The developer based in Singapore by Bitcoin Mining Asic Chips and Rigs Canaan (CAN) has had a brutal race, but could be a five -time bagger, suggests the reference analyst Mark Palmer.

Palmer initiated ADR coverage on Tuesday with a purchase note and a price target of $ 3. The shares closed yesterday at $ 0.62, down 72% per year at the start.

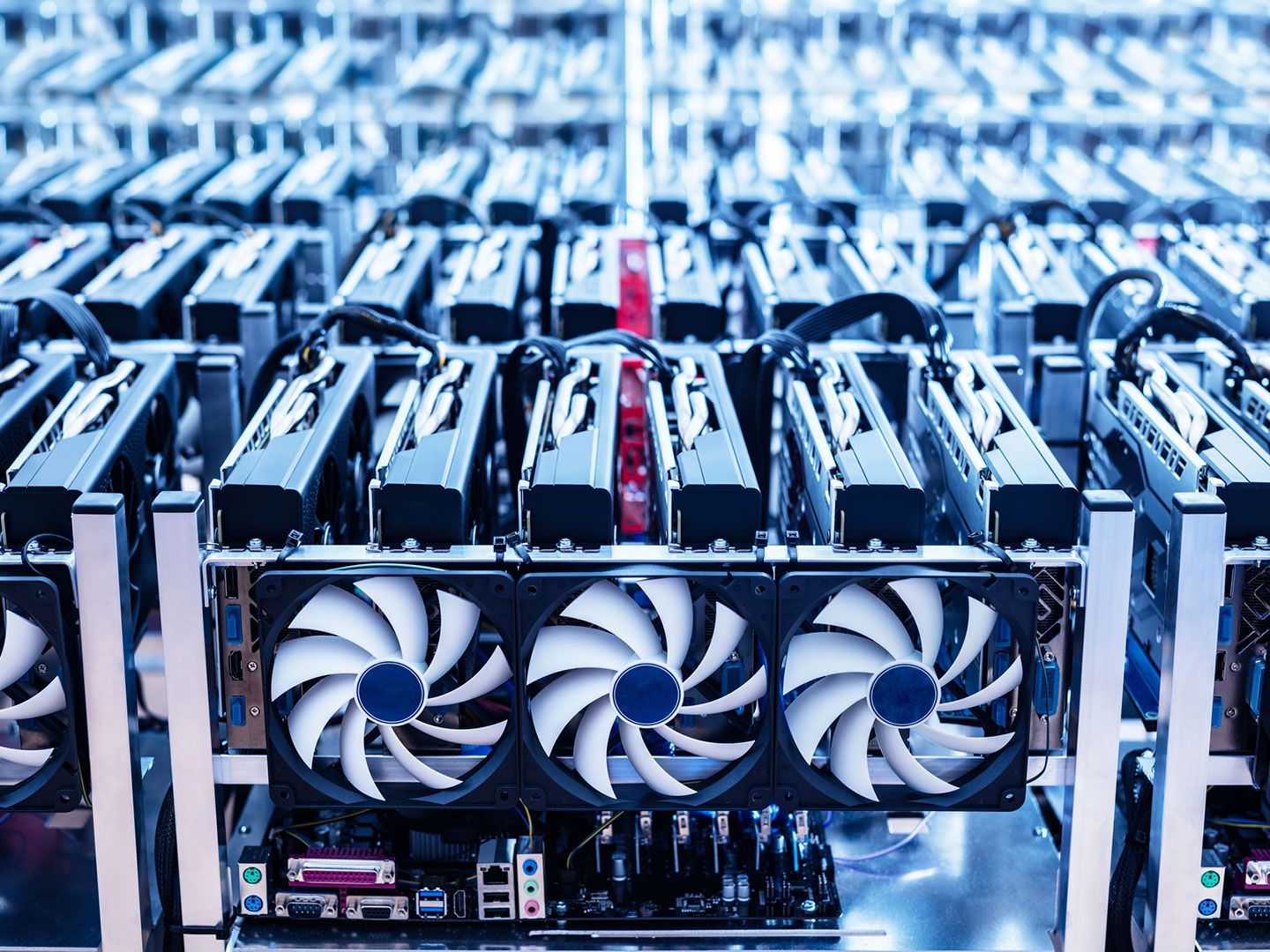

Canaan’s double strategy is focused on the development of Bitcoin Asic fleas and platforms, and the expansion of its auto-mine operations, especially in the United States, said Palmer.

“The vertically integrated approach of CAN differs in the Bitcoin mining space while positioning it to capitalize both on flea / platform sales and owner mining income,” he wrote.

Canaan’s Push in Home Mining Rigs has diversified the company’s income, he noted.

The equipment manufacturer also increases its self-mining capacity in the United States and worldwide.

“Although the company has only drawn 16.3% of its 2024 revenue from its auto-mine operations, it intends to increase total computer power stimulating its operations to exploit by mid-2025 to 10 eh / s in North America and 15 eh / s in the world,” added Palmer.

Canaan has a battery of 1,408 bitcoin with a current value of around $ 133 million, or almost 70% of its current market capitalization, Palmer said. This should support the business assessment.

Find out more: Bitcoin minors with HPC exhibition subperformed BTC for the third consecutive month: JPMorgan