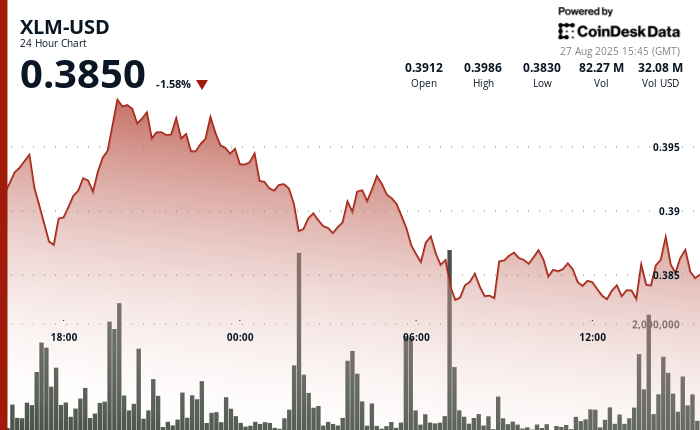

The native token of Stellar, XLM, exchanged in a narrow but active range in the last 24 hours, reflecting wider pressures on the digital asset market. Between August 26 at 3:00 p.m. and August 27 at 2:00 p.m., the cryptocurrency moved to a band of $ 0.017 – approximately 4% – a maximum of $ 0.40 to a minimum of $ 0.38. After having briefly tested the resistance at $ 0.40 at the end of August 26, XLM paid $ 0.39, a 2% drop in session openings, while the sellers dominated trading overnight. The volumes were greater than the average at more than 45 million tokens exchanged, a sign that institutional activity remained high despite the decline.

The peak of negotiation coincided with broader regulatory developments. Daily turnover jumped from 115% to 402.21 million dollars when XLM affected $ 0.40, which underlines how institutional engagement has intensified in parallel with the anticipation of possible approvals from negotiated funds in exchange for cryptocurrency. Recent deposits of funds related to digital assets developed in the country, including Stellar, have helped attract money from companies and institutional in space, even if political decision -makers weigh more strict surveillance.

The intraday action on August 27 offered an instantaneous of this dynamic. Between 1:20 p.m. and 2:19 p.m., XLM went from $ 0.38 to $ 0.39, winning approximately 1% in less than an hour before consolidating. The volumes culminated at 1.42 million tokens per minute during the movement, fixing technical resistance at $ 0.39 and establishing support nearly $ 0.38. The ability to maintain the support above in the face of taking advantage emphasizes that institutional flows continue to shape the market structure in the short term.

Market analysis indicates a mixed feeling

- The overall negotiation parameters showed a range of $ 0.017 representing a distribution of 4% between $ 0.40 maximum and minimum levels of $ 0.38.

- The initial price assessment from $ 0.39 to $ 0.40 was supported by a high volume of negotiation of 41.02 million units.

- Strong resistance emerged at $ 0.40, triggering subsequent sales pressure from institutional participants.

- A prolonged drop occurred with a systematic reduction in prices at fence levels of $ 0.39.

- A sustained sales activity during the early hours presented a volume exceeding the unit average of 45.67 million.

- A concentrated period of 60 minutes demonstrated a price movement of $ 0.38 to 0.39 $ peak.

- The escape model at 1:30 p.m. had a substantial volume of 1.42 million units.

- A new resistance established at $ 0.39 with technical support identified approximately $ 0.38.

- The final consolidation phase indicates a potential continuous institutional interest.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.