The cryptocurrencies found feet on Monday after a difficult start at the negotiation session, reflecting a broader recovery of risk assets while merchants digested Moody’s demotion of American government obligations.

Bitcoin

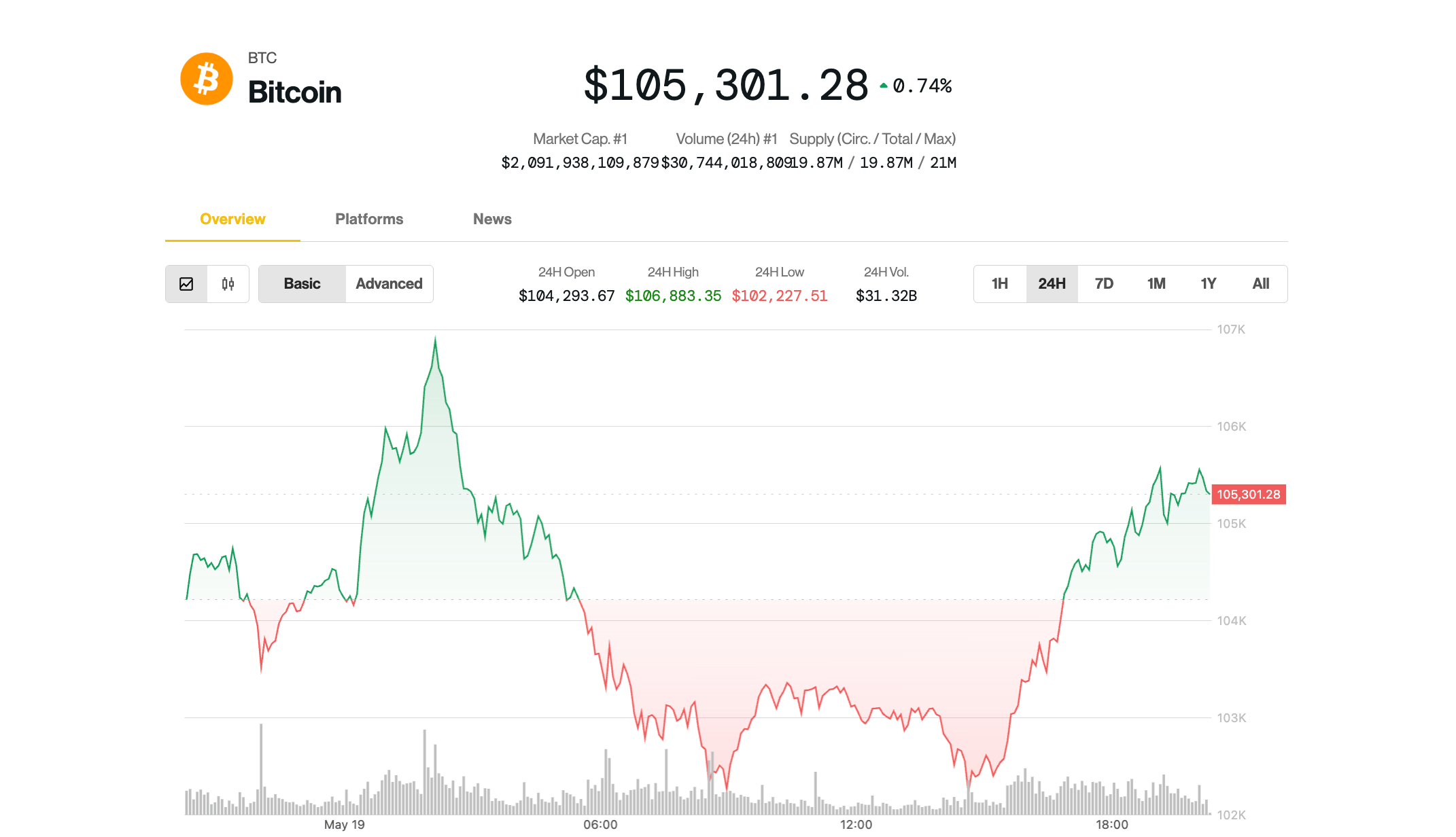

Marked a solid rebound after slipping up to $ 102,000 at the start of the American session, after its weekly record for $ 106,600 overnight. The largest cryptocurrency by market capitalization has rose to $ 105,000 in exchange for the afternoon, up 0.4% over 24 hours. Ether increased by 1.2%, recovering the level of $ 2,500.

DEFI AAVE loan platform

In outperformed the largest altcoins, while the majority of the members of the Coindesk 20 large market index remained in the red despite their advance of their daily stockings. Solana, Avalanche and Polkadot fell from 2% to 3%.

The rebound has also extended to American actions, the S&P 500 and the Nasdaq eraaring their morning decline.

The early withdrawal of the crypto and actions came after Moody’s late Friday, lowered the American credit rating of its AAA status. The move has shook the bond markets, pushing the treasury yields at 30 years old above 5% and the 10 -year note at more than 4.5%.

However, some analysts have minimized the long -term impact of demotion on asset prices.

“What does [the downgrade] Mean for the markets? In the longer term – really nothing, “said Ram Ahluwalia, CEO of the heritage management company Lumida Wealth. He added that in the short term, there could be sales pressure centered on American treasury bills due to large institutional investors, because some of them are mandated to hold assets only in the titles classified by AAA.

“Moody’s is the last of the three main rating agencies to downgrade the American debt. It was the opposite of a surprise – it was a long period to come,” said Callie Cox, chief market strategist at Ritholtz Wealth Management, in a Post. “This is why equity investors do not seem to care.”

Bitcoin targets $ 138,000 this year

While BTC hovers just below its record prices in January, the digital issuer Asset ETF 21Shares sees more upwards for this year.

“Bitcoin is about to make a break,” wrote the research strategist Matt Mena in a Monday report. He argued that the current Rally of the BTC is not motivated by the retail mania, but by a confluence of structural forces, including institutional entries, a crunch of historical supply and the improvement of macro-circles which suggest a more sustainable and mature path to new peaks of all time.

The FNB Bitcoin Spot systematically absorbed more BTC than what is extracted daily, tightening the supply while large institutions, companies such as the strategy and the newcomer twenty-one capital accumulate and even the states explore the creation of strategic reserves.

These combined factors could bring BTC to $ 138,500 this year, Mena has planned, resulting in a rally of around 35% for the greatest cryptography.