The actions correction could be completed according to a key technical indicator and this could be good news for Bitcoin (BTC), which has also violated similar resistance.

For 1.7% on Monday to follow the winnings last week, the S&P 500 has exceeded its mobile average at 200 days (200 DMA), after having corrected up to 10% in recent months. This 200 DMA is calculated by taking the average of closing prices in the last 200 days of negotiation and is often used to assess larger market trends and potential turns.

The S&P 500 crossed this gauge for the last time on March 10, and – although it has decreased a little shortly after – has taken up an upward trend that continued today.

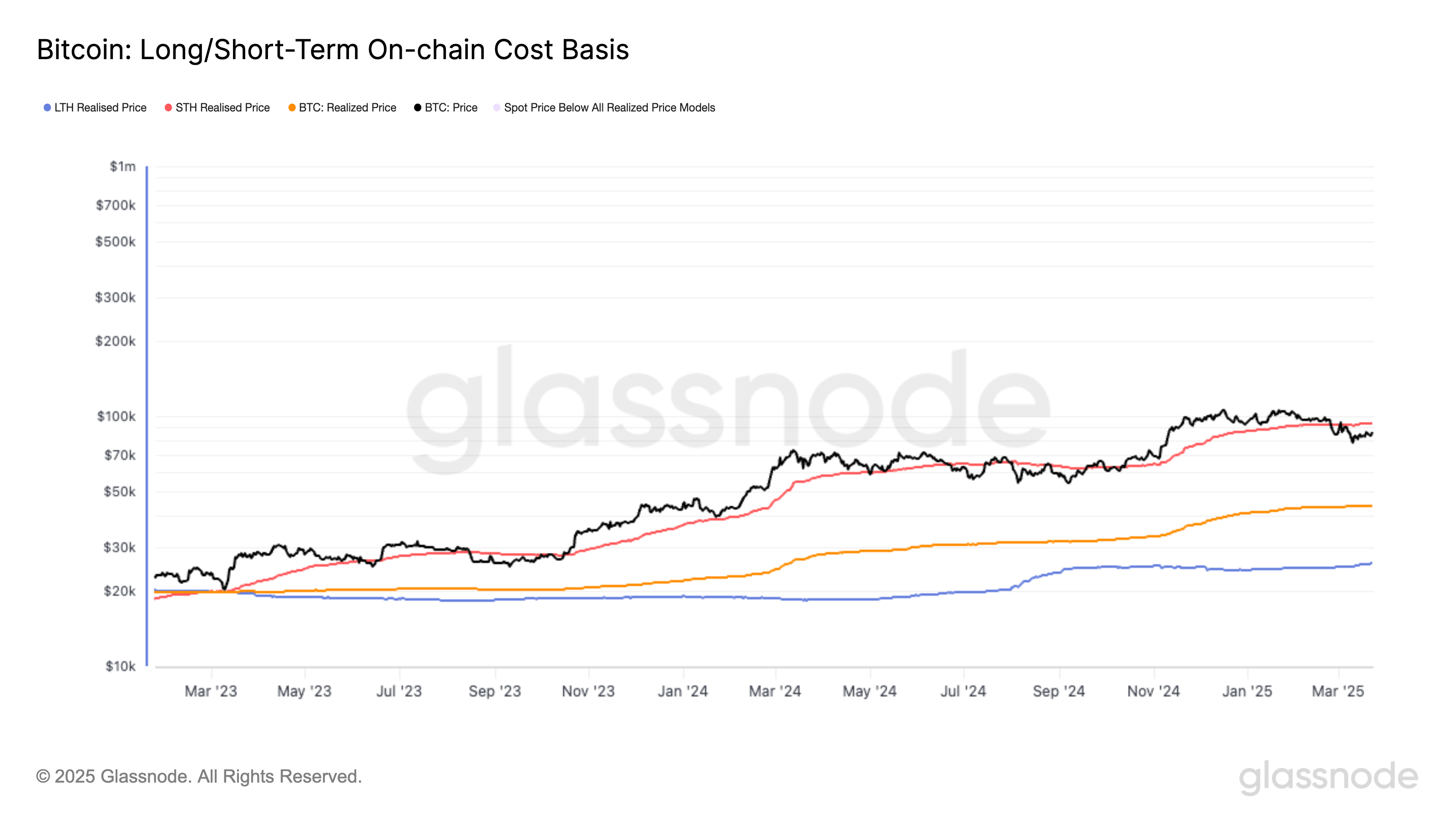

Bitcoin (BTC) moved to STEP, now negotiating above $ 88,000 after having decisively allowed its own DMA 200 of $ 85,046 during the weekend. The next level of major resistance is $ 93,245, which corresponds to the price made of the short-term holder-that is to say the average acquisition cost on the chain of parts held outside the exchange reserves and has moved in the last 155 days. These pieces are considered to be the most likely to be devoted to a given moment.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.