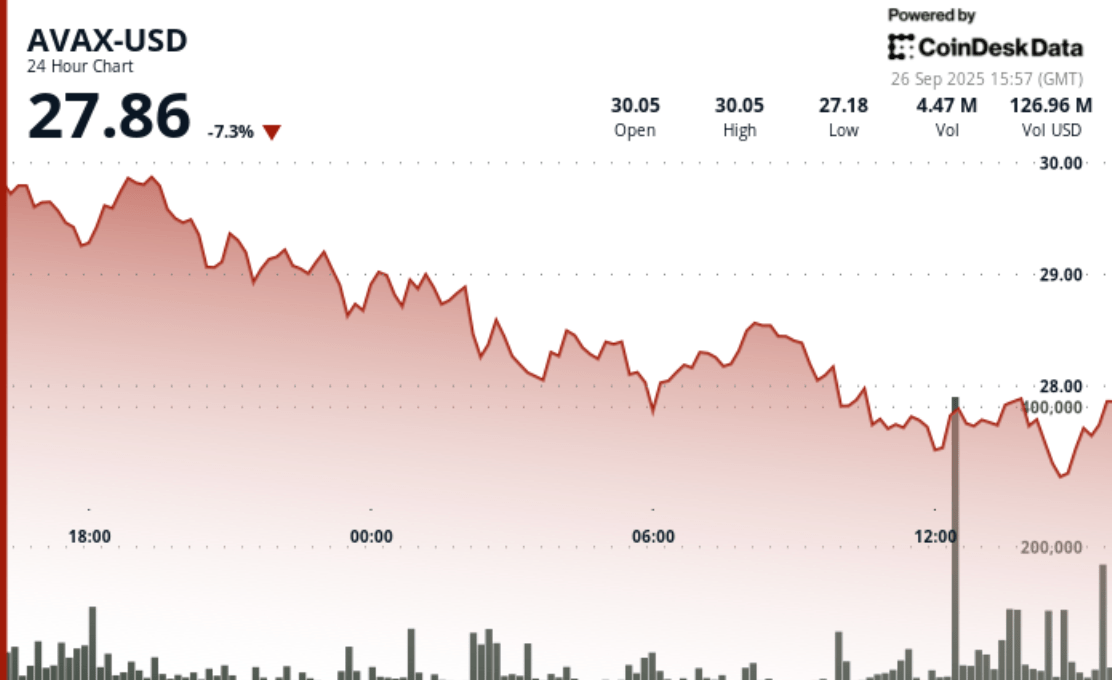

The Avalanche Avax native token fell 8% in the last 24 hours to $ 27.72, extending a one -week slide which has erased almost 18% of its value. The drop occurred alongside a large dive on the cryptographic markets which saw ETH, Sol, Doge, after a two -digit percentage, the decreases in last week and the BTC drops by 6%.

AVAX had trouble breaking over a resistance level of $ 30.28 and found only low support nearly $ 27.65. Coindesk’s analysis data show that trading volume increased to 121,896 tokens at the start of negotiation on Friday, reporting that institutional sale can slow down but has not yet reversed.

Prices ignition occurs in the wake of corporate initiatives aligned by avalanche aimed at deepening institutional commitment. Earlier this week, the Agriforce Growing Systems technological company has renamed Avx One and announces collection plans of $ 550 million to acquire and hold Avx. This decision would make it the first company listed in Nasdaq to focus exclusively on the avalanche ecosystem.

The company has gathered a high -level advisory team led by the founder of Skybridge Capital, Anthony Scaramucci, and Brett Tejpaul from Coinbase Institutional, positioning itself as an Avx major goalkeeper. AVAX One aims to have more than $ 700 million token, to cement its role of central figure in the history of avalanche growth.

But for the moment, the market has not bought.

The downward price suggests that institutional donors can always be careful about the long -term avalanche positioning. Although the regulatory approvals of vehicles linked to tokens are pending, they have not yet translated as the purchase of momentum.

The avalanche roadmap includes partnerships and business use cases, but these fundamentals have not yet counterbalanced the current sales pressure.