Bitcoin

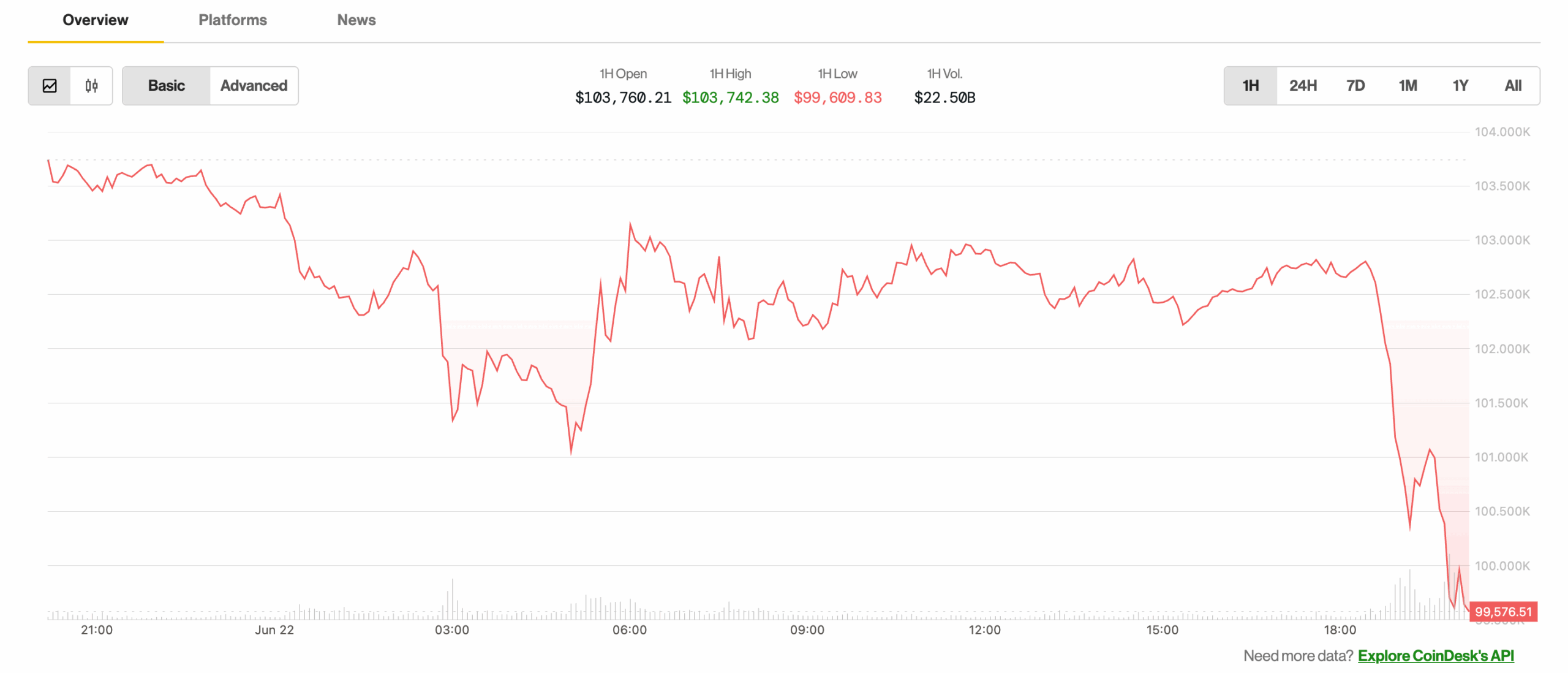

I fell below $ 100,000 on Sunday, its lowest point since May, reporting a risk aversion to Wall Street on Monday in the midst of the reports according to which Iran is looking to block the Hormuz Strait.

The Strait, located between Oman and Iran, links the Persian Gulf to the Gulf of Oman and the Oman Sea, managing around 20% of the world’s world oil trade.

The reports of Iranian politicians reflecting on the closure of the Strait had observers concerned about an important peak in oil prices on Monday.

“After the American strikes on Iran last night, more than 50 great oil tankers were unleashed to leave the Hormuz Strait. The markets were closed, but an immediate drop in the offer should send higher prices. JP Morgan described this as their worst scenario in the War of Israel-Iran,” said Kobeissi’s letter to X.

According to JPMorgan, oil could increase to $ 120 to $ 130 per barrel in this scenario. This could potentially bring the American inflation rate to 5%, the highest since March 2023. At the time, the federal reserve increased interest rates.

BTC losses weighed heavily on the larger cryptography market, as usual, causing major altcoins such as XRP, soil and eth lower. Payment XRP slipped by $ 1.935, the lowest since April 10.