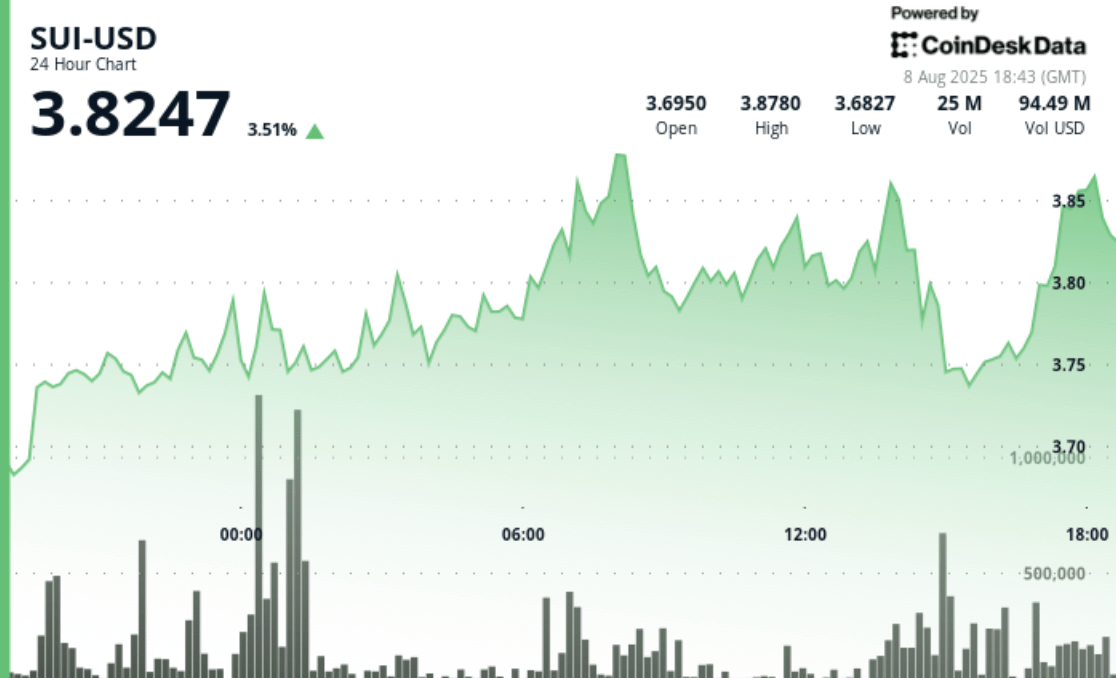

Am (Sui) The price has increased by 4% in the last 24 hours to $ 3.82 while the SYGNUM Swiss Digital Asset Bank has expanded its offers to include custody, negotiation and loan products related to blockchain for its institutional customers.

This decision means that regulated investors in Switzerland can now hold, exchange and borrow against Suit via the Sygnim platform, expanding access to the Blockchain Ecosystem of layer 1. Bank services are intended for professional and institutional investors who seek exposure under Swiss financial regulations.

Earlier this week, another Swiss institution, Amina Bank, said that it had started to offer negotiation and custody services. Amina described the step as by making the first regulated bank worldwide to support the native assets of the blockchain.

Ads seem to have stimulated market activity. Coindesk Analytics data show that the negotiation volume increased to 36.45 million tokens at midnight, more than double the daily average of 14.31 million, while buyers intervened to defend a support area between $ 3.72 and $ 3.74. This level has taken place since mid-July, suggesting that short-term traders consider it a key floor.

The daily earnings of suis are in close collaboration with the wider market of cryptography, as measured by the Coindesk 20 index which climbed 4.5% in the last day. The monthly token performance is also positive, up 7% in the last 30 days, but significantly lower than the wider market, the CD20 up 24%.

For institutional clients, the expansion of regulated access to new blockchain projects as SUPs represents more than another trading option. It indicates growing comfort among banks to integrate blockchain networks beyond the most important and most established assets. In practice, this could mean that asset managers, corporate treasury bills and Haute Nou customers have more ways to diversify assets without leaving regulated executives.

SU, developed by MySten Labs, aims to offer high speed and low cost transactions using a new data structure called “objects” to improve scalability. Wider access through banks like Sygnim and Amina could help him compete for the attention of developers and real world applications.

If the request for an exhibition at the Blockchain mediated by banks continues to grow, SU can find itself in a stronger position to attract not only speculative traders but also the adoption of companies.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.