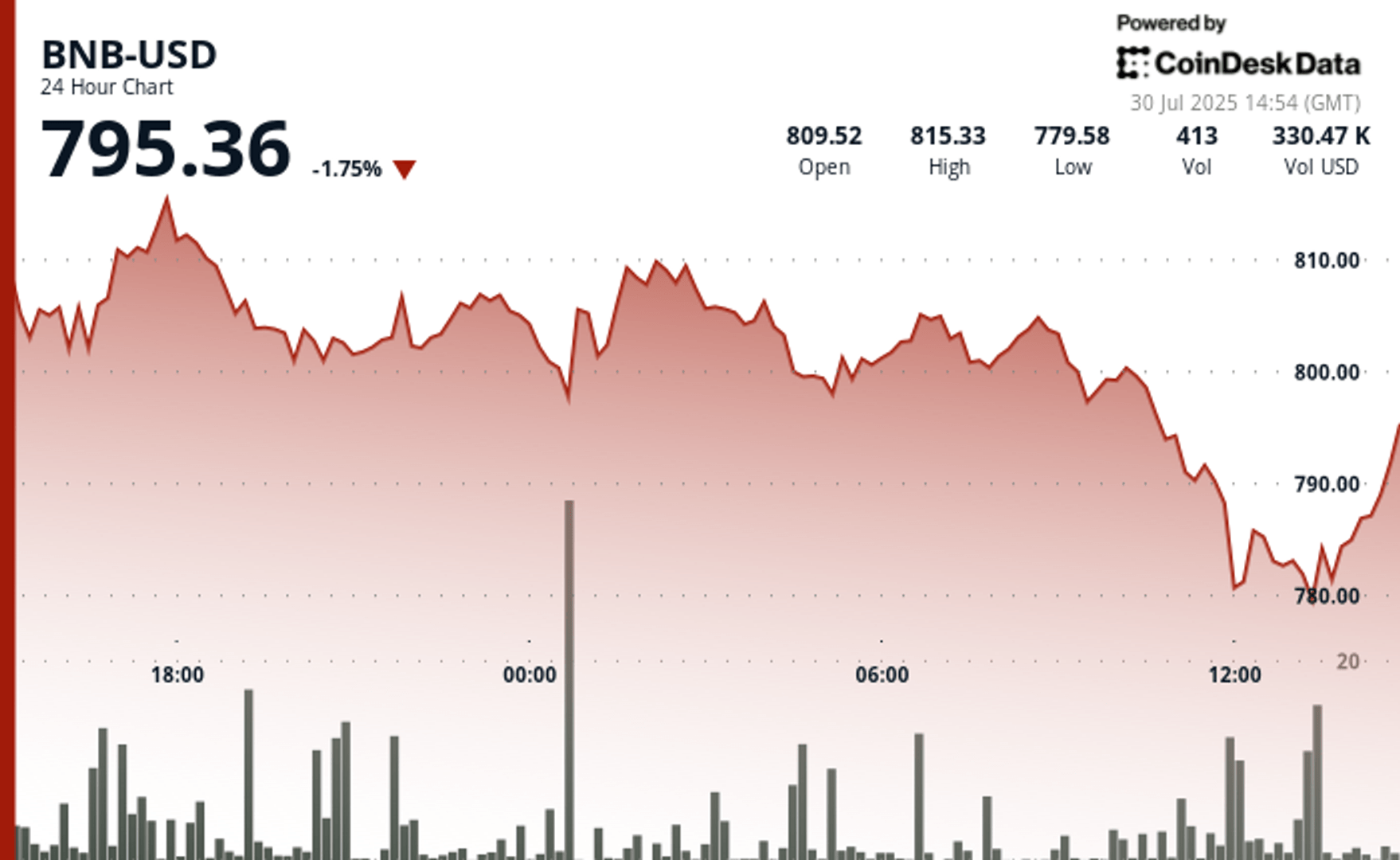

The price of BNB has increased from around $ 815.8 to $ 795 in a decision that violated the level of support largely regarded of $ 800.

At the bottom, BNB hit $ 780 before bounced slightly. Commercial activity during this window increased to more than 4,000 tokens per minute, according to the Technical Analysis model of Coindesk Research.

A drop below $ 800 is considered to be a violation of psychological support, raising questions for business treasury bills that hold exchange tokens as part of their digital asset strategy.

The decline occurred after BNB reached a record of almost $ 860, because several public companies have revealed aggressive movements in the token.

CEA Industries (vape), supported by the co-founder of Binance, the family office of Changpeng Zhao, Yzi Labs, said that it was aimed at raising $ 500 million, with a possible prolongation at $ 1.2 billion, to build what it calls the largest Treasury BNB mentioned by the United States. Its stock jumped more than 700% after the announcement.

Other companies also jump. Biopharma Limminatus Pharma (LIMN) has launched a subsidiary focused on BNB investments with an objective of $ 500 million, while Windtree Therapeutics (WINT) unveiled an acquisition plan of $ 700 million last week.

In addition, Nano Labs said that he had already bought 128,000 BNB shortly after revealing new cryptographic treasure goals.

The volume models during the session, in particular near the resistance of $ 815.40, indicate an active rebalancing and a lack of sustained demand. While a rebound at the end of the session suggests pockets of trust, the wider market structure remains fragile.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership in Our standards. For more information, see Complete Coindesk AI policy.