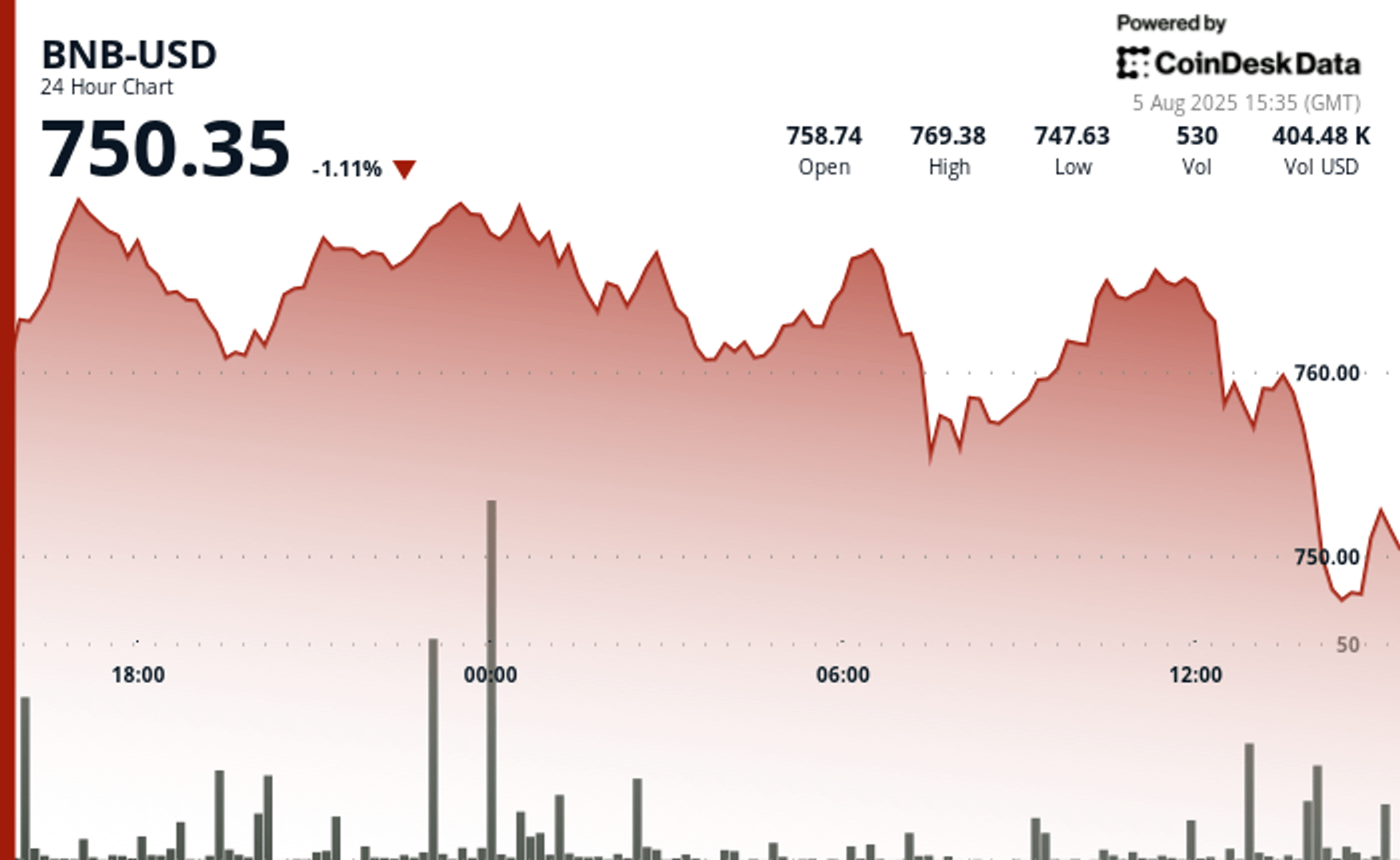

BNB has dropped by more than 1% in the last 24 hours to lower briefly below the support level of $ 750, which it currently holds. The drop came after a brief rally that moved it on the $ 760 line.

The previous gathering of cryptocurrency was motivated by the adoption of companies and deployments of Binance products. The decline came as a wider market sale, launched by the drop in Bitcoin to $ 112,800, triggered $ 360 million in liquidations according to Coinglass.

One day earlier, BNB crossed key resistance levels at $ 759 and $ 761 on a coordinated wave of purchase, according to the Technical Analysis model of Coindesk Research. The volume has increased by 50% above daily averages, partially powered by launching a web version of its portfolio and opening Bitcoin options to all users.

This optimism came in the middle of an accumulation of a business. CEA Industries has unveiled a fundraising plan focused on the BNB of $ 1.2 billion, while Limminatus Pharma and Windtree Therapeutics revealed respectively $ 500 million and $ 700 million in BNB. Nano Labs said he bought 128,000 BNB for his business treasure.

These gains have proven to be short -lived. BNB fell from its local summit of $ 769.70 in the middle of a peak in volume beyond 49,000 tokens which reported a large sale.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.