Significant deleveraging in derivatives markets sends XRP lower before buyers defend the $2.40 area, setting up a new test of key support ahead of Asia trade.

News context

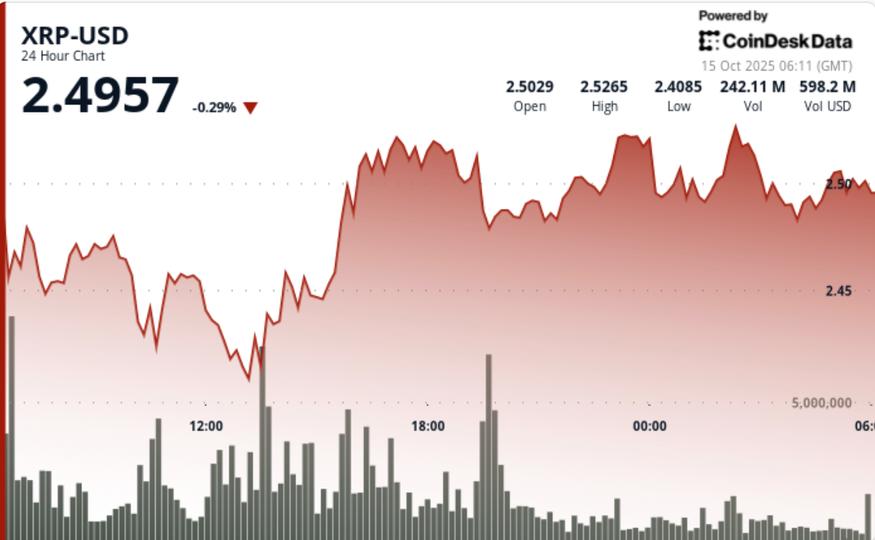

- XRP traded sharply lower during the October 14-15 session as macroeconomic pressure and broad crypto deleveraging pushed open interest down 50% to $4.22 billion.

- Despite the disaster, spot volumes jumped 40%, signaling institutional re-entry.

- Ripple’s recently announced partnership with Immunefi – a $200,000 XRP Ledger security test run from October 27 to November 27. 24 – helped anchor sentiment after an early session decline.

Price Action Summary

- XRP fell 1.97% from $2.54 to $2.49 while passing through a $0.16 band ($2.55 to $2.39), representing an intraday volatility of around 6%.

- Buyers repeatedly intervened between $2.40 and $2.42, defending key support after a midday capitulation.

- Volume exploded to 179.4M at 1:00 p.m., nearly double the 24-hour average, validating the accumulation at the lows.

- Sellers capped rebounds near $2.53, where consistent distribution formed a short-term ceiling.

- Late session trading saw XRP rebound slightly to $2.50 as dip buying stabilized order books.

Technical analysis

- The $2.40 to $2.42 area remains the critical pivot for the bulls. Multiple rebounds confirm institutional defense, but momentum remains fragile below the $2.53-$2.55 resistance group.

- An extended break below $2.40 would open downside targets at $2.33 and $2.25, while reclaiming $2.53 could reestablish an advance towards the broader $2.65 breakout line.

- Volume-weighted metrics indicate accumulation amid forced unwinds – a classic short-term base-building phase if funding normalizes.

What traders are looking at

- If $2.40 continues to hold until Monday’s Asian open.

- Signs of re-leveraging after open interest halving on derivatives exchanges.

- Tracking volume above $2.50 confirming accumulation.

- Macroeconomic headlines are linked to trade war rhetoric and Fed policy as drivers of volatility.