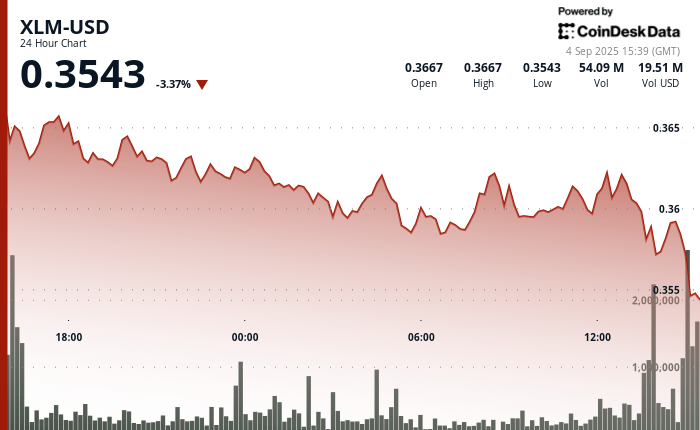

Stellar Continued to slide lower in the last hours, with a price action highlighting a light lower bias. Between September 3 at 3:00 p.m. and September 4 at 2:00 p.m., XLM lost 2.72%, going from $ 0.368 to $ 0.358.

The move came in a tight range of $ 0.012, reflecting intra -day volatility of 3.26%. The sellers systematically rejected attempts to exceed the level of $ 0.362, especially during the September 4 session 1:00 p.m., while the area from $ 0.357 to $ 0.358 briefly provided support. However, the assembly of the downward pressure suggests that the area may not hold, leaving room for prolonged weakness.

Market forces seem to exacerbate the recent drop in Stellar. Despite several rebound attempts, resistance almost $ 0.362 remains firmly intact. These dynamics coincided with the deployment of upgrading of the Stellar 23 protocol on September 3, but the technical milestone failed to provide the type of bullish catalyst necessary to counter the macro pressures in force.

The institutional feeling also reflects the prudent tone. On September 2, a wave of liquidation worth around $ 192,000 occurred when XLM went from $ 0.40 to $ 0.45, highlighting the vulnerability of merchants with sudden movements of decline. This liquidation cascade has since prepared the ground for current retirement, which aligns more important models of risks positioning by the main market players in the midst of geopolitical and monetary uncertainty.

For the future, Stellar faces a crucial support test. After a repeated rejection at the resistance level of $ 0.45, the token now drifts to the request zone from $ 0.32 to $ 0.30. The question of whether this level can arouse sufficient purchase interest will likely determine the short -term trajectory of XLM. For the moment, the technical and macro signals indicate that the two indicate a downward momentum sustained unless the wider feeling is stabilized.

Technical indicators report additional weakness

- The price went from $ 0.368 to $ 0.358, which represents a drop of 2.72% over 24 hours.

- The overall negotiation range reached $ 0.012, which is equivalent to a volatility of 3.26%.

- Clear resistance established at $ 0.362 with several rejection attempts.

- A high volume of 21.47 million during September 4 1:00 p.m. exceeded the average of 24 hours of 16.23 million.

- The support area identified approximately $ 0.357 at $ 0.358 seems fragile.

- The acceleration of the drop in final negotiation hours suggests continuous sales pressure.

- The volume decreased from the peak of 28.5 million to 16.7 million shares indicating a weakening of the momentum.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.