Solana (soil) remains under pressure as macroeconomic opposite – in particular renewed tariff concerns – investors’ confidence.

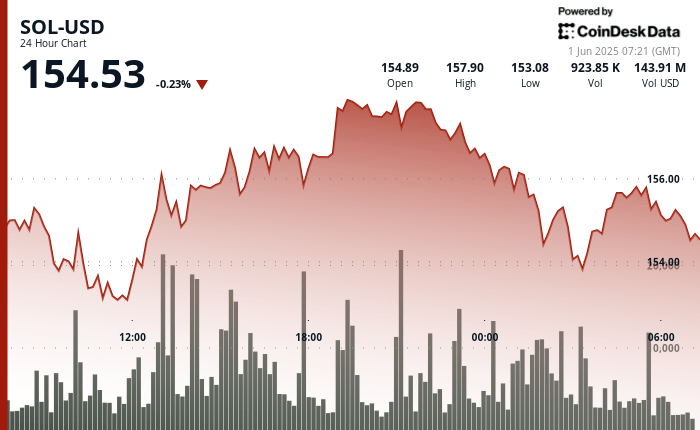

The token now oscillates about $ 154.50 after establishing a tight negotiation range between $ 152.33 and $ 158.06, reflecting a 3.76% swing in the last 24 hours, according to the Technical Analysis Data model of Coindesk Research.

Although higher stockings previously suggested resilience, Sol has gone from $ 156.74 to $ 154.86 in one hour, breaking under its trend channel upon height in mid-April.

The derivative data reflects the lowering feeling: the interest open in the soil term contracts is down 2.47% to $ 7.19 billion, while long liquidations increased to $ 30.97 million, which indicates pressure on lever -effect positions. Short liquidations remain minimal, strengthening the lower bias.

However, institutional interest remains obvious. The recent $ 250 million USDC mint from Circle sur Solana added liquidity and ceased chain management to the chain, with 34% of the entire volume of Stablecoin now routed via the network. In addition, the signals of the validator fund of $ 1 billion in strategies have maintained long -term confidence in the scalability of the protocol, even if short -term price action vacillates.

Strengths of technical analysis

- Sol has established a range of 5.73 points ($ 152.33 at $ 158.06), indicating an intraday swing of 3.76%.

- An earlier price action has drawn a clear ascending channel with solid support nearly $ 152.80, supported by a strong accumulation. SOL reached a session of $ 158.06 during the 19:00 in a strong volume, signaling an anterior bruise.

- A reversal took place early in the morning, the soil from $ 156.74 to $ 154.86 increasing the sale pressure. The sale pressure culminated between 01: 53–01: 54, with more than 74,000 units exchanged in a strong explosion.

- The short -term momentum has become lower because the lower summits and the lower volume have defined the final trading section. As writing, Sol is consolidated nearly $ 154.50, suggesting price stability but with a risk of decline if the volume does not improve.

External references