Sui

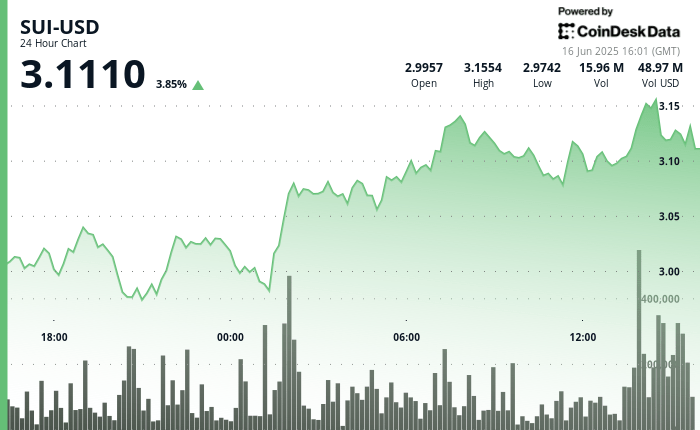

Exchanged at $ 3.1110 on Monday, up 3.85% in the last 24 hours after an upward trend of several hours which has pushed the token through key resistance levels. The asset reached a session of $ 3.1554 before paying just more than $ 3.11, with a strong volume supporting the attempted break.

Michaël Van de Poppe called Suis “super interesting as an ecosystem” in an article on X earlier on Monday, indicating several major stages in chain. The Stablecoin offer on the Suis network increased from $ 400 million in January to nearly $ 1.2 billion. Meanwhile, the total locked value (TVL) reached $ 1.8 billion – ranking third among the non -EVM channels. The adoption of the portfolio also accelerates, helped by the integration of Phantom and the launch of melting snow, the following portfolio.

Suilend, the Protocol loan platform, saw its TVL increase by 90% in the month to more than $ 600 million. Van de Poppe noted that this growth, coupled with a previous bullish graphic behavior, could prepare the ground for a strong escape if suis can close more than $ 3.30. He described this level as a key liquidity zone which could trigger a passage to new heights.

The analysis period has also shown a strong commitment from buyers, in particular about $ 3.12. The price briefly consolidated after the peak, but continued to form higher intradays – suggesting continuous momentum despite a modest recharge of session highs.

Strengths of technical analysis

- During the analysis period, followed between $ 2,9742 and $ 3,1554, marking an intraday decision of 6.09%.

- The price has formed a coherent upward trend, exceeding resistance of $ 3.08 with established support from $ 2.96 to $ 2.97.

- The volume exceeded 12 million units between 01:00 and 07:00 GMT, confirming a wide accumulation interest.

- At 1:56 p.m. GMT, Suis jumped through the level of $ 3.12 over a volume of more than a million units, initiating a break.

- Between 1:56 p.m. and 2:03 pm GMT, the price action remained solid and trained a new support group around $ 3.12.

- Towards the end of the analysis window, SU has gone from $ 3.09 to $ 3.13 in a movement of 1.29%, closing with intact bullish continuation models.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.