Sui

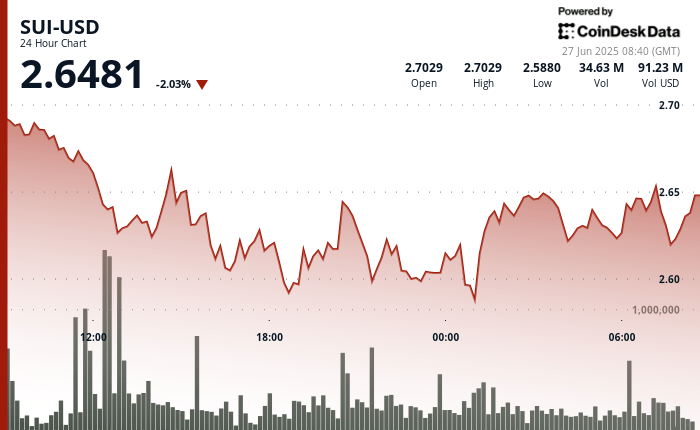

Negotiates to $ 2,6481, down 2.03% in the last 24 hours, after rebounding the support range of $ 2.58 to $ 2.60 during the session from June 26 to 27, depending on the Technical Analysis model of Coindesk Research.

The rebound followed a sharp intra -day drop from $ 2.70 to $ 2.58, but was supported by a renewed volume and an improved feeling linked to institutional interest.

Key development came via Lion Group Holding Ltd. (LGHL)which announced on June 26 of its intention to acquire Suit tokens as part of a wider strategy of $ 600 million in treasury.

In a press release, the company listed by NASDAQ based in Singapore has confirmed an acquisition of $ 2 million of media threshing tokens at an average price of $ 37.30, marking the first strategic purchase as part of this program. The company also said that it intended to use future products of its convertible denying ease to buy Soland Su.

CEO Wilson Wang described media threshing as a “final execution asset” and said LGHL considered it a basic infrastructure for the future of capital markets. The company plans to use at least 75% of net products for each closure of its convertible installation for chip acquisitions, including Suit, and the rest for wider cryptography operations and the working capital.

Lion Group operates a multi-active trading platform offering services such as total return exchanges (TRS)Contracts for difference (CFDS)OTC shares and brokerage options for securities and term contracts. The company underlined its growing commitment to the Layer 1 blockchain ecosystems and said it would continue to update the market on other cash reserve developments.

This announcement follows an increased activity in the SUP ecosystem, including solid purchases at $ 2.60 and a V -recovery at the end of the high volume session, which helped push the token to its current price. Analysts remain cautious, noting resistance around $ 2.66, but the short -term feeling seems to have improved.

Strengths of technical analysis

- SUP exchanged in a 24 -hour fork of $ 2.58 to $ 2.70, showing a 4.5% drop in peak in the hollow.

- A temporary background was formed at $ 2.58 during the 9:00 p.m. UTC session on June 26, followed by accumulation panels.

- Multiple rejection wicks emerged nearly $ 2.66, confirming short -term resistance during the UTC window from 09: 00 to 11: 00 on June 27.

- A minor bullish reversal model appeared from 07:51 to 08:24 UTC on June 27, with a recovery of 0.9% from $ 2.61 to $ 2.63.

- A higher stocking sequence developed from 01:00 to 8:00 UTC on June 27, reporting a progressive change in the momentum.

- The volume increased by 18% above the average of 24 hours during the recovery phase from 8:00 am UTC on June 27, strengthening the support at $ 2.60.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.