Solara

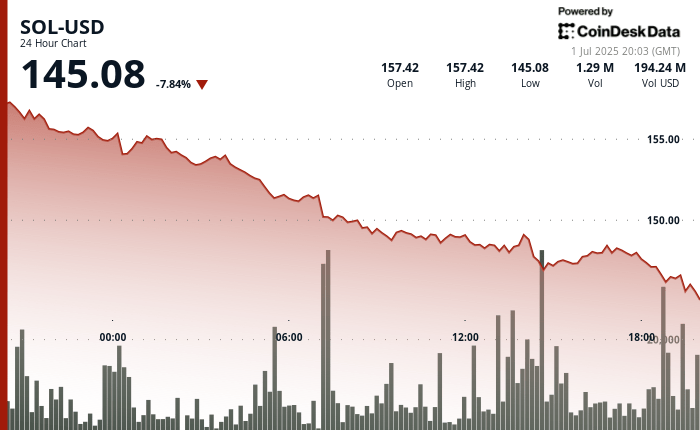

decreased by 7.84% in the last 24 hours, trading at $ 145.08 at 20:03 UTC on July 1, 2025, according to the Technical Analysis model of Coindesk Research; During the same period, the larger cryptography market, indexed by the Coindesk 20, dropped only by 0.24%.

The clear drop in soil occurs one day before an important step for the ecosystem: the launch of the FNB Rex-Osprey Sol + Striking.

Presented to make its debut on July 2, 2025, the ETF Rex-Osprey Sol + Striking (Ticker: SSK) is the first fund negotiated by the United States to provide direct exposure to the Solana’s native token while providing access to stalement. Unlike traditional crypto ETFs that only follow the price, this fund allows holders to passively benefit from the solana assistance proof system.

About 80% of FNB assets will be allocated to soil, with around 50% of these tokens actively. The fund is structured under the 1940 investment companies law, a framework generally considered to be more favorable from a regulatory point of view than the law of 1933. The structure of the law of 1940 can improve investors and accelerate approvals, which may influence a broader institutional participation.

Analysts say that this launch represents a major step for Solana’s credibility among American financial institutions. By integrating the generation of elements directly into the FNB, it offers a more complete exposure to assets than the points of monitoring of points. Some market players believe that this could serve as a catalyst for long -term adoption, in particular as other companies, especially in gray levels, in Vaneck and by pursuing similar and SF applications.

However, despite the launch pending ETFs, Sol experienced a large base pressure on Monday, stressing the prudent market position before the event.

Strengths of technical analysis

- Sol refused $ 12.34 in the last 24 hours, from $ 157.42 to $ 145.08 – a loss of 7.84% with a price range of $ 12.34.

- Strong resistance was encountered at $ 157.42 during the first hour of the analysis window, followed by constant sales pressure throughout the session.

- The largest volume peak occurred during the hour 06:00 of the UTC, exceeding 1.57 million units, with a price rejection nearly $ 151.50.

- Uptport emerged at $ 146.55 during the hour of 2:00 p.m. UTC, also coinciding with a high volume, indicating the accumulation interest around this level.

- In the last hour of the analysis window from 7:01 p.m. to 8:00 p.m. UTC, Sol went from $ 146.31 to $ 145.08, reaching its lowest price of the day.

- The action of the prices has formed a well -defined descending channel, characterized by lower ups and lower stockings over the entire negotiation period.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.