The race to define the future of money accelerates – and according to the leaders of the industry, the stablecoins are at the center.

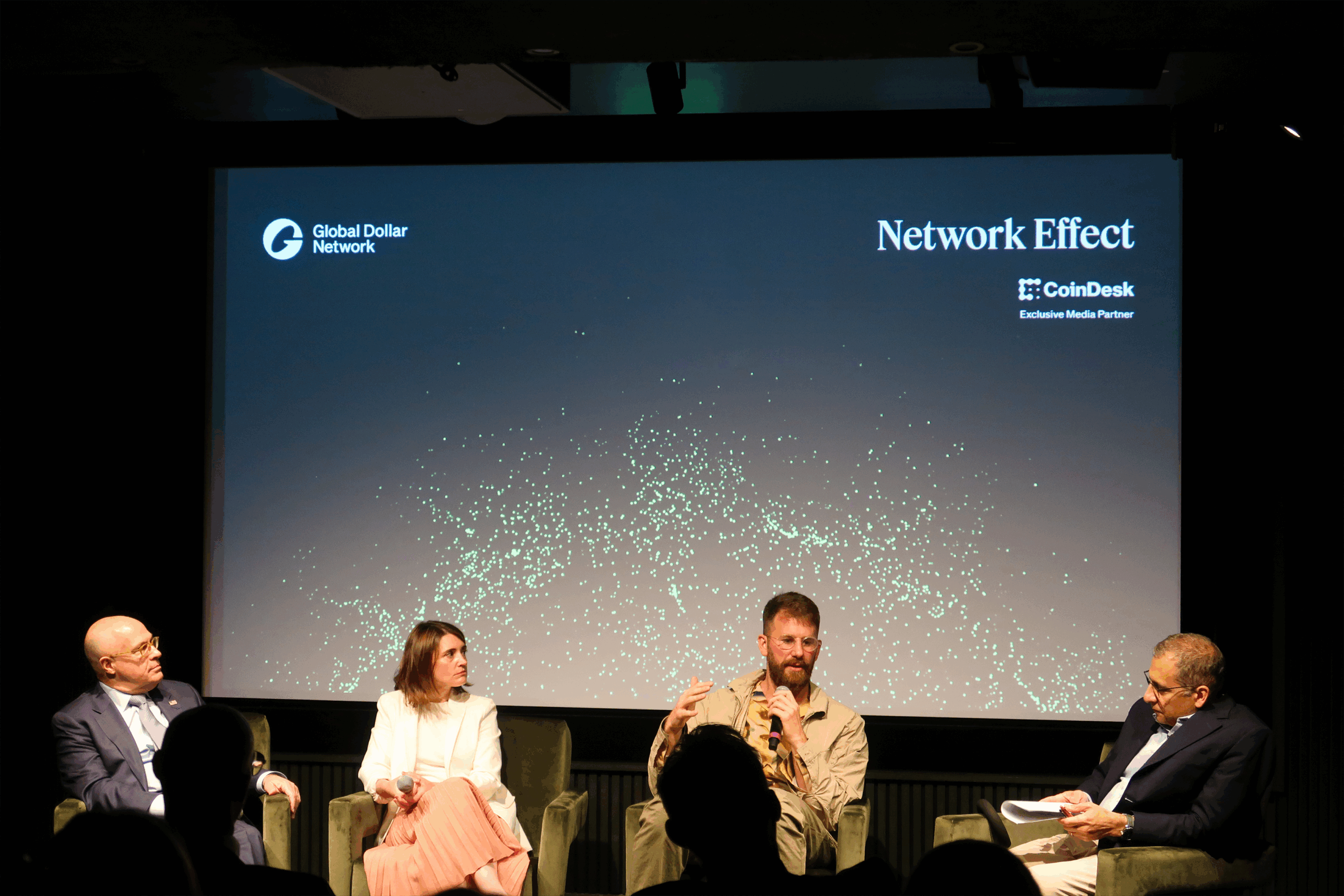

“It is clear that the most important element of our roadmap is to understand the speed with which we can move, and it is obvious that the next three years are the fastest that we will never see in the development of digital assets,” said Sergio Mello, manager of digital digital stablecoins during the global dollar Network event in New York City.

“2025 will have a clarity here, 2026 will have a clarity elsewhere, and 2027 is when everything will happen.”

Mello did not speak in hypotheses. From his point of view within one of the first cryptographic banks to be federal in the United States, he considers stablecoins not as niche financial instruments but as a fundamental upgrade of the global monetary system.

“Stablecoins are a better representation of Fiat, a better way to transfer Fiat, but it’s really just money that you move,” he said. “We were the transport layer and the value layer in the same instrument.”

This evolution of money is far from theoretical.

According to Mello, the players in the industry of all payment networks, guardians and financial services providers set the foundations for what he called a “critical mass” of institutional adoption – what he predicted will strike in the next 12 to 24 months, in particular in payments. “This is where money is going,” he said.

From experience to infrastructure

Stablecoins were once considered as tools for cryptographic speculators or offshore arbitrators. However, according to Raj Dhamodharan, EVP at Mastercard, this perception changes quickly.

Stablecoins are now operating as the “moving layer of money” in increasingly traditional use cases, he said, adding that cross-border funds, B2B payments and even retail expenses are already seeing traction.

For example, MasterCard allows cards where users can choose the motto – Fiat or Stablecoin – they want to spend, while traders can choose what they want to receive. “We started doing this with cards. We started doing so with funding,” said Dhamodharan.

Ahmed Zifzaf de Worldpay has echoed this, describing how their customers use stablecoins for real -time treasure management. “You can start to see how you accelerate all these payment and financial flows,” he said, noting that Worldpay focuses on work with “tested” blockchains like Solana to evolve these efforts.

The banker dilemma

However, not all financial institutions rush.

“What constraints do you have because you are a bank?” asked Luca Cosentino de Cross River. The barriers are real, he said-the batteries of inherited technologies, the risk of conformity and cultural resistance all slow down the pace of innovation. But the split of strategy becomes clear.

“Some banks will not touch the crypto […] Some others will focus on the guard […] Some others will focus on money movements, “he said.” But I doubt a large part of the banks […] Go to the crypto in one way or another.

Sunil Sachdev de Fiserv noted the same ditch. “We had about 12 ready-to-use banks,” he said, describing how the new rules under SAB 121 actually frozen many of these plans. “Then, everything, in one day, a little closed.” But interest has not disappeared, especially among small banks.

“The biggest guys seem cautious,” he said. “Small banks are much more aggressive because they seek to use it as an opportunity to call on deposits at low cost. They consider it an opportunity to differentiate themselves.”

He painted a living image of the way a small town bank could evolve: three branches, deep community ties and now a roadmap to become a “trusted knot” in a world blockchain network, offering tokenized financial products not available elsewhere.

Better than Fiat

While many in the industry assume that institutions will direct adoption, Mark Greenberg de Kraken is not so sure. “Americans could actually be among the last groups to adopt a world dollar,” he said. But outside the United States, demand is strong.

“I believe that a world dollar is better than holding Fiat, and we will see it,” he said, adding that this is more important in countries where inflation erodes value and yield is rare.

And it will not only be used for savings. “You save your money there; you use a card there. At one point, you transfer to your friends, you pay your bills,” he said. “And maybe you buy a piece of the same or a stock.”

Mike Dudas of 6th Man Ventures suggested that the application layer will stimulate consumer behavior. Stablecoins “is the fundamental thing in which people need to be able to store value,” he said. “And now, because of the visa, mastercard and ramp suppliers, I can really spend these dollars that I receive.”

Sheraz Shere of the Solana Foundation added that the infrastructure now exists to support these ambitions. “There is this hypothesis that the tradfi infrastructure is good,” said Greenberg. “There are breakdowns there [TradFi institutions] Also. “Instead of talking about performance, he said that the best strategy is to let the results speak for themselves.

A piece to strengthen the domination of the US dollar

Although stablecoins are often discussed through the objective of innovation and financial inclusion, political decision -makers may think of something more immediate: the demand for American debt, according to the former president of the CFTC, Chris Giancarlo.

“95% of the driving force of the stablescoin legislation is to create more demand for American treasury bills,” he said. “The remaining 5% simply determine which regulator gets surveillance.”

It is not a story focused on the crypto, explained Giancarlo. Stablecoins are now considered a means of strengthening the global role of the US dollar by digitizing it and distributing it on a large scale. “Stablecoins have shown that the global demand for dollars far exceeds supply in an analog world, and that the beauty of the stablecoins meets this demand,” he said.

Jonathan Levin, CEO of Chainalysis, said that banks are cautious in space, by emphasizing the stability of assets and the contagion of the market than most crypto-native companies. “Regarding banks, they look at it and they say: I must not only understand the stability of my asset, I must understand the stability of the assets of all the others.”

According to Levin, the data will be essential. Emitters must follow performance on thousands of pairs of currencies and places, while managing risks without compromising decentralization. “It is a data challenge that will be vital,” he said.

The years to come

While legislative efforts are advancing in Washington, many panelists have agreed that lasting rules – on reserves, ramps, disclosure – are late. But the opportunity to come is greater than compliance.

“The main thing is that even if politicians focus on the demand for treasury bills, it is in the American interest that the dollar continues to serve as a global reserve currency,” said Giancarlo.

At the end of the day, a theme crossed the four panels: Stablecoins are no longer an experience. Whether small banks are looking for relevance, companies are pursuing faster regulations or regulators meet pressure from the treasury market, the stable reserve ecosystem evolves quickly – and the road around 2027 could decide how global finance is wired for the next generation.

Read more: Stablecoins develop beyond the trade in cryptography, are part of the traditional economy, predicts Citi