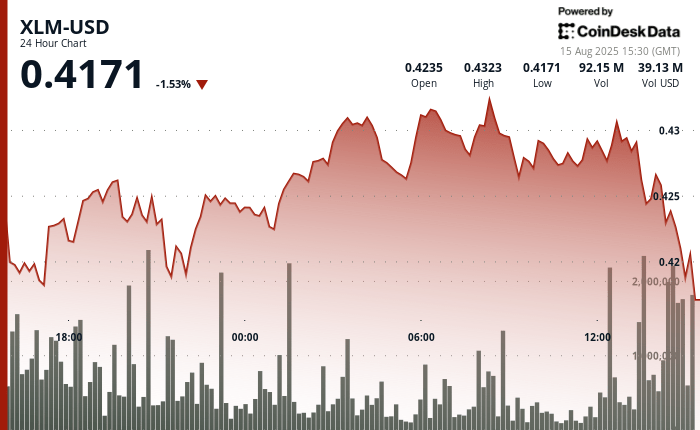

Stellar lumens (XLM) Exchanged in a tight range in the last 24 hours, holding between $ 0.42 and $ 0.43 from August 14 at 3:00 p.m. UTC at August 15 at 2:00 p.m. UTC.

The token saw measured gains before taking profit at the end of the sessions pushed prices from $ 1% to $ 0.43 in the last hour of commerce. The Coindesk Data technical analysis model suggests that XLM tackles a key resistance level at $ 0.50, with an escape potentially targeting $ 0.60 to $ 0.77, supported by the strengthening of network fundamentals and increasing institutional participation.

Channel metrics continue to paint a bullish painting. Stellar’s active business portfolios have reached a summit of 9.69 million, with 5,000 to 6,000 new institutional addresses added daily.

The total value locked on the network jumped from 80% to $ 150 million, reflecting an increase in the adoption of companies. Traders are looking closely at the area from $ 0.47 to $ 0.50, a potential trigger point for short institutional coverage that could feed the next leg.

Although the early pressure pushed XLM to $ 0.42 during the first six hours of the session, buyers have constantly emerged at this level, reporting strong institutional support.

Overnight, the token organized a regular recovery, withdrawing $ 0.43 before consolidating itself. In the last 60 minutes, the heavy sale briefly returned the prices to $ 0.42, but a quick rebound and a lighter volume suggest that the sales pressure can be relaxed, leaving room for an increase in the rise up.

Consolidation phase of the technical indicators of the company

- Stellar established robust institutional support in an area of $ 0.42 with a coherent emergence of buyers at the start of the session.

- The cryptocurrency tested resistance almost $ 0.43 during institutional trading overnight before consolidating itself in a higher price range.

- The volume of negotiations culminated at 71.43 million during the initial drop of six hours, indicating significant participation and institutional interest.

- Technical training approaches critical resistance at $ 0.50, representing the key institutional break.

- Business Momentum indicators suggest potential progress to $ 0.60 to $ 0.77 for institutional price target areas.

- The decrease in the volume of exchanges in the last hour signals exhausted institutional sales pressure and the potential for stabilization of the market.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.