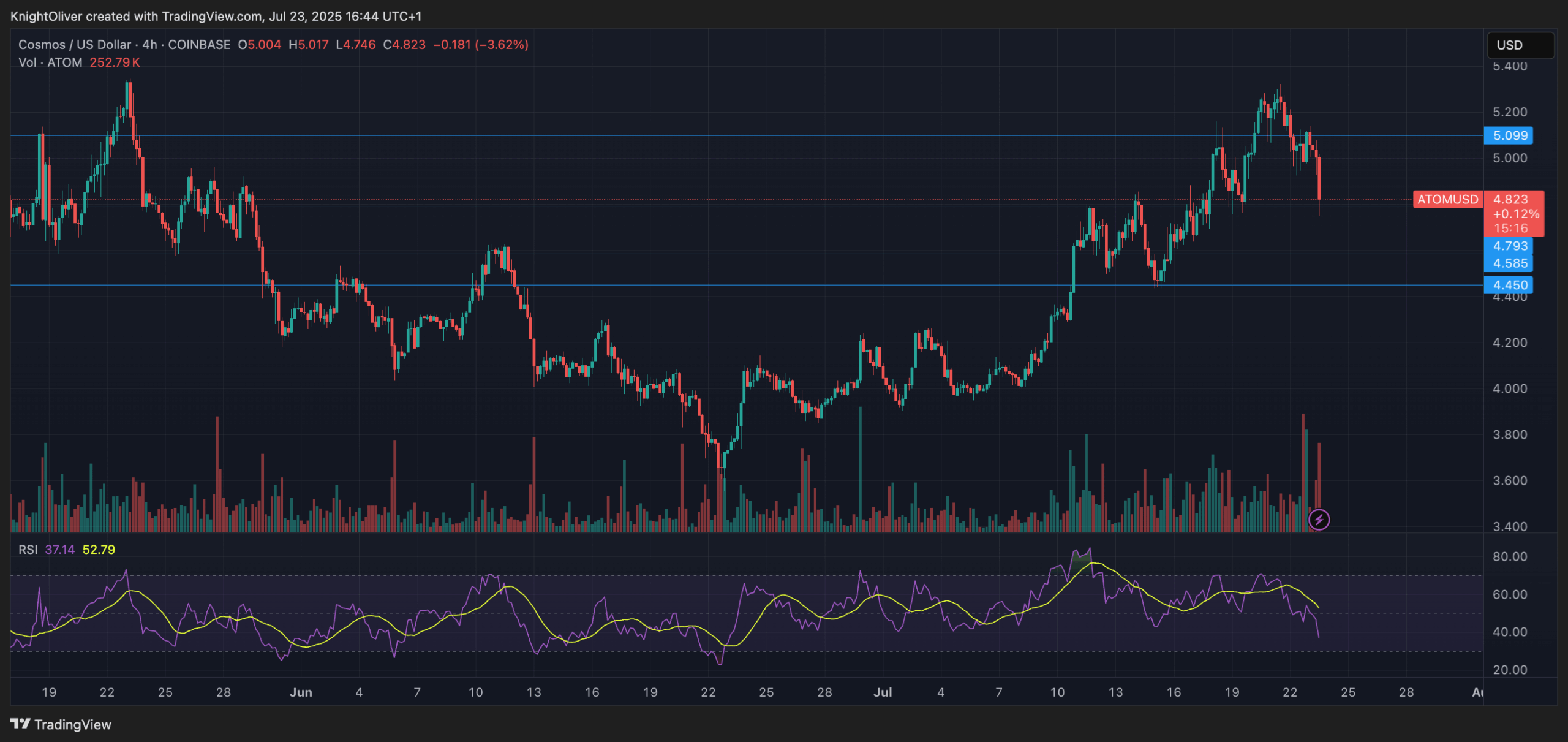

Cosmos Hub’s atom token has had a sharp drop in the last 24 hours, from $ 5.08 to $ 4.82 while institutional participants intensified the liquidation activity. The decrease of 5.1% was accompanied by an increase in the volume of negotiation, with a peak of 7.73 million tokens changing hands during a particularly heavy sale between 9:00 am and 2:00 pm UTC on July 23.

The net movement reinforced the resistance around the range of $ 5.07 to $ 5.13, while the accumulation interests surfaced in the area of $ 4.78 to $ 4.88, providing provisional support. However, persistent breakdowns below the threshold of $ 5.00 highlighted the continuous distribution pressure that could question recovery attempts without a sustained dynamic of purchase.

During the last hour of negotiation on July 23, Atom experienced pronounced volatility. The price went from $ 4.90 to a session hollow of $ 4.78 before rebounding at $ 4.81. This recovery, although notable, occurred as a decrease in volume – pointing out a potentially exhaustion in short -term buyers.

Akash Network (AKT), another COSMOS -based project, continues to show its strength in long -term forecasts, with a potential objective of $ 6.19 in 2025, contrasting Atom’s current technical fragility.

Strengths of technical analysis

- Movement 24 hours a day: Atom dropped from $ 5.08 to $ 4.08 with a total range of $ 0.35 (6.8%).

- Maximum liquidation: July 23, 09: 00-14: 00 UTC SAW Volumes Plays at 7.73 m, well above the average of 1.11 m.

- Critical support: $ 4.78 – $ 4.88 Zone showing accumulation over a high volume.

- Intermediate resistance: $ 4.98 – The level of $ 5.00 is faced with several refusals.

- Institutional pressure: A supported breakdown less than $ 5.00 Signals distribution activity.

- Intra -day volatility: July 23, 13: 10-14: 09 UTC experienced a net drop from $ 4.90 to $ 4.78, followed by a rebound at $ 4.81.

- Rebound weakness: Recovery at $ 4.81 has dropped as a volume, suggesting a possible exhaustion.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.