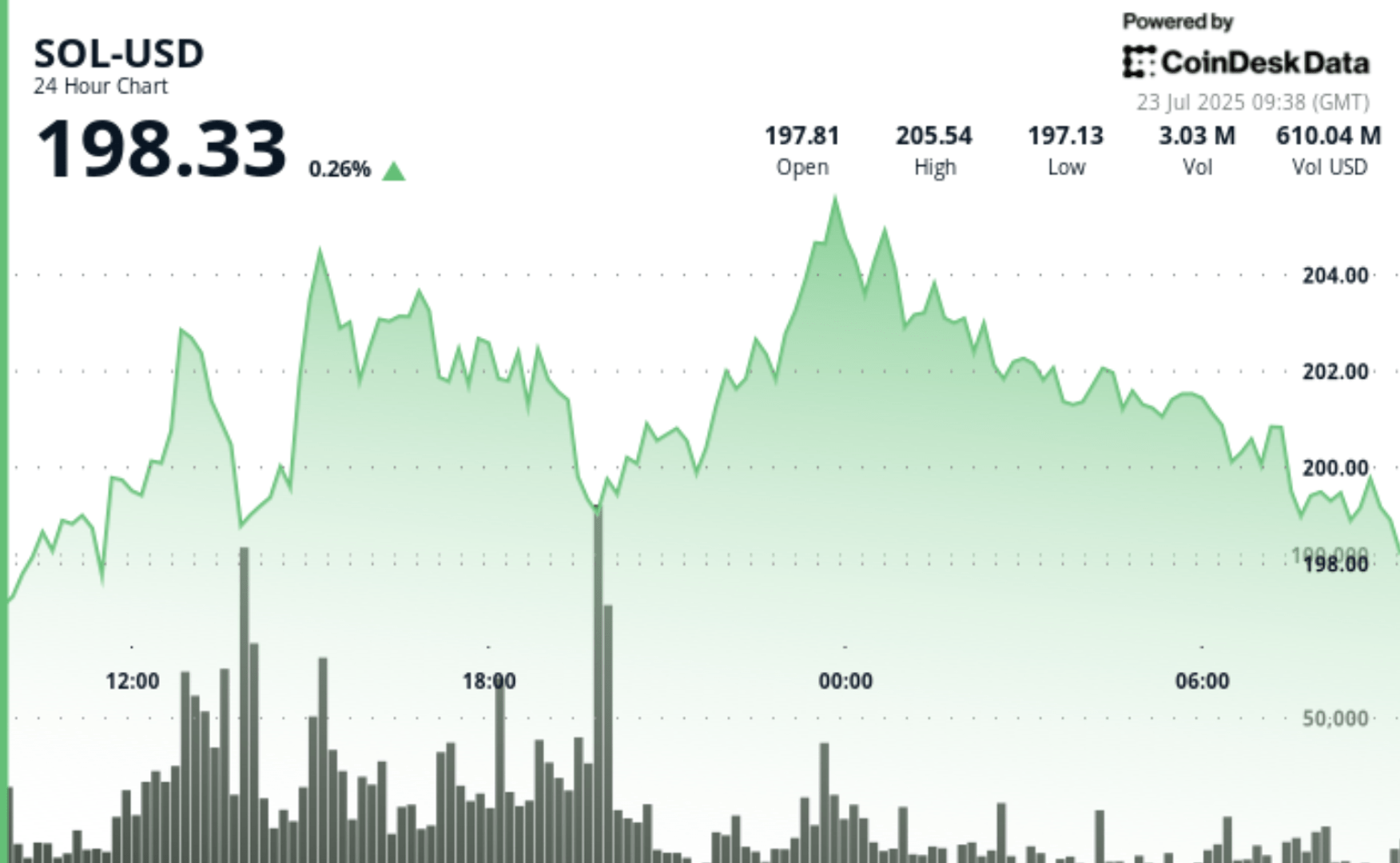

At the time of writing the editorial staff, Sol is negotiated at $ 198.33, up 0.26% in the last 24 hours, according to Coindesk data. The token joined 20% in last week, 30% in the last two weeks and 47.6% in the last month, making it one of the main most efficient assets on the cryptography market this quarter.

Strengths of technical analysis

- According to Coindesk Research technical analysis data, Sol was exchanged in a beach of $ 11.48 from July 22 at 9:00 am UTC at July 23 at 8:00 am UTC, culminating at $ 205.99.

- The volume increased to 3.77 million units at 1:00 p.m. UTC on July 22, forming high resistance at $ 203.81.

- Sol rose from $ 200.04 to $ 198.95 in the last hour, raising the level of support of $ 200 as the institutional sale emerged.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.