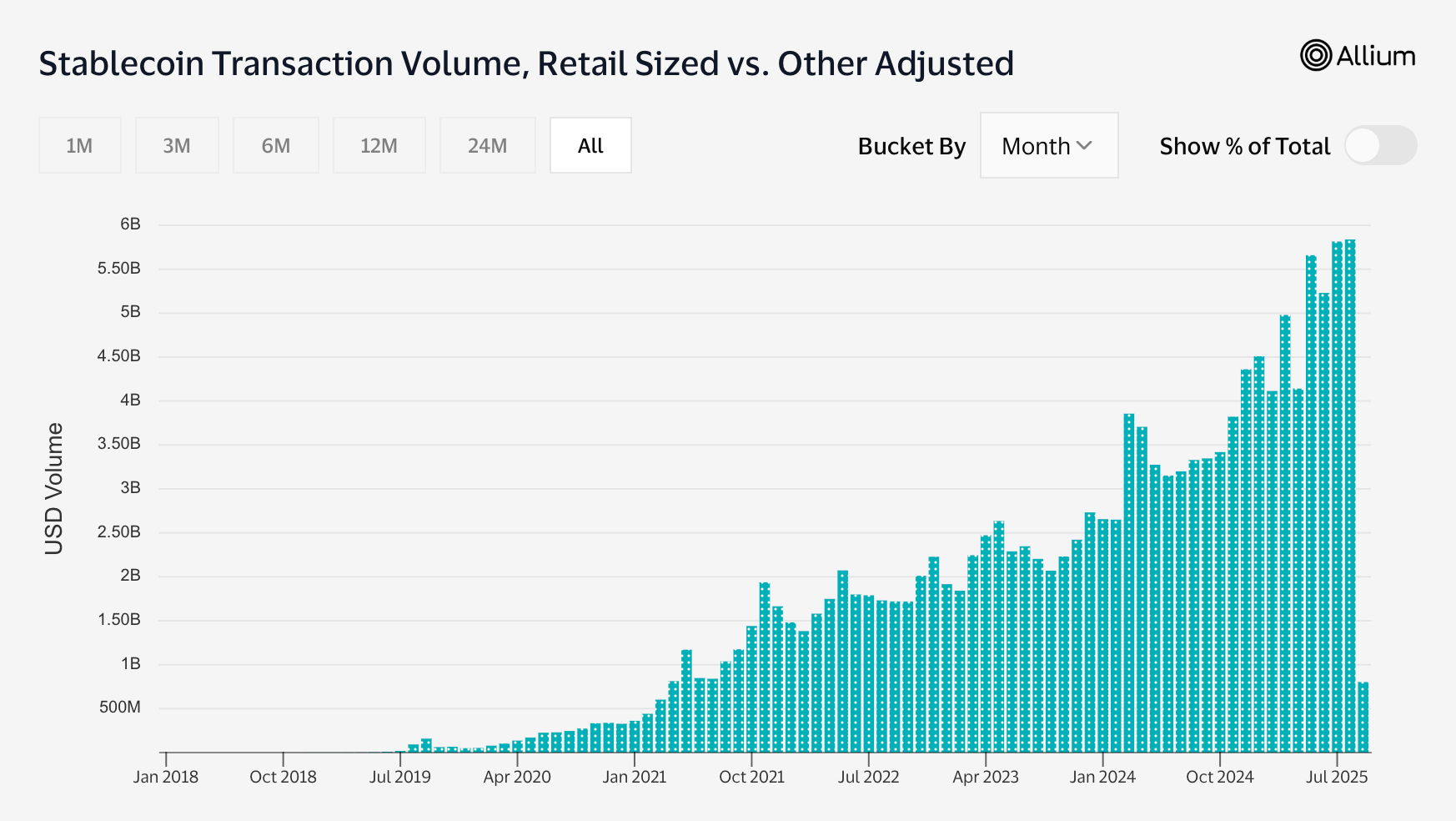

The adoption of stablescoin among retail users has established new files this year, the transaction volumes until August already exceeding the total of last year, said a new report from Cex.io.

Detail transfers, including transactions of less than $ 250, crossed $ 5.84 billion in August only, the highest recorded, according to Visa and Allium data in the report. With almost four months of the year, 2025 has already become the busiest period to date for the stable transfer volume at the consumer level.

The figures underline the Stablecoins, a group of cryptos linked to fiduciary currencies such as the US dollar, becoming more and more integrated into daily financial activity, from cross -border funds to microtransactions, the report underlined.

The survey data of emerging markets, requiring more than 2,600 consumers in Nigeria, India, Bangladesh, Pakistan and Indonesia, have strengthened this image of Cex.io. The majority of respondents said they turned to Stablecoins to avoid high banking costs and slow transfers, according to the report. Almost 70% of them said they used stablecoins more frequently than last year, and more than three -quarters expect that the use continues to increase, depending on the report.

Ethereum Gains, Tron turns around

The distribution of the activity between the blockchains has changed, noted the report. The Tron Blockchain, traditionally popular for retail transfers because of its low costs and large support for the USDT of Tether (Usdt)has abandoned market share. The monthly counts of transactions fell by 1.3 million, or 6%, and its growth in volume has lagged behind its nearest competitors.

In its place, Binance Smart Chain (BSC) appeared as the first choice for retail users, capturing almost 40% of the retail activity, according to the report. The number of network transactions jumped 75% this year, the transfer volume increasing by 67%. A large part of the momentum occurred after Binance has struck the USDT in March for European users and a recurring of the same merchant on Pancakeswap on BSC.

The Ethereum complex, with the basic chain and the 2 -handed layer networks, represented more than 20% of the transfer volume and 31% of transactions, noted the report. While small transfers took place largely on L2S, the Mainnet experienced a significant increase in the retail segment. Transfers of $ sub250 to the Mainnet increased by 81% in volume and 184% count.

Ethereum was mainly used for high -value transactions due to its high costs, but transaction costs have dropped more than 70% in the past year, making the main transactions more competitive even in the range of less than $ 250, the authors said.

Read more: Ripple brings $ 700 million Rlusd Stablecoin in Africa, test extreme weather insurance