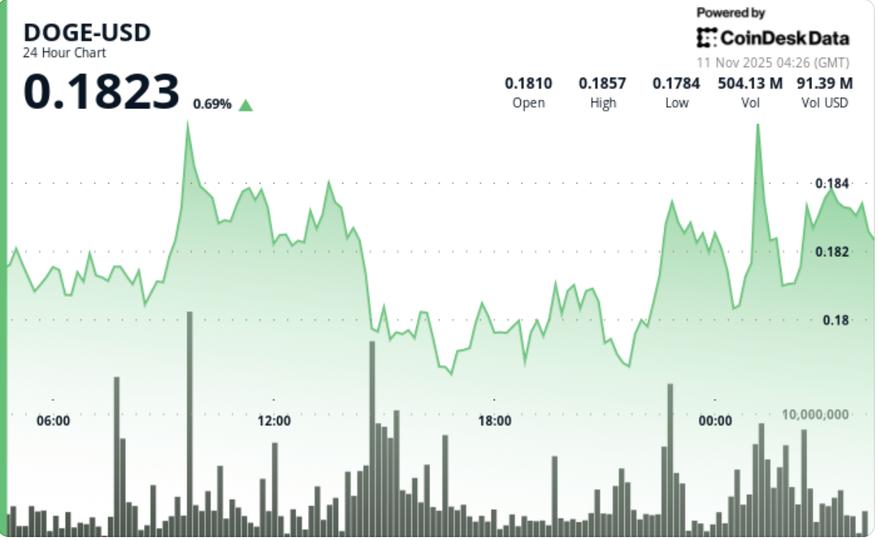

DOGE broke key resistance at $0.1815 during Tuesday’s session as volume surged 96% above average before a late session reversal erased most of the intraday gains. This move has created a lower high formation that signals a potential shift in near-term dynamics.

News context

- Dogecoin advanced 3.1% to $0.1824 during Tuesday trading, extending a rally over several sessions before encountering selling pressure near the $0.184 area.

- The meme coin traded between $0.1769 and $0.1838, carving out a 3.9% range as traders tested the upper limits of the channel.

- The Bitwise spot DOGE ETF could launch within 20 days via an automatic approval process, making it a catalyst for dogecoin price predictions.

- Bitwise’s approach places the memecoin ETF on a 20-day countdown to automatic approval under Section 8(a) of the Securities Act, unless the SEC intervenes.

- DOGE consolidated between $0.1810 and $0.1835 during mid-session trading, with buyers defending the $0.1800 support.

- However, the late session reversal indicated exhaustion among short-term traders after repeated tests of intraday highs.

Price Action Summary

- DOGE’s rally came to an abrupt halt at 14:00 GMT as profit-taking triggered a 1.1% pullback from $0.1842 to $0.1821. The correction took place on a high volume of 7.8 million tokens, piercing the intermediate support near $0.1830 and disrupting the previous structure of the ascending channel.

- This move established a lower upper formation at $0.1842/$0.1821, a common early signal of weakening bullish momentum.

- Despite the overall intraday gains, the market’s inability to hold above breakout levels suggests the move may have been fueled by short-term liquidity rather than sustained accumulation.

Technical analysis

- Dogecoin’s short-term structure remains constructive above $0.1800 but vulnerable to further selling below $0.1820. The ascending channel visible on the 4-hour charts was compromised by the late session breakout, introducing a neutral to bearish bias heading into midweek trading.

- Momentum indicators show decreasing strength: the RSI has fallen from 64 to 52, while the MACD has narrowed towards convergence. The high turnover during the reversal phase indicates active distribution, although support areas near $0.1800 continue to attract buying interest.

What Traders Should Know

- DOGE’s near-term trajectory depends on its ability to defend support at $0.1800 and reclaim resistance around $0.1835 to $0.1840.

- A close above this band could restore momentum towards $0.1860 – $0.1880, while failure to hold support risks retesting the $0.1760 base.

- Analysts note that ETF speculation remains a underlying catalyst, but near-term price behavior appears primarily driven by technical positioning and profit-taking resulting from recent whale accumulation.