Solara

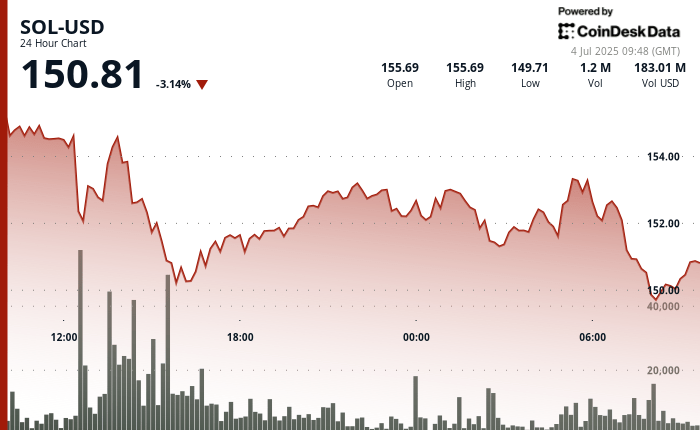

decreased by 3.36% in the last 24 hours, going from $ 155.69 to $ 150.81, according to the Technical Analysis model of Coindesk Research, in the middle of wider market pressures, even if institutional developments in Asia signal an increasing dynamic for blockchain,

One of the most progressive banks in Japan has launched a new initiative that could extend the real applications for Solana’s infrastructure.

Minna Bank, a digital native bank and a subsidiary of Fukuoka Financial Group, has announced a new research collaboration with Fireblocks, Solana and Tis to assess how stabblecoins and web portfolios can reshape the finance of consumers in Japan. The joint study will focus on use cases such as payments, banking infrastructure on chain and user experiences adapted to the mobile population first of the country.

The company in the commandity occurs while the stablescoins exceed $ 250 billion in market capitalization, arousing increased interest in banks that seek to modernize cross -border payments, deposits and settlement processes. The CEO of Fireblocks, Michael Shaulov, stressed that the project could unlock new efficiency in the way the value is transferred through the digital economy.

Minna Bank’s clientele is mainly between 15 and 39 years old – underestimated by traditional banks – making it a candidate of choice to test solutions based on stables. The bank’s approach, which integrates financial services into daily expenditure models, reflects its banking strategy as a service.

Although Solana’s price continues to negotiate below its recent highs, initiatives like this highlight its appeal as a platform for business and fintech innovation. With the FNB Rex-Osprey Solana + Stoking ETF recently launched and Development Corp. Expolving its solutions, institutional confidence in the ecosystem does not seem discouraged by short -term volatility.

Strengths of technical analysis:

- Sol fell from 3.36% from $ 155.69 to $ 150.46 over the 24 -hour period of July 3 at 10:00 a.m. to 9:00 a.m.

- Rice share varied between $ 155.79 and $ 149.13, indicating 4.28% intraday volatility.

- The resistance appeared at $ 153.77 during July 4, 05:00 in a high volume.

- Support held firm at $ 149.13 in 8:00 a.m., with high purchase activity.

- A recovery phase started in the last 60 minutes, from soil from $ 149.97 to $ 150.57, a gain of 0.40%.

- The price formed a mini-time with higher stockings after having broken resistance from $ 150.20 to 9:03.

- The volume increased to 08:50 (24,245 units) and 09:15 (22,894 units)confirming the momentum upwards.

- Soil stabilized above $ 150.63 with low resistance in the immediate path.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.