Solana soil

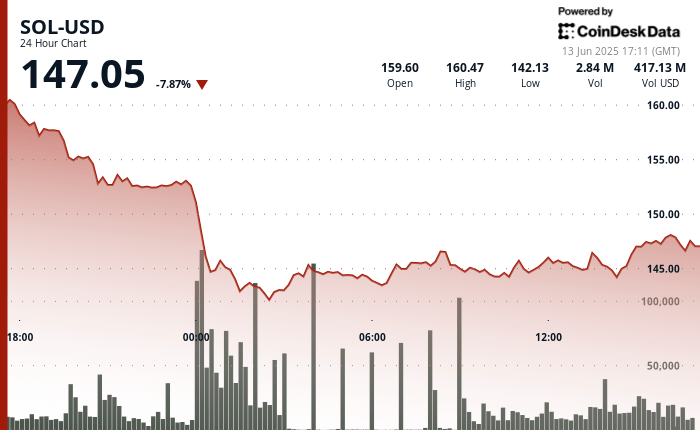

fell from 7.87% to $ 147.07 in the last 24 hours, while traders reacted to renewed volatility in cryptographic markets. After opening $ 159.60, Sol fell strongly at the end of Thursday and early Friday, reaching a hollow of $ 142.13 before stabilizing above the $ 147 bar. The key peaks of intrajournual volume suggest a certain accumulation close to support, but the overall structure remains fragile because the token is negotiated at almost 40% below its marching.

Short -term weakness emphasizes a target at the end of May of the Global Research Team of Standard Charterd. In a note of May 27, initiating official soil coverage, the bank plans that Solana would reach $ 275 by the end of the year, with a long-term objective of $ 500 by 2029. The report cited the speed and efficiency of Solana as a basic differentiators, but has recognized a large part of its recent activity focused on the same-body remains highly updated by the market.

The growing gap between upward perspectives and current market conditions illustrates the basic dilemma faced with long -term soil investors: whether to treat recent prints as a temporary noise or as a fundamental rejection of the growth story. While Standard said that Solana expected to underline the short-term ether, he positioned the token as a strong beta bet on retail ecosystems that could strongly reassess if the adoption extends beyond mecoins.

For the moment, the price of the prices remains jerky, the buyers walking nearly $ 143 but respecting the resistance nearly $ 150. The question of whether soil can find an upward -in -time traction to validate even part of the end -of -year forecasts may depend on wider macro stabilization and a renewed activity on the chain in the coming weeks.

Strengths of technical analysis

- Sol fell from 11.87% intraday, from $ 160.49 to a hollow of $ 142.13.

- An intense sale occurred between 23: 00 and 01: 00 UTC before the stabilization of prices.

- A tight consolidation range was formed between $ 143.50 and $ 146.50.

- Bases higher since 02:00 suggest a possible increased divergence.

- The volume culminated at 13:31 (31.8K Sol) and 13:39 (43.4K Sol) as buyers defended support.

- Resistance is $ 152; An above rupture could change the short-term trend.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.